Zilber: Fermentation’s Endless Potential

David Zilber says the potential for fermented food is endless. “There isn’t any sort of food that doesn’t benefit from some aspect of fermentation,” he said. “There’s really no limitation to its application.”

Zilber, the former head of the Noma fermentation lab, co-authored “The Noma Guide to Fermentation” with Noma founder Rene Redzepi. In the fall of 2020, Zilber surprised the food world when he left his job at Noma to join Chr. Hansen, a global supplier of bioscience ingredients.

He shared his insight on fermentation on The Food Institute Podcast. An Oxford study found over 30% of the world’s food has been touched by microbes. Zilber, a microbe champion, says one of the best parts of fermenting with plant-based ingredients is the microbes don’t need to change.

“We do need to find ways to adapt them to new sources, but there will always be a place within the pie chart of what humans are eating on earth for fermentation,” he says.

Part of Zilber’s work at Chr. Hansen is in the plant-based protein alternative segment, fermenting plant ingredients to “bring this other set of characteristics” to a new food item. He advises fermenters using plant-based ingredients to make their ingredient list concise and pronounceable to consumers.

“I am a huge proponent for formulating recipes from whole ingredients,” Zilber says. “Keeping the ingredient list short and concise and using natural processes to achieve flavor or textual properties … because it is the healthiest way to eat.”

Across the spectrum of fermentation, he feels fermented beverages is the category where he sees the greatest opportunity.

Read more (The Food Institute)

- Published in Food & Flavor

Kombucha Sales Crawl

Two years after kombucha sales began to clock double-digit growth during the pandemic, sales are slowing, increasing only 1% over the last 52 weeks. But kombucha is still the sales leader in the fermented, non-alcoholic beverage space, representing nearly 85% of the category.

Kombucha pioneered the refrigerated functional beverage industry. For years it was one of the few beverages in the fermented, non-alcohol beverage space. But now there’s competition from new functional drinks — like prebiotic- and probiotic-infused sodas — that are diverting sales from kombucha.

“The consumer really is not OK with just drinking water. They want functionality out of everything they consume,” says Caroline Davidson, director of channel partnerships at SPINS (a data provider for natural, organic and specialty products). “Non-alcoholic beverages are traditionally not healthy options. To see that kombucha is actually one of the few segments contributing to double-digit growth (in that category), it’s really refreshing and encouraging.”

Those numbers were presented at KombuchaKon, the conference and trade show produced by Kombucha Brewers International (KBI). The event had been virtual the last two years, and brewers were anxious to meet in person again. Hundreds of brewers and brand leaders converged last week in Long Beach, Calif.

Here are highlights from SPINS’s kombucha market analysis.

Functional Beverages Grow

Refrigerated functional beverages are a top growth category across all sales channels — natural products stores, regional groceries and multi-outlet retailers (MULO) like WalMart, Target and CVS. Beverages made with -biotic cultures, high fiber sodas, water kefir sodas, drinking vinegars, kvass and tepache are all part of that growing category — and they compete with kombucha.

Shelf-stable functional beverages are growing even more quickly. For example, in the natural channel, sales of these drinks have increased nearly 25%, versus 4% for their refrigerated counterparts.

“It may not be refrigerated, but it still may be competition to a kombucha,” Davidson says.

Major Brands Diversify

Kombucha-adjacent products — like powdered kombucha and kombucha-flavored yogurt bites — are entering the market. So are kombuchas with no sugar or less than 1 gram of sugar.

“I am consistently seeing no sugar options in fermented beverages, which I know I’m speaking to an audience that already knows this, but fermentation doesn’t happen without sugar,” Davidson says. She notes more and more beverage categories “are seeing differentiation within probiotics of fermentation.”

Of the five fastest growing kombucha brands,— only two – Wild Tonic and Better Booch – are selling just traditional kombucha or hard kombucha. The other three – Humm, Health-Ade and Rowdy Mermaid – have added new product lines. Humm and Health-Ade sell prebiotic sodas and Rowdy Mermaid offers tonics.

Health-Ade is marketing their brand as a “gut health beverage” instead of simply kombucha. In a statement, Health-Ade CEO and co-founder Diana Trout says: “We have seen a dramatic increase in consumer interest in gut health over the past year as people begin to realize just how important gut health is to immunity and overall health. We wanted to offer our customers something that doesn’t compromise on taste and has legitimate gut health benefits, and (our new prebiotic drink) Pop does just that.”

Defining the Product

KBI has been well aware of changes in the category. Two years ago, it released the kombucha Code of Practice, the first set of safety and quality standards for the industry.

“Kombucha” is not a protected product name, unlike “tequila” or “champagne.” With the code, KBI aims to protect kombucha as a traditional fermented beverage. But KBI also doesn’t want to eliminate kombucha brands that may pasteurize and sell in shelf-stable cans, process from a base or brew with sweeteners.

Joshua Rood, CEO and managing director of Dr Hops hard kombucha, attended the SPINS presentation and thinks KBI “is standing in the right place.”

“First, we have to define what kombucha is. And then how you label variations of that, like if it’s filtered or pasteurized. Then you can actually have clarity and transparency for consumers so they actually know what they’re getting,” Rood says. “Right now, we don’t have that. It’s very rough, it’s essentially just an honor system.”

Rood emphasizes he has no problem with kombucha brands not brewing with traditional methods. But he says there needs to be a classification system and transparent labeling of how a kombucha is made. “There’s a lot of room for education,” he says.

Dr Hops, for example, prints a nutrition fact panel and calorie listing on their hard kombucha, even though most beer, wine and spirits are not legally required to do so.

“We try to be massively over-communicative on our labels,” Rood says. “And, if you’re looking at our labels from a calorie stance, it doesn’t look good because we have such high alcohol content. We’re not competitive in calories. But if we put it on there, people will learn that it’s 10% alcohol and most of the calories come from the alcohol.”

Shift in Retail Channels

Sales in natural stores – the retail channel that helped launch the kombucha industry have slowed, actually declining 5% over the past year. . But sales over the same period grew 3% in MULO outlets and 2% at convenience stores.

“People are still trying to find outlets where they can get everything in one trip,” Davidson says. “We’re seeing a lot more consolidation of what people are purchasing in one trip or fewer trips per month.”

Hard Kombucha “Massively Outperforming”

SPINS’s “flavored malt beverages” category includes a number of alcoholic drinks that don’t contain malt. While hard seltzers have long dominated here, six of the 10 fastest-growing brands in natural retailers are now hard kombucha brands: Boochcraft, Flying Embers, June Shine, Kyla, Strange Beast and Nova Easy.

“Natural retailers are fully embracing this as a new category and it’s paying off exponentially,” Davidson says.

Hard kombucha sales are still small overall, at $58.31 million, are driving growth in the category and “massively outperforming hard cider,” Davidson says. Dollar growth for hard kombucha is almost 60%, while sales of hard cider are declining. Sales for the hard seltzer – including category leaders White Claw and Truly – are also slipping in all retail channels.

- Published in Business

“Consumers Have Changed” — State of Natural & Organic Industry

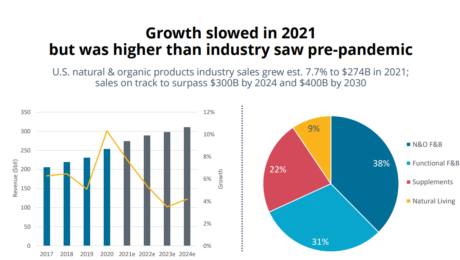

After the pandemic pantry stock-up of 2020, when grocery food purchases skyrocketed, sales of U.S. natural and organic products have slowed. Sales increased 7.7% to $274 billion in 2021. That’s a lower growth rate than the 13% pace seen at the height of the pandemic in 2020, but still higher than the pre-pandemic level of 5.3%. Sales are forecast to exceed $400 billion by 2030.

“For an industry that was always called a fad and a niche, to be able to hit $400 billion by 2030 just indicates that we have moved mainstream, ”said Carlotta Mast, senior vice president of the New Hope Network (a division of Informa PLC), which produces Natural Products Expo West. The stats were presented during the expo’s State of Natural & Organic Industry presentation.

Speaking to a standing-room only crowd, industry experts shared how the Covid-influenced sales boost will stay because “consumers have changed.”

“They’re paying more attention to their health and wellness, they’re investigating new brands, they’re cooking more at home and this is creating longer-term opportunities for this industry,” Mast said.

After a two-year hiatus, 2022 marked the return of Expo West, the largest natural products show.The event was smaller than in pre-pandemic times. There were 57,000 attendee registrations this year, versus 86,000 in 2019; 2,700 exhibitors, compared with 3,600.

Kathryn Peters, executive vice president at SPINS (a data provider for natural, organic and specialty products), said wellness-positioned brands are the main source of CPG growth and innovation. She cited that, while wellness products represent only 25% of the market, they produce 68% of growth.

“The pursuit of wellness is driving this industry and its changing consumers,” Peters said. “People are paying attention to what they’re putting in and on our bodies.”

Functional Flourishing

The natural, organic and functional food and beverage category — where fermented products reside — drives nearly 70% of natural product sales. Functional food and beverage sales grew 8.3% to $83.78 billion in 2021. Functional beverages, frozen foods and snacks are the top selling items in the functional space.

From kombucha to kraut, from chocolate to yogurt, dozens of fermented brands exhibited at this year’s event.

Esther Lee, CEO of Korean fermented tea brand IDO tea (a long-time participant in Expo West), doesn’t think it’s wellness attributes that initially attract consumers to functional beverages. She says it’s packaging and ingredients.

“Later on they usually realize their body feels different after using our products for weeks,” Lee said.. IDO Tea is currently sold in Korea, online on Amazon and in small shops in Los Angeles. It was at Expo West looking for a U.S. distributor.

New brand Miso Good attended the show as a relaunch. Founder Rhonda Cole began the woman-owned, start-up company with her daughter Lauren in 2019. The Florida-based brand then took a hiatus during the Covid-19 pandemic.

“It has been difficult the past few years,” Cole said, adding she hopes to find success at the show. “Our motto is ‘ancient superfoods for the everyday eater’ and our fermented miso is great as a soup, sauce or condiment.”

It was the first Expo West for Local Culture Live Ferments, a Northern California brand that sells small batch sauerkraut, kimchi, hot sauce and brine tonic.

“We’re too small to be big, but too big to be small. We’re in this in-between stage and that’s very much why we’re here, to break through that threshold and get our product out to people,” said Chris Frost-McKee, director of operations. Local Culture was one of 40 brands selected by food distributor KeHe at their TrendFinder Event (read more about Local Culture in TFA’s Q&A). “We were maxing out our range with our current distribution. Our goal here was to open doors and make connections, and we’ve accomplished that.”

- Published in Business, Food & Flavor

Expo West Returns

In March 2020, Natural Products Expo West became one of the first casualties in the U.S. events world, shut down by the outbreak of Covid-19 even as booths were being set up in Anaheim. Now, two years later, Expo West returns to Orange County with natural food exhibitors from around the world. TFA staff and advisory board members will also be in attendance.

In 2019, the enormous spring trade show attracted around 88,000 registrations; this year, that number is estimated at 55,000-60,000. Show producer New Hope Network (part of London-based Informa PLC) is also including a virtual option for attendees still unable or unwilling to travel.

The trends at this year’s event are being driven by Millennial and Gen Z consumers. New Hope put a spotlight on six top themes in a recent webinar:

No. 1: Functional Ingredients. “Health and wellness products make up a quarter of the volume of the industry but represent two-thirds of all growth,” said SPINS Data Analyst Scott Dicker. “We’re seeing consumers pushing for individual pursuit of wellness across channels.”

No. 2: Organic & Regenerative. Food that focuses on performance nutrition, food made with ashwagandha or food with paleo ingredients are driving growth for organic and regenerative products. Sodas and carbonated beverages are also helping organic products grow, “one of the last ‘junk food’ categories penetrated by natural and organic,” Dicker said. Gut health sodas, especially.

No. 3: Climate and Sustainability. Media headlines are declaring carbon as the new calorie. Consumer surveys speak to that — 70% will pay more for “premium, sustainable, climate-friendly products” and 80% want brands to educate them on their roles in climate issues. Companies are changing ingredient sources and product packaging to be more environmentally-friendly.

No. 4: Diversity. “Over the past couple years, we’ve seen tremendous growth in women, minority, NGLCC (National LGBT Chamber of Commerce) certified and veteran-owned businesses and you’re going to see it all over the show floor,” Dicker said.

No. 5: Plant-Based Innovation. Plant-based eating has skyrocketed over the last five years. “But plant-based alone isn’t enough anymore. What are plant-based brands doing to keep up with innovation?” Dicker said.

No. 6: Sustainable Meat & Dairy. Though the sustainable meat and dairy category is down 2.1%, pockets of it are growing, specifically grass-fed, fair trade and animal welfare and sustainability claims. Innovations are coming from small and local farms.

Read more (New Hope Network)

- Published in Business, Food & Flavor

Bubbling Over: Pandemic Sourdough

Homebound during the Covid-19 outbreak, budding home bakers around the globe made sourdough baking their new hobby. Hailed as the “breakout star of pandemic-era kitchens” by The New York Times, sourdough became a national fascination as more people experimented with the microbe-enabled, tangy bread.

We asked three experts to share their thoughts on the sourdough craze — educator Vanessa Kimbell (of The Sourdough School), bakery owner Azikiwee Anderson (Rize Up Bakery) and Karl De Smedt, curator of the world’s only sourdough starter library.

The question: How did the pandemic change the market for professionally-baked sourdough? Are more people making their own or are they buying from professional bakers?

Vanessa Kimbell, founder The Sourdough School

The pandemic changed the market in several ways. The first thing is, some of the large manufacturers that I’ve been talking to have been starting to appreciate and understand that people want real sourdough. And by that I mean sourdough that is genuinely long, slow fermented with wild yeast and lactic acid bacteria. They’ve also begun to appreciate the connection between bread and health. Authenticity and integrity are the two words that come to my mind when I think about how the pandemic has impacted the professional sourdough market.

There’s no question that there was an exponential increase in home bakers making sourdough during the pandemic. It’s rather beautiful. I think when we were gifted the time to make those connections, so many of us used that. Will there be sudden change in behavior? People have now gone back to work and now I’d say there’s almost been a backlash against people wanting to take up sourdough. It became almost too trendy to the point where there can be a backlash. I have noticed there was a significant drop off as life has returned to normal. But that’s only to be expected. The joy of discovering we have a little freedom as a home baker making their own bread, I’d say it’s leveling back out again to pre-pandemic numbers.

Azikiwee Anderson, founder Rize Up Bakery

I started baking like most of the world did during the pandemic. Normally we would all just go to the store and pick up whatever mediocre bread they had on hand, never thinking twice [that] it was full of preservatives and made with cheap industrial flour. Then all of sudden we had the thing that is always in short supply “TIME”! So we all tried to connect to the nostalgia of being self-sufficient since we had no real control over most things.

The sheer amount of people connecting to their food and what it is made of is what made it amazing for small new found bakers like me! The uptick in sourdough baking taught millions of people how hard it is and how good it could be. What more is there to say!

Karl De Smedt, curator The Sourdough Library, senior communication and training manager Puratos Center for Bread Flavour

Many consumers today are excited about sourdough bread. During the pandemic, many have started baking it at home and, on social media, sourdough reached a massive peak as a sign of consumer engagement. No wonder because it truly has a unique, rich taste. According to research by Puratos, 52% of today’s consumers know sourdough . Approximately 45% of consumers associate sourdough with “better taste” and nearly 30% associate sourdough with “Rustic,” “Healthier,” and “More Natural” – opening an excellent opportunity for value creation.

For professionally-baked sourdough, there are immense opportunities. The most considerable evolution we see is that it will not matter who makes the bread in the future, but how it’s made — going from fast processes in two to three hours with only baker’s yeast. Or long processes with sourdough from 12 to 48 hours. A project like the Puratos sourdough library aims to discover more about the use of sourdough in all its aspects. We are sharing knowledge, preserving, and protecting the biodiversity of sourdough and bringing back the tradition used by more than 250 generations of bakers who used sourdough as their most precious ingredient in bread baking. That’s why, at Puratos, we believe the future of bread lies in its past.

- Published in Business, Food & Flavor, Health

“More Brew, Less Buzz”

The craft beer industry has been dominated by strong brews or alcohol-free varieties. The New York Times highlights how “craft brewers are increasingly aiming for the sweet spot in the middle.” Low-alcohol beers are growing in popularity, appealing to consumers who want moderation not abstinence.

“There’s just this completely unexplored space,” says Sean Boisson. He started Bella Snow Soft Ale in California, which focuses on ales with no more than 2.4 percent ABV (about half the strength of a traditional beer). Christophe Gagné, owner and brewmaster of Jack’s Abby Craft Lagers in Massachusetts, created a series of low-alcohol beers he calls the 2% Beer Initiative, which has become a bestseller. “I would much rather have two beers and not fall over,” he adds.

The trend is reflecting the preferences of older beer drinkers. Their bodies can’t handle the aftereffects of alcohol and they want to ease back into their IRL responsibilities without a hangover.

“We’re not surprised that lower-ABV. beers are coming of age because, well, millennials are coming of age,” said Lester Jones, the chief economist for the National Beer Wholesalers Association.

Brewers note low-alcohol beer is a challenge. A beer with less alcohol is not easier or even cheaper to produce. Low-ABV beers require less malt (the grains supplying the sugars that are fermented into alcohol) but, if hops are too plentiful, the flavor becomes bitter. And a quality low-alcohol beer also can’t be watery.

Read more (The New York Times)

- Published in Food & Flavor

Retail Sales Trends for Fermented Products

Miso, frozen yogurt and pickled and fermented vegetables are driving growth in the $10.97 billion fermented food and beverage category. The fermented products space grew 3.3% in 2021, outpacing the 2.1% growth achieved by natural products overall.

“It really highlights how functional products have become the norm for shoppers when they’re in stores,” says Brittany Moore, Data Product Manager for Product Intelligence at SPINS LLC, a data provider for natural, organic and specialty products. Moore notes there’s an “explosion of functional products” in the market — “[they] are appearing everywhere. And fermented products have been leading that space in the natural market for years.”

The data was shared during TFA’s conference, FERMENTATION 2021. SPINS worked with TFA to drill into data covering 10 fermented product categories and 64 product types (an increase from last year). [A note that wine, beer and cheese sales are excluded from the data. These categories are very large, and would obscure trends in smaller segments. Wine, beer and cheese are also well-represented by other organizations.]

Yogurt dominates the fermented food and beverage landscape with 75% of the market, but sales growth is soft. Frozen yogurt and plant-based offerings, though small portions of the yogurt category, are fueling what growth there is. “Novelty products are catching shopper’s eyes,” Moore notes.

Kombucha, the fermented tea which led the U.S. retail revival of fermented products, still rules the non-alcoholic fermented beverages market, with 86% of sales. But growth is slowing. Moore points out that this slowdown is due to kombucha having penetrated the mass market with lots of brands on grocery shelves.

“There’s opportunity in kombucha for new innovations to catch the progressive shopper’s eye,” Moore says. “Shoppers are looking for an innovative twist to their functional product.”

Moore points to successful twists like hard kombucha, which grew nearly 60%, and probiotic sodas, which grew 31%.

Growth is slowing for hard cider, too, though hard cider leads the alcoholic beverages category with 83% share of sales.

All sectors of the pickled and fermented vegetables category are growing, totalling nearly $563 million in sales. Refrigerated products are nine of the top 10 subcategories here. The “other” pickled vegetable subcategory is increasing at a 60% growth rate, “other” being the catch-all for vegetables that are not cucumbers, cabbage, carrots, tomatoes, beets or ginger. Fermented radish, garlic and seaweed fall into this subcategory.

Soy sauce is not surprisingly still the largest product in sauces, representing 58% of the category. But that share is dropping. Gochujang is the growth leader, increasing at rate of nearly 20%.

Miso and tempeh are also performing well, which Moore attributes to the growing plant-based movement and the Covid-19 pandemic pantry stocking boom. Miso products — soups, broths, pastes and mixes — totaled over $24 million in sales in 2021. Though instant soups and meal cups represented only 8% of sales, they grew more than 110%.

- Published in Business

Fermented Foods Top 2022’s Superfood List

For the fifth year in a row, fermented foods again top the Today’s Dietitian annual list of superfoods.

The 10th annual What’s Trending in Nutrition survey “reveals a wave of change resulting from the pandemic.” Public relations firm Pollock Communications, who conducted the survey for the magazine, surveyed 1,173 Registered Dietitian Nutritionists (RDNs) about trends for 2022. The “most surprising change from the past decade,” RDNs agreed, was “the shift from low-carb to high-fat diets…followed by plant-based eating.”

Health- and immunity-boosting food “will be the biggest trend in the next decade that will shape changes in the food industry.” Immunity support, affordability and emotional well-being are consumers’ top purchase drivers; convenience, healthy, taste, low-cost and natural are the top label attributes.

The label attribute “healthy” first made the top three list in 2019 “as consumers began to better understand the connection between food and overall well-being.” RDNs say the Covid-19 pandemic accelerated the healthy food trend.

“With the focus on health and immunity in the next decade, and the increased popularity of plant-based eating, nutrient-dense options will be an important part of consumer diets, as [consumers]embrace food as medicine to help prevent disease,” says Louise Pollock, president of Pollock Communications. “In addition, there will likely be an increased interest in functional foods containing ingredients that provide health benefits beyond their nutrient profile.”

Consumer desire for gut-boosting benefits pushed fermented foods to #1 on the list. Changes to the top 10 show salmon is out and ancient giants are in.

“The predictions of RDNs, the frontline experts in food and nutrition, are always reliable to help food and beverage manufacturers and marketers meet the demands of consumers. Our survey has accurately tracked health and wellness trends for a decade,” says Mara Honicker, publisher of Today’s Dietitian. “We are pleased to have been able to share these insights for the past ten years and especially during this chaotic time in our lives, when food is playing such a major role in providing health, wellness and emotional support.”

The full superfoods list is:

- Fermented foods, like yogurt and kefir

- Blueberries

- Seeds, like chia and hemp

- Exotic fruit, like acai and golden berries

- Avocados

- Green tea

- Nuts

- Ancient grains

- Leafy greens, like spinach

- Kale

To read all the takeaways from the 2022 survey, check out the Pollock Communications press release.

- Published in Food & Flavor, Health

Kombucha for the Skin

Will 2022 be the year of fermented cosmetics? Market research firm WGSN thinks so. As consumers continue to desire natural cosmetics and Korean and Japanese skincare products, fermentation is a leading trend in the cosmetics industry.

Consumers want to protect their skin from environmental stresses and restore skin’s youthful glow and use potent ingredients that last longer, both factors fermentation addresses. WGSN calls the fermented beauty trend as “kombucha for the skin”

“…fermentation releases enzymes that break down molecules so they can better penetrate the skin, delivering powerful ingredients into the very structure of the skin or hair. The process of fermentation also cultivates the growth of beneficial bacteria such as lactic, organic and acetic acids, which act as natural preservatives,” according to WGSN. “These naturally occurring bacterias prolong the shelf life of formulas, appealing to both the sustainably minded and value-focused consumer.”

Smaller, niche brands already offer cosmetics using fermented ingredients. Gallinée’s hair cleansing cream is enriched with fermented rice water and Innisfree makes fermented soy masks.

Read more (Premium Beauty News)

- Published in Business

Definition & History of Fermentation

“Human civilization simply would not have been possible without fermented foods and beverages…we’re here today because fermented foods have been popular for humans for at least 10,000 years,” says Bob Hutkins, professor of food science at the University of Nebraska (and a recent addition to TFA’s Advisory Board).

Hutkins was the opening keynote speaker at FERMENTATION 2021, The Fermentation Association’s first international conference. His presentation explored the history, definition and health benefits of fermented foods.

Cultured History

The topic of fermentation extends to evolution, archaeology, science and even the larger food industry.

“The discipline of microbiology began with fermentation, all the early microbiologists studied fermentation,” Hutkins says.

Louis Pasteur patented his eponymous process, developed to improve the quality of wine at Napoleon III’s request. The microbes studied back then — lactococcus, lactobacillus and saccharomyces — remain the most studied strains.

“What interested those early microbiologists — namely how to improve food and beverage fermentation, how to improve their productivity, their nutrition — are the very same things that interest 21st century fermentation scientists,” Hutkins says.

Hutkins is the author of one of the books considered gospel in the industry, “Microbiology and Technology of Fermented Foods.” He says that fermented foods defined the food industry. In its early days, it was small-scale, traditional food production that “we call a craft industry now.” At the time, food safety wasn’t recognized as a microbiological problem.

Today’s modern food industry manufactures on a large-scale in high throughput factories withmany automated processes. Food safety is a priority and highly regulated. And, thanks to developments in gene sequencing, many fermented products are made with starter cultures selected for their individual traits.

“But I would say that there’s been kind of a merging between these traditional and modern approaches to manufacturing fermented foods, where we’re all concerned about time sensitivity, excluding contaminants, making sure that we have consistent quality, safety is a vital concern and extensive culture knowledge,” Hutkins says.

Defining & Demystifying

Fermentation — “the original shelf-life foods” — is experiencing a major moment. “Fermented foods in 2021 check all the topics” of popular food genres: artisanal, local, organic, natural, healthy, flavorful, sustainable, entrepreneurial, innovative, hip and holistic. “They continue to be one of the most popular food categories,” Hutkins continues.

Interest in fermentation is reaching beyond scientists, to nutritionists and clinicians. But Hutkins says he’s still surprised to learn how many professionals don’t understand fermentation. To address the confusion, a panel of interdisciplinary scientists created a global definition of fermented foods in March 2021.

“Fermentation was defined with these kind of geeky terms that I don’t know that they mean very much to anybody,” he says.

The textbook biochemical definition of fermentation that a microbiologist learns in Biochemistry 101 doesn’t work for a nutritionist or clinician focusing on fermentation’s health benefits. The panel, which spent a year coming to a consensus, wanted a definition that would simply illustrate “raw food being converted by microbes into a fermented food.” The new definition, published in the the journal Nature and released in conjunction with the International Scientific Association for Probiotics and Prebiotics (ISAPP), reads: “Foods made through desired microbial growth and enzymatic conversions of food components.”

Fermentation in 2022

Hutkins predicts 2022 will see more studies addressing whether there are clinical health benefits from eating fermented foods. The groundbreaking study on fermented foods at Stanford was important. It found that a diet high in fermented foods increases microbiome diversity, lowers inflammation, and improves immune response. But research like this is expensive, so randomized control trials are few.

Fermented foods could also make their way into dietary guidelines.

“Fermented foods, including those that contain live microbes, should be included as part of a healthy diet,” Hutkins says.

- Published in Food & Flavor, Science