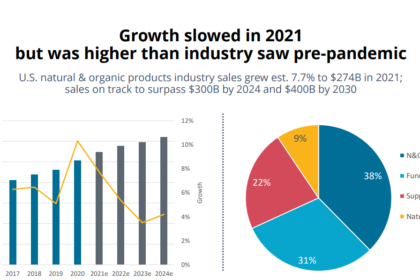

After the pandemic pantry stock-up of 2020, when grocery food purchases skyrocketed, sales of U.S. natural and organic products have slowed. Sales increased 7.7% to $274 billion in 2021. That’s a lower growth rate than the 13% pace seen at the height of the pandemic in 2020, but still higher than the pre-pandemic level of 5.3%. Sales are forecast to exceed $400 billion by 2030.

“For an industry that was always called a fad and a niche, to be able to hit $400 billion by 2030 just indicates that we have moved mainstream, ”said Carlotta Mast, senior vice president of the New Hope Network (a division of Informa PLC), which produces Natural Products Expo West. The stats were presented during the expo’s State of Natural & Organic Industry presentation.

Speaking to a standing-room only crowd, industry experts shared how the Covid-influenced sales boost will stay because “consumers have changed.”

“They’re paying more attention to their health and wellness, they’re investigating new brands, they’re cooking more at home and this is creating longer-term opportunities for this industry,” Mast said.

After a two-year hiatus, 2022 marked the return of Expo West, the largest natural products show.The event was smaller than in pre-pandemic times. There were 57,000 attendee registrations this year, versus 86,000 in 2019; 2,700 exhibitors, compared with 3,600.

Kathryn Peters, executive vice president at SPINS (a data provider for natural, organic and specialty products), said wellness-positioned brands are the main source of CPG growth and innovation. She cited that, while wellness products represent only 25% of the market, they produce 68% of growth.

“The pursuit of wellness is driving this industry and its changing consumers,” Peters said. “People are paying attention to what they’re putting in and on our bodies.”

Functional Flourishing

The natural, organic and functional food and beverage category — where fermented products reside — drives nearly 70% of natural product sales. Functional food and beverage sales grew 8.3% to $83.78 billion in 2021. Functional beverages, frozen foods and snacks are the top selling items in the functional space.

From kombucha to kraut, from chocolate to yogurt, dozens of fermented brands exhibited at this year’s event.

Esther Lee, CEO of Korean fermented tea brand IDO tea (a long-time participant in Expo West), doesn’t think it’s wellness attributes that initially attract consumers to functional beverages. She says it’s packaging and ingredients.

“Later on they usually realize their body feels different after using our products for weeks,” Lee said.. IDO Tea is currently sold in Korea, online on Amazon and in small shops in Los Angeles. It was at Expo West looking for a U.S. distributor.

New brand Miso Good attended the show as a relaunch. Founder Rhonda Cole began the woman-owned, start-up company with her daughter Lauren in 2019. The Florida-based brand then took a hiatus during the Covid-19 pandemic.

“It has been difficult the past few years,” Cole said, adding she hopes to find success at the show. “Our motto is ‘ancient superfoods for the everyday eater’ and our fermented miso is great as a soup, sauce or condiment.”

It was the first Expo West for Local Culture Live Ferments, a Northern California brand that sells small batch sauerkraut, kimchi, hot sauce and brine tonic.

“We’re too small to be big, but too big to be small. We’re in this in-between stage and that’s very much why we’re here, to break through that threshold and get our product out to people,” said Chris Frost-McKee, director of operations. Local Culture was one of 40 brands selected by food distributor KeHe at their TrendFinder Event (read more about Local Culture in TFA’s Q&A). “We were maxing out our range with our current distribution. Our goal here was to open doors and make connections, and we’ve accomplished that.”