FDA: Pickles & Yogurt “Unhealthy”?

Pickle and yogurt brands are speaking out against new labeling rules proposed by the U.S. Food and Drug Administration. The FDA’s new guidelines say some brands of the fermented products cannot be marketed as healthy because pickles are too salty, while some yogurt has too much sugar.

The guidelines are being updated for the first time since the 90’s. They redefine what can be labeled as “healthy” on a food package. Healthy products have high amounts of key nutritious ingredients, like fruits and vegetables, and low amounts of added sugar, sodium and/or saturated fat. Those updated nutrient content claims would go into effect in 2026. They wouldn’t ban “unhealthy” foods, but prevent the use of “healthy” on a label.

“Pickles have a role to play in a healthy diet because they are predominantly comprised of vegetables and serve as a delicious condiment to other nutrient-dense foods,” Pickle Packers International said in a statement.

Though pickles are made from low-sodium cucumbers, they are either fermented through a brine made of water, salt and seasonings or preserved in a brine of vinegar, salt and seasonings. Without enough salt in the brine, bacteria can grow and spoil the pickles. The new guidelines put the limit for sodium from a vegetable product at 10% of the daily value per serving (230 milligrams per serving). But most pickles include 11% sodium per serving.

Yogurt, too, is under fire. The new guidelines outline that a ¾ cup of yogurt should only include 5% per serving of the daily value of sugar (2.5 grams of added sugar per serving). Chobani’s plain greek yogurt includes 5.5 grams of sugar per serving. Chobani has actively protested the FDA’s ruling, noting that “reducing sugars to the level proposed by FDA for the ‘healthy’ claim would result in significant, deleterious effects to product quality, taste, and texture.”

Other companies are protesting the FDA’s guidelines – like General Mills, Kellogg’s, SNA International, the National Pasta Association and the Consumer Brands Association. The FDA guidelines put tighter restrictions on cereal and pasta, too.

“Hardly anything would qualify, so of course food manufacturers don’t like the idea,” says Marion Nestle, emeritus professor of nutrition and public health at New York University. She told nutrition and medicine publication STAT that the FDA’s regulation “automatically excludes the vast majority of heavily processed foods in supermarkets, as well as a lot of plant-based meat, eggs, and dairy products,” from bearing the healthy claim.

The publication notes nutrition experts gave “overwhelmingly positive remarks.” The new guidelines are supported by the American Society for Nutrition, the Association of State Public Health Nutritionists and the Robert Wood Johnson Foundation. Some experts argued the GDA could go further in restricting the healthy label.

Read more (STAT)

- Published in Food & Flavor, Health

Serial Pickler’s Pickling Prowess

Israel scientific magazine ISRAEL21c got a tour of Noa Berman-Herzberg’s pickle paradise in her home kitchen. Berman-Herzberg, who uses the moniker Serial Pickler, has garnered a large following online (64,000 Instagram followers).

Pickling first piqued her interest when her grandparents ran a Jewish deli in Philly. Today she is a fermentation education and screenwriter, producing the culinary storytelling project “Sour Food, Sour Stories” where her guests talk with Berman-Herzberg while eating her pickles. They must each tell a story about something they felt they missed out on life (the Heber word for pickle means “missed out on.”).

Her unusual ferments and pickle pairings have attracted the attention of chefs from around the world. At any given time Berman-Herzberg has 100 different pickle varieties at home, from a fiery pineapple pickle to a pickle with a miso-coffee spread.

“To taste these fruits and vegetables is to feel you have landed the golden ticket to a Willy Wonka land of pickles. Flavors and textures are exciting and unexpected,” the article reads.

When Berman-Herzberg began, she says most people thought she was a “weirdo.” Today, she believes pickles have found their moment.

“We need to rethink the way we prepare food,” she says. “Preservation is going to be especially important as we head into a future of food shortages and climate change.”

Read more (ISRAEL21c)

- Published in Food & Flavor

Does Organic vs. Conventional Matter for Fermented Foods?

Organic food is considered by some to be healthier and more nutritious than its conventional counterpart. But what about when that food is fermented? Does organic vs. conventional matter?

A new study reveals some surprising results: when it comes to fermented foods, “the quality of organic food is not always better than conventional food.”

Organic vs. conventional agricultural production is a hotly debated topic – some reports indicate organic food is more nutritious, but other research suggests the nutritional differences are not significant. Meanwhile, fermented foods are scientifically-proven to include higher nutritional value. “During fermentation, the concentration of many bioactive compounds increases, and the bioavailability of iron, vitamin C, beta carotene, or betaine is also improved,” the study notes. Fermented products also “inhibit the development of pathogens in the digestive tract.”

Researchers at the Bydgoszcz University of Science and Technology in Poland questioned whether fermenting organic food would change its nutritional output versus using conventional food. Their results were published in the journal Molecules.

Analyzing fermented plants (pickles, sauerkraut, beet and carrot juices) and dairy (yogurt, kefir and buttermilk), researchers measured the vitamins, minerals and lactic acid bacteria in the items. They compared using organic ingredients in one group to products made from conventional ingredients.

“Research results do not clearly indicate which production system–conventional or organic–provides higher levels of bioactive substances in fermented food,” the study reads.

Results were mixed. Lactic acid bacteria – the good, healthy kind – were higher in organic sauerkraut, carrot juice, yogurt and kefir. Organic kraut and pickles produced more vitamin C than conventional versions. And calcium levels were higher in yogurt made with organic milk.

But, interestingly, lactic acid bacteria levels were higher in conventional pickles and beet juice. Conventional beet juice also had five times more beta-carotene (vitamin A).

Read more (Molecules)

LAB Makes Sour Cream Healthier

Adding fermented pickles to sour cream increases the health benefits of the cream, lowering cholesterol and increasing antioxidant properties, according to new research.

Scientists from the Poznań University of Life Sciences in Poland based their research on the French paradox, “the observation that… reduced heart disease is associated with a diet high in saturated fat and cholesterol.” They picked sour cream because of its high levels of saturated fat and cholesterol.

“The results also show that the health-promoting potential of sour cream is enhanced by the presence of metabolically active LAB,” continues the study, published in the Journal of Dairy Science.

The scientists note future work will revolve around characterizing the properties of specific lactic acid bacteria produced by spontaneous fermentation.

Read more (Medical and Life Sciences)

Cleveland Kitchen Acquires Sonoma Brinery

One of the under-the-radar stories from the recent Expo West was another acquisition in the fermented foods space, coming on the heels of the Bubbies and Wildbrine purchases. Ohio’s Cleveland Kitchen, producers of sauerkraut, kimchi, salad dressings and pickles, bought Healdsburg,Calif.-based Sonoma Brinery (makers with a similar line-up of pickles, kraut and pickled vegetables). No public announcement has been made, but executives from both companies confirmed the transaction to TFA. Sonoma Brinery founder/owner David Ehreth is expected to remain with the company. [Note – both Ehreth and Cleveland Kitchen’s Drew Anderson have been TFA Advisory Board members since the organization’s inception.]

- Published in Business

Retail Sales Trends for Fermented Products

Miso, frozen yogurt and pickled and fermented vegetables are driving growth in the $10.97 billion fermented food and beverage category. The fermented products space grew 3.3% in 2021, outpacing the 2.1% growth achieved by natural products overall.

“It really highlights how functional products have become the norm for shoppers when they’re in stores,” says Brittany Moore, Data Product Manager for Product Intelligence at SPINS LLC, a data provider for natural, organic and specialty products. Moore notes there’s an “explosion of functional products” in the market — “[they] are appearing everywhere. And fermented products have been leading that space in the natural market for years.”

The data was shared during TFA’s conference, FERMENTATION 2021. SPINS worked with TFA to drill into data covering 10 fermented product categories and 64 product types (an increase from last year). [A note that wine, beer and cheese sales are excluded from the data. These categories are very large, and would obscure trends in smaller segments. Wine, beer and cheese are also well-represented by other organizations.]

Yogurt dominates the fermented food and beverage landscape with 75% of the market, but sales growth is soft. Frozen yogurt and plant-based offerings, though small portions of the yogurt category, are fueling what growth there is. “Novelty products are catching shopper’s eyes,” Moore notes.

Kombucha, the fermented tea which led the U.S. retail revival of fermented products, still rules the non-alcoholic fermented beverages market, with 86% of sales. But growth is slowing. Moore points out that this slowdown is due to kombucha having penetrated the mass market with lots of brands on grocery shelves.

“There’s opportunity in kombucha for new innovations to catch the progressive shopper’s eye,” Moore says. “Shoppers are looking for an innovative twist to their functional product.”

Moore points to successful twists like hard kombucha, which grew nearly 60%, and probiotic sodas, which grew 31%.

Growth is slowing for hard cider, too, though hard cider leads the alcoholic beverages category with 83% share of sales.

All sectors of the pickled and fermented vegetables category are growing, totalling nearly $563 million in sales. Refrigerated products are nine of the top 10 subcategories here. The “other” pickled vegetable subcategory is increasing at a 60% growth rate, “other” being the catch-all for vegetables that are not cucumbers, cabbage, carrots, tomatoes, beets or ginger. Fermented radish, garlic and seaweed fall into this subcategory.

Soy sauce is not surprisingly still the largest product in sauces, representing 58% of the category. But that share is dropping. Gochujang is the growth leader, increasing at rate of nearly 20%.

Miso and tempeh are also performing well, which Moore attributes to the growing plant-based movement and the Covid-19 pandemic pantry stocking boom. Miso products — soups, broths, pastes and mixes — totaled over $24 million in sales in 2021. Though instant soups and meal cups represented only 8% of sales, they grew more than 110%.

- Published in Business

Fermentation Tourism

The state of Pennsylvania has created a unique tourist experience, Pickled: A Fermented Trail. The self-guided, culinary tour showcases fermented food and drink from around the state.

The fermented trail is broken into five regional itineraries, and includes historic businesses, artisanal food makers and large producers. Stops range from an Amish gift shop that ferments root beer to a master chocolatier, from a kombucha taproom to a fermentation-focused restaurant, and from a fourth-generation cheesemaker to a convenience store that makes its own pickles, sauerkraut and vinegar. Mary Miller, cultural historian and professor, spent two years designing the trail.

“Cultured foods have been part of PA’s culinary culture since the beginning,” reads the Visit Pennsylvania Pickled: A Fermented Trail website. “Many groups that have migrated to Pennsylvania throughout history were fond of fermented foods for both health and flavor, as well as for preserving food through the winter.”

The website also features a history of fermented food and drink, both regionally and globally. It shares a brief overview of root beer, which was created in Pennsylvania as a sassafras-based, yeast-fermented root tea. And it notes that, while Germans brought sauerkraut to the state, the Chinese are believed to have been the first to ferment cabbage.

The fermented trail is one of Pennsylvania’s four new culinary road trips, along with those highlighting charcuterie, apples and grains. These paths aim to showcase the state’s culinary history, and preserve its foodways.

This unique culinary adventure — the first we have seen at TFA — could be a model for tourism in other states and countries.

Read more (Food & Wine)

- Published in Business

The Rise of Fermented Foods and -Biotics

Microbes on our bodies outnumber our human cells. Can we improve our health using microbes?

“(Humans) are minuscule compared to the genetic content of our microbiomes,” says Maria Marco, PhD, professor of food science at the University of California, Davis (and a TFA Advisory Board Member). “We now have a much better handle that microbes are good for us.”

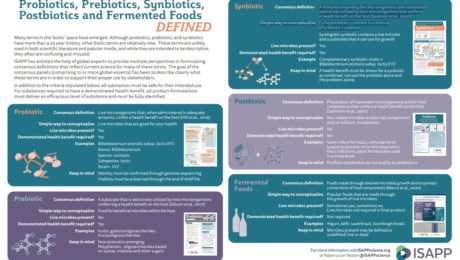

Marco was a featured speaker at an Institute for the Advancement of Food and Nutrition Sciences (IAFNS) webinar, “What’s What?! Probiotics, Postbiotics, Prebiotics, Synbiotics and Fermented Foods.” Also speaking was Karen Scott, PhD, professor at University of Aberdeen, Scotland, and co-director of the university’s Centre for Bacteria in Health and Disease.

While probiotic-containing foods and supplements have been around for decades – or, in the case of fermented foods, tens of thousands of years – they have become more common recently . But “as the terms relevant to this space proliferate, so does confusion,” states IAFNS.

Using definitions created by the International Scientific Association for Postbiotics and Prebiotics (ISAPP), Marco and Scott presented the attributes of fermented foods, probiotics, prebiotics, synbiotics and postbiotics.

The majority of microbes in the human body are in the digestive tract, Marco notes: “We have frankly very few ways we can direct them towards what we need for sustaining our health and well being.” Humans can’t control age or genetics and have little impact over environmental factors.

What we can control, though, are the kinds of foods, beverages and supplements we consume.

Fermented Foods

It’s estimated that one third of the human diet globally is made up of fermented foods. But this is a diverse category that shares one common element: “Fermented foods are made by microbes,” Marco adds. “You can’t have a fermented food without a microbe.”

This distinction separates true fermented foods from those that look fermented but don’t have microbes involved. Quick pickles or cucumbers soaked in a vinegar brine, for example, are not fermented. And there are fermented foods that originally contained live microbes, but where those microbes are killed during production — in sourdough bread, shelf-stable pickles and veggies, sausage, soy sauce, vinegar, wine, most beers, coffee and chocolate. Fermented foods that contain live, viable microbes include yogurt, kefir, most cheeses, natto, tempeh, kimchi, dry fermented sausages, most kombuchas and some beers.

“There’s confusion among scientists and the public about what is a fermented food,” Marco says.

Fermented foods provide health benefits by transforming food ingredients, synthesizing nutrients and providing live microbes.There is some evidence they aid digestive health (kefir, sourdough), improve mood and behavior (wine, beer, coffee), reduce inflammatory bowel syndrome (sauerkraut, sourdough), aid weight loss and fight obesity (yogurt, kimchi), and enhance immunity (kimchi, yogurt), bone health (yogurt, kefir, natto) and the cardiovascular system (yogurt, cheese, coffee, wine, beer, vinegar). But there are only a few studies on humans that have examined these topics. More studies of fermented foods are needed to document and prove these benefits.

Probiotics

Probiotics, on the other hand, have clinical evidence documenting their health benefits. “We know probiotics improve human health,” Marco says.

The concept of probiotics dates back to the early 20th century, but the word “probiotic” has now become a household term. Most scientific studies involving probiotics look at their benefit to the digestive tract, but new research is examining their impact on the respiratory system and in aiding vaginal health.

Probiotics are different from fermented foods because they are defined at the strain level and their genomic sequence is known, Marco adds. Probiotics should be alive at the time of consumption in order to provide a health benefit.

Postbiotics

Postbiotics are dead microorganisms. It is a relatively new term — also referred to as parabiotics, non-viable probiotics, heat-killed probiotics and tyndallized probiotics — and there’s emerging research around the health benefits of consuming these inanimate cells.

“I think we’ll be seeing a lot more attention to this concept as we begin to understand how probiotics work and gut microbiomes work and the specific compounds needed to modulate our health,” according to Marco.

Prebiotics

Prebiotics are, according to ISAPP, “A substrate selectively utilized by host microorganisms conferring a health benefit on the host.”

“It basically means a food source for microorganisms that live in or on a source,” Scott says. “But any candidate for a prebiotic must confer a health benefit.”

Prebiotics are not processed in the small intestine. They reach the large intestine undigested, where they serve as nutrients for beneficial microorganisms in our gut microbiome.

Synbiotics

Synbiotics are mixtures of probiotics and prebiotics and stimulate a host’s resident bacteria. They are composed of live microorganisms and substrates that demonstrate a health benefit when combined.

Scott notes that, in human trials with probiotics, none of the currently recognized probiotic species (like lactobacilli and bifidobacteria) appear in fecal samples existing probiotics.

“There must be something missing in what we’re doing in this field,” she says. “We need new probiotics. I’m not saying existing probiotics don’t work or we shouldn’t use them. But I think that now that we have the potential to develop new probiotics, they might be even better than what we have now.”

She sees great potential in this new class of -biotics.

Both Scott and Marco encouraged nutritionists to work with clients on first improving their diets before adding supplements. The -biotics stimulate what’s in the gut, so a diverse diet is the best starting point.

New FDA Requirements for Fermented Food

By August, any manufacturer labeling their fermented or hydrolyzed foods or ingredients “gluten-free” must prove that they contain no gluten, have never been through a process to remove gluten, all gluten cross-contact has been eliminated and there are measures in place to prevent gluten contamination in production.

The FDA list includes these foods: cheese, yogurt, vinegar, sauerkraut, pickles, green olives, beers, wine and hydrolyzed plant proteins. This category would also include food derived from fermented or hydrolyzed ingredients, such as chocolate made from fermented cocoa beans or a snack using olives.

Read more (JD Supra Legal News)

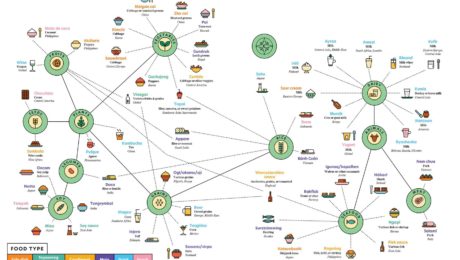

The World of Fermented Foods

In the latest issue of Popular Science, a creative infographic illustrates “the wonderful world of fermented foods on one delicious chart.” It represents “a sampling of the treats our species brines, brews, cures, and cultures around the world,” and is particularly interesting as it shows mainstream media catching on to fermentation’s renaissance. Fermentation fit with the issue’s theme of transformation in the wake of the pandemic.

Read more (Popular Science)

- Published in Food & Flavor