FERMENTATION 2021 Wrap-Up

Nearly 300 individuals from around the world participated in The Fermentation Association’s first conference, FERMENTATION 2021. The virtual event included 35 educational keynotes, presentations, and panel discussions from more than 60 speakers over three days. Topics ranged from the science of fermentation to the art of fermenting to create flavor, from how fermented products are selling at retail to what’s next in the world of fermentation.

“I’ve been in this field for 40 years and, in all honesty, this is one of the biggest honors I’ve received, to be the speaker for this opening meeting of this really cool organization,” said Bob Hutkins, professor of food science at the University of Nebraska. Hutkins presented the conference’s opening keynote, Definition & History of Fermented Foods.

Over five years ago, John Gray, TFA’s founder, envisioned a trade show for producers of fermented foods and beverages, to make those artisanal items a more prominent part of the retail space. John connected with Neal Vitale, TFA Executive Director, and the organization was born out of their collective vision. TFA has grown, with a robust website, biweekly newsletter,a series of webinars and, now, an international conference. TFA has an Advisory Board that includes food and beverage producers, academics and researchers, and food and flavor educators and authors. TFA has formed working relationships with a number of other like-minded trade associations and organizations, and established a Buyers Council to create an active dialogue with food and beverage distributors, brokers and retailers.

“I have to tell you what a thrill it is to have you all here to witness and to participate in the beginning of a dream coming true,” added Gray in his welcoming remarks. Gray is the chairman and CEO of Katalina Holding Co., a food incubator and parent company of Bubbies Pickles.

FERMENTATION 2021 content paralleled TFA’s primary missions: first, help consumers better understand fermentation and its potential health benefits; second, work to improve health and safety regulations as they pertain to fermented products and third, connect the science and health research communities with producers, supporting scientific research and for a better understanding of the “state of the art.”

What made FERMENTATION 2021 unique is that it was the first event to bring together everyone involved in the world of fermentation — producers, retailers, chefs, scientists, authors, suppliers and regulators. The conference was not a how-to fermentation education event, as TFA feels there are numerous, effective resources for the person looking to, for example, make kimchi or learn about using koji.

“”We were delighted with how well FERMENTATION 2021 met — in fact, exceeded — our goals,” said Vitale. “While we were disappointed that the continuing impact of COVID-19 kept us from meeting in person, we were gratified by how all the participants responded, interacted, and engaged during our three jam-packed days. And, with recording of all our sessions now available online for our registrants, we expect that energy and excitement to continue.”,

“Fermentation is experiencing a major surge of interest in restaurants and kitchens around the globe,” says Amelia Nielson-Stowell, TFA Editor. “Our conference was a major milestone for the industry and we are already in the planning stages for FERMENTATION 2022 next summer. And, assuming we will be able to meet in person once again, we plan to host a tasting and sampling event for consumers alongside our conference.”

- Published in Business, Food & Flavor, Health, Science

Food Technology’s “Gut Feeling”

Food Technology’s latest issue features an article entitled “Not Just A Gut Feeling” which details how and why more consumers are buying and making fermented foods and drinks. Spurred by the Covid-19 pandemic, there is growing interest in the gut microbiome and healthier food options.The curiosity around fermentation is buoying the retail category.

“It checks off all the boxes — artisanal, local, natural, sustainable, innovative,” says Bob Hutkins, food science professor of food science at the University of Nebraska–Lincoln (and a recent addition to TFA’s Advisory Board.) “People are making sourdoughs at home; they’re making kimchi at home; they’re going to kombucha bars. It’s definitely got the Gen Xers and the millennials intrigued.”

Included in the article are many insights from TFA — Advisory Board members Alex Lewin and Kheedim Oh, Executive Director Neal Vitale, and Editor Amelia Nielson-Stowell are all quoted.

Read more (Food Technology Magazine)

- Published in Business, Food & Flavor

Natural & Organic Sales Growing but Slowing

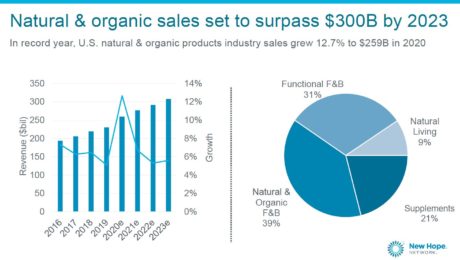

Sales of natural and organic products grew nearly 13% to $259 billion in 2020 , “despite the pandemic and, in some ways, because of the pandemic.”

“It’s very strong and, in many ways, it’s never been stronger,” says Carlotta Mast, senior vice president of the New Hope Network (producers of the event). Between pandemic-driven pantry loading, new brand exploration and the drive to purchase healthier, natural products, “people tried those new brands and, in many cases, they stuck with them, especially across the food and beverage categories.”

Mast shared these stats during the State of the Natural & Organic presentation at Natural Products Expo East. But forecasts show sales growing at a slower pace this year, to $271 billion. By 2023, sales are projected to surpass $300 billion.

Natural foods and beverages (including most fermented products) account for 70% of all natural product sales (the rest includes items like supplements and home and pet care products). Natural products are growing three times as fast as their mainstream counterparts.

“Not only were we growing quickly, we were outpacing the rest of the store…not only did our sales accelerate, they drove the whole (food) industry forward,” says Kathryn Peters, executive vice president at SPINS (a data provider for natural, organic and specialty products). “We’re finding consumers are coming and staying and continuing to buy more.”

Expo East Returns In-Person

Expo East is the first major food trade show to meet in-person since the Covid-19 pandemic shuttered events in March 2020. New Hope Network used a hybrid virtual and in-person model to produce the show, live-streaming the conference portion to virtual attendees.

“It was really exciting and satisfying to be back on a live show floor, interacting with people again. There was a real buzz,” says Chris Nemchek, TFA’s buyer relations director. “On day 1, you could tell there was a lot of pent-up demand.”

Health precautions were increased. Attendees had to show a Covid-19 vaccination card or a negative Covid-19 test administered within 72 hours. Masks were mandatory. Badges were no longer distributed to all attendees, only being printed upon request.

Food sampling, too, was much different than at a typical pre-pandemic trade show. Samples were only given by a gloved brand representative at an exhibitor’s booth. Food was stored behind sneeze guards, and surfaces were wiped down frequently.

“Exhibitors gave away less product, but the product they did give away was for more productive reasons — the people who took the sample really wanted it,” Nemchek notes.

“It was a good step back towards normal, but it wasn’t normal,” he adds. The size of the crowd at the show was not close to pre-pandemic levels (attendance numbers have not been released). But Nemchek notes that New Hope should still be pleased. “There’s now more confidence in the industry in putting on a food show again.”

Immune Health Driving Purchases

The natural and organic industry’s most popular products continue to be ones supporting immunity, health and wellness. Those attributes were consumer’s top purchase priorities in 2020, and remain strong in 2021.

Paleo (+25%), grain-free (+17%) and plant-based (+13%) foods and beverages registered the strongest sales growth. Plant-based products have seen especially strong sales over the past two years.

“Covid was a major driver for this boost in sales growth,” Mast says. Now “it’s our opportunity to keep those consumers.”

Consumers are exploring how they can use their diet as the first line of defense against illness, Peters adds. Immunity-related ingredients traditionally found on the supplement aisle, like cider vinegar, collagen, elderberry, moringa and ashwagandha,are now in grocery and refrigerated products.

“It’s revolutionizing the aisles in the store,” Peters says.

Changing Grocery Store Shelves

The U.S. is diversifying faster than predicted as well, and those demographic changes are influencing what’s selling. International foods are outperforming in grocery sales, growing at a 21% rate (compared with U.S. food at 16%).

“This is a huge shift for our country,” Mast says. “We’re seeing that, across our industry, more consumers are looking for that multicultural food.”

Mast notes, though, that leadership of the natural and organic products industry does not reflect the U.S. population.More BIPOC representation is needed on i company boards and leadership teams.

Shopping with Values

Consumers’ social and environmental values are also driving purchasing behavior. A survey by Nutrition Business Journal and SPINS found 76% of natural shoppers pay more for high-quality ingredients, 57% avoid buying food grown on industrial feedlots or chemical-intensive farms and 53% will pay more to support businesses that are socially- or environmentally-responsible. Consumers want companies to take social and political stances that reflect their own values.

“Our industry, because of our size, our scale and our influence, we could truly help create solutions to these problems and be part of building that new future,” Mast adds. “Think about the changes that we could help create for people, animal, planet — but it’s if we chose to do so.”

- Published in Business, Food & Flavor

Post-Pandemic, Sales Plateaus for Fermentation Brands?

This is the first in a series of articles that TFA will be releasing over the next few months, analyzing trends from our Member Survey.

Though fermentation brands overwhelmingly reported substantial sales gains during the Covid-19 pandemic, they’re not breaking out the champagne. Now, nearing fall 2021, many are starting to see sales flatten. This trend is consistent with sales for the food industry at large, which started to plateau in March 2021.

Most fermenters reported struggles meeting demand — packaging shortages (38%), costly and time-consuming Covid-19 sanitation protocols (30%), distribution delays (29%) and ingredient and labor shortages (both 28%). Then there’s the challenge of keeping a fermented product in stock with constantly changing sales demands.

Jared Schwartz, a TFA Advisory Board member, is founder of fermented sauce producer Poor Devil Pepper Co. and director of operations and quality for Farm Ferments (a facility in Hudson, N.Y., that is home to Hawthorne Valley Farm). He says forecasting has been especially difficult for a refrigerated fermented food with a processing cycle more delicate than that of its shelf-stable counterpart.

“While these spikes in sales are incredible, they also depleted our on-hand WIP [Work-In-Progress],” Schwartz says. He would project barrels of fermenting vegetables to provide adequate inventory for a certain length of time, but peak pandemic demand depleted stock. Finding new ingredients is difficult because everything is sourced locally. “With fermentation, there is of course a much longer lead time on a finished product as the process can’t be rushed. So these challenges left us extending our production season and looking to source from the spot market, which is generally out of our norm. We generally source 95% of our ingredients from New York State and base our projections around the trajectory aforementioned.”

Sales Flatten After Record Year

While predicting sales has been difficult — especially as many states are again increasing Covid-19 restrictions because of the Delta variant — some brand leaders were prepared for a decrease in sales in 2021.

Kheedim Oh, founder of Mama O’s Kimchi (and also on TFA’s Advisory Board), said sales doubled in 2020. But, this summer, they fell dramatically from that peak. “July was terrible,” Oh says, but they “anticipate a boost in the fall since summer months are typically slower.”

Revenue almost tripled in 2020 for hard kombucha brand Dr. Hops, but sales have since started to flatten. The company had secured new distribution before the pandemic, then redesigned their product line this year. “We would have likely done much more… if we had been able to do all the field sales and marketing we had planned,” says Joshua Rood, co-founder and CEO of Dr. Hops Real Hard Kombucha,

Hawthorne Valley is seeing a similar downturn. Sales from March to April spiked about 50%, with overall year-over-year growth at 46%. But “things have definitely plateaued for now,” Schwartz says.

Supply Chain Nightmares

Small packaging supplies — like the tiny plastic caps for glass kombucha bottles — caused huge production issues. Hannah Crum, president of Kombucha Brewers International, says this was the biggest challenge for brewers. “It’s had a massive impact,” she says.

Twenty-four percent of survey respondents said they anticipate production constraints will continue to be a challenge throughout 2021.

And though sales remain strong for Bubbies pickles according to John Gray, owner of Bubbies (and TFA Advisory Board member), “glass shortages have affected the entire industry. Sales are strong, but shortages persist,” as he describes the pandemic’s double-edged sword facing many fermented brands.

Production and distribution issues hit frozen pizza brand Alex’s Awesome Sourdough, too — packaging costs went up 10%, and freight expense nearly doubled. But these didn’t slow the company’s growth. They expanded massively in 2020, from 100 to 1,500 stores. An overall uptick in frozen food sales helped them as well, especially as competing pizza brands went out of stock.

“Sales are strong as pizza is a seasonal category and the end of summer and early fall are the beginning of peak season,” says Alex Corsini, founder of Alex’s Awesome Sourdough (and another TFA Advisory Board member). “We anticipate sales being even stronger if Covid protocols remain strict and restaurants continue operating at a limited capacity. Restaurants definitely take a piece of our pie (pun intended).”

- Published in Business

U.S. Celebrities Infiltrate Mexico’s Tequila Industry

Tequila sales last year were 60 million gallons, 800% higher than two decades ago. This agave-based spirit has become so popular that distillers are “selling it at the price of gold.” What caused the boom? Celebrity endorsements.

From George Clooney to Arnold Schwarzenegger, LeBron James to Nick Jonas and Dwayne “The Rock” Johnson to Kendall Jenner, celebrities have made billions off their tequila brands.

A Los Angeles Times article highlights the pros (a booming local economy in Mexico, tequila being introduced to more people) and the cons (environmental concerns, agave plants harvested too young, diverse crop fields and forests turned into monocultures of agave, foreigners taking over a traditional drink) of this growth. The article continues:

“Pre-Hispanic Indigenous groups in Mexico had been fermenting agave into a viscous alcoholic drink known as pulque for centuries when Spanish conquistadors arrived in the 16th century and first distilled tequila. It has since evolved into an $10.8-billion-a-year industry.”

Read more (Los Angeles Times)

- Published in Business

Should Groceries Eliminate the Ethnic Aisle?

In America, where 40% of the population identifies as nonwhite, why do grocery stores still have an ethnic aisle? The outdated aisle initially began after World War II as a way for soldiers to buy the food they ate while in Italy, Germany or Japan. But the European foods, like pasta sauces and sauerkraut, eventually became integrated with the rest of the store, while foods from BIPOC countries stayed put.

Heads of ethnic food brands and grocery chains have been pushing for a change, but it’s been a hard sell. Doing away with the aisle is a layered problem — and still not the most popular approach with food professionals.

“Several food purveyors of colors see the aisle as a necessary evil — a way to introduce their products to shoppers who may be unfamiliar with, say, Indian food — though a barrier to bigger success,” reads an article in The New York Times.

Some ethnic brands come to store buyers with little capital to get their products on the shelf, so the only spot for them is on the ethnic aisle. They will never break out unless they’re acquired by a larger company. Larger corporations, like Pepsi or Nestlé, can afford to pay stores to put their products on shelves with prime product placement. And large ethnic brands (like Goya beans and Maruchan ramen) are placed on both ethnic aisles and their respective traditional product section because they’re considered broadly recognized.

But many products with international flavors made by nonwhite brands are not placed on the ethnic shelf. The Times shares the story of Toyin Kolawole, who runs the African ingredients brand Iya Foods. Kolawole tried to get her cassava flour into the flour aisle with a Midwestern retailer with no success. But when cassava flour began trending as a substitute for traditional flour, bigger companies launched their own cassava brands — which were put in the flour aisle.

On the flip side, other food professionals note that consumers turn to the ethic aisle in search of international flavors. Customers like the convenience. There is a fear that unique ingredients (like tamarind or pomegranate molasses) without a clear spot in a grocery store would get lost in a conventional aisle. And, even worse for some brands, integration in an American grocery store means being “divorced from its cultural background.”

Read more (The New York Times)

- Published in Business, Food & Flavor

Highlights from TFA’s Member Survey

The Fermentation Association recently surveyed our community to better understand who has engaged with us, how their businesses are doing and to gauge the impact of the pandemic. We want to share the very interesting results.

A few qualifying comments first, however. This survey should not be interpreted as producing a profile of the fermented industry — it reached only those with whom we have connected since TFA was launched in 2017. This group is heavily weighted to Food and Beverage Producers and those in the Science, Health and Research fields. And, even as we note surprisingly high response rates below, the quantities of responses to certain questions were small and would not meet standard analytical thresholds of statistical significance. So please treat the comments and conclusions that follow as directional rather than definitive.

We received 450 full or partial responses — nearly twice the number we had expected and what we would have considered “good.” Not surprisingly, the bulk of these were from Food and Beverage Producers — just under half — with a strong representation of the Science, Health and Research community, a little less than one-fifth. The balance of the respondents were classified as Supplier or Service Provider (9%); Chef/Writer/Educator (8%); Retailer/Distributor/Broker (3%); Food Service/Hospitality (3%); or fell into a miscellaneous Other category (12%).

We will be presenting further analyses and follow-up discussions in the coming weeks. This article focuses on the two largest segments: first, Food & Beverage Producers; then, Science, Health, and Research.

FOOD & BEVERAGE PRODUCERS

- We found that over 80% of our Producers are small businesses with 25 or fewer employees, and 65% had 2020 sales of less than $500,000. That said, over 11% of the companies represented are toward the other end of the spectrum, with 100 or more on staff, and 13% with revenue of over $10 million.

- We reach a lot of Owners/Founders/Senior Executives, over 70% of respondents. The next most well-represented functional areas are Operations and Product Development.

- These businesses are spread across the developmental timeline — a little over 40% are selling at the local level, or earlier in their growth cycle (selling at farmers market or still in testing/pre-launch mode). Yet 45% are selling regionally, nationally or internationally.

- Retail is still the largest (45%) channel of sale for these producers, but Direct-to-Consumer (DTC) is just slightly behind at 40%, with the remaining 15% through Food Service/Hospitality.

- Sauerkraut/Kimchi, Pickles, Condiments/Sauces and Kombucha were the most frequently-listed product categories, each mentioned by more than 20% of the producers. Kefir, Vinegar/Shrubs, Wine and Miso also were mentioned often. Of the 25 product categories listed, we had respondents involved in every one — except poor, slimy, and unrepresented natto.

- Nearly half of producers selling at retail and/or DTC had sales gains in 2020 and another third maintained their revenues. Not surprisingly, nearly 40% of producers selling into food service saw sales take a hit — only 15% reported gains.

- The Covid-19 pandemic caused a host of issues for producers, though their prevalence seemed to vary depending on the size of the company. Among larger producers, over 90% had issues meeting demand, with the primary problems being shortages of raw materials, packaging and staff, as well as distribution delays. Fewer of the small producers reported issues, but their problems fell into the same categories. Financial difficulties were cited more often among small producers.

- Nearly 30% of producers took advantage of the government’s Payroll Protection Plan.

- This year appears to continue or build on the sales levels achieved in 2020 for most producers. Nearly 40% report first quarter 2021 sales at the same level as last year, and nearly 50% reported further increases. And producers are optimistic about continuing these trends, with a mere 5% anticipating sales declines.

- Most (nearly two-thirds) of responding producers did not participate in tradeshows and conferences, and therefore felt no business impact from show cancellations in 2020.

- The producers that did participate in events favored the Natural Products Expos, Fancy Food Shows and IFT Show. While some felt that they lost short-terms sales and their future growth was hurt by the shows being cancelled, nearly 30% noted that they saved money and time by not attending. Some of those savings were reinvested in increased marketing, DTC sales and virtual events.

- Interestingly, half of the producers plan to continue their involvement as events resume at the same level as before the pandemic, and fully one-third plan to increase activity.

- Looking ahead, producers see numerous challenges on the horizon, led by a need for expanded distribution. They expect many of the recent shortages to continue to challenge, compounded by production, facility and financial constraints. While Covid protocols and food safety concerns persist, they are joined by the need for product development, e-commerce skills, and consumer marketing

- The clearly-articulated top priority for producers is a better-educated consumer. When asked what would foster increased consumption of fermented foods and beverages, the top item for nearly 70% is consumer education as to the nature and benefits of fermentation. The next highest priorities all support this same goal — more research into health impact (+40%), greater familiarity with flavors of fermentation (+40%) and more exposure at retail (+30%).

SCIENCE, HEALTH & RESEARCH

- The bulk — nearly 75% — of these respondents work in an academic environment, with very small clusters in government and medical/health organizations. It’s a well-educated group, with over half holding doctorates, plus another quarter with Master’s degrees. Roles are split quite evenly into thirds — professors, science/technical support and students/postdocs.

- Over 60% of these respondents are looking into connections between fermentation and health; roughly half are specifically focused on gut health and the human microbiome. Overall, three-quarters are currently researching fermentation and fermented products. Their activities, though, span the full spectrum of product categories. All the key categories among our producers — Sauerkraut/Kimchi, Pickles, Condiments/Sauces, Kombucha and Kefir — were well-represented in research. But they were joined by meaningful work across the board — Yogurt, Beer, Cheese, Alternative Proteins, Koji, Wine, Sourdough, Tempeh, Tea — even Natto!

- Slightly more than a third of this group is involved with fermented alternative proteins – an important, emerging category.

- Funding for research showed more declines (30% of respondents) than gains (under 15%) over the last year. But half of our sample expects funding to increase in the coming 12-18 month.

- Our Science, Health & Research respondents were split in how they viewed the interest in fermentation research — 60% felt the focus was increasing, but the topic was not yet a top priority. Yet a third saw fermentation as a hot topic, with more emphasis and activity than ever.

- Respondents in this group shared the views of producers that the key activities that would drive increased consumption of fermented products are:

- Consumer education about fermentation

- More research into health benefits

- Greater consumer familiarity with fermented flavors

- Published in Business, Food & Flavor, Health, Science

Natural Production Changing the Wine Industry

Natural winemaking is moving mainstream, as more viticulturists preach the importance of soil health and shun traditional herbicides. “Where does natural wine finish and conventional wine start? These days, it’s hard to tell,” reads an article in Vinepair. Though the vast majority of global wine production still relies on conventional methods, the virtues of natural winemaking are helping change the industry.

“While it used to be rare for wines to be fermented with wild yeast — allowing the microbes present on the grapes to carry out fermentation — this is now much more common. And conventional producers have been prompted to question their use of additives such as sulfur dioxide. In fact, many aspects of winemaking that were championed by natural wine folk have now become much more common, even replacing some of the triumphs of more heavy-handed methods. As more producers trend away from making big, international-style reds with dark color, sweet fruit, high alcohol, and obvious new oak character, extracting less color and tannin for lighter-style reds is gaining popularity.”

Read more (Vinepair)

- Published in Food & Flavor

Fermentation for Alternative Proteins

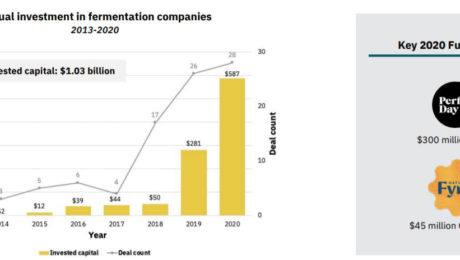

Investments in alternative protein hit their highest level in 2020: $3.1 billion, double the amount invested from 2010-2019. Over $1 billion of that was in fermentation-powered protein alternatives.

It’s a time of huge growth for the industry — the alternative protein market is projected to reach $290 billion by 2035 — but it represents only a tiny segment of the larger meat and dairy industries.

Approximately 350 million metric tons of meat are produced globally every year. For reference, that’s about 1 million Volkswagen Beetles of meat a day. Meat consumption is expected to increase to 500 million metric tons by 2050 — but alternative proteins are expected to account for just 1 million.

“The world has a very large demand for meat and that meat demand is expected to go up,” says Zak Weston, foodservice and supply chain manager for the Good Food Institute (GFI). Weston shared details on fermented alternative proteins during the GFI presentation The State of the Industry: Fermentation for Alternative Proteins. “We think the solution lies in creating alternatives that are competitive with animal-based meat and dairy.”

Why is Alternative Protein Growing?

Animal meat is environmentally inefficient. It requires significant resources, from the amount of agricultural land needed to raise animals, to the fertilizers, pesticides and hormones used for feed, to the carbon emissions from the animals.

Globally, 83% of agricultural land is used to produce animal-based meat, dairy or eggs. Two-thirds of the global supply of protein comes from traditional animal protein.

The caloric conversion ratios — the calories it takes to grow an animal versus the calories that the animal provides when consumed — is extremely unbalanced. It takes 8 calories in to get 1 calorie out of a chicken, 11 calories to get 1 calorie out of a pig and 34 calories to get 1 calorie out of a cow. Alternative protein sources, on the other hand, have an average of a 1:1 calorie conversion. It takes years to grow animals but only hours to grow microbes.

“This is the underlying weakness in the animal protein system that leads to a lot of the negative externalities that we focus on and really need to be solved as part of our protein system,” Weston says. “We have to ameliorate these effects, we have to find ways to mitigate these risks and avoid some of these negative externalities associated with the way in which we currently produce industrialized animal proteins.”

What are Fermented Alternative Proteins?

Alternative proteins are either plant-based and fermented using microbes or cultivated directly from animal cells. Fermented proteins are made using one of three production types: traditional fermentation, biomass fermentation or precision fermentation.

“Fermentation is something familiar to most of us, it’s been used for thousands and thousands of years across a wide variety of cultures for a wide variety of foods,” Weston says, citing foods like cheese, bread, beer, wine and kimchi. “That indeed is one of the benefits for this technology, it’s relatively familiar and well known to a lot of different consumers globally.”

- Traditional fermentation refers to the ancient practice of using microbes in food. To make protein alternatives, this process uses “live microorganisms to modulate and process plant-derived ingredients.” Examples are fermenting soybeans for tempeh or Miyoko’s Creamery using lactic acid bacteria to make cheese.

- Biomass fermentation involves growing naturally occurring, protein-dense, fast-growing organisms. Microorganisms like algae or fungi are often used. For example, Nature’s Fynd and Quorn …mycelium-based steak.

- Precision fermentation uses microbial hosts as “cell factories” to produce specific ingredients. It is a type of biology that allows DNA sequences from a mammal to create alternative proteins. Examples are the heme protein in an Impossible Foods’ burger or the whey protein in Perfect Day’s vegan dairy products.

Despite fermentation’s roots in ancient food processing traditions, using it to create alternative proteins is a relatively new activity. About 80% of the new companies in the fermented alternative protein space have formed since 2015. New startups have focused on precision fermentation (45%) and biomass fermentation (41%). Traditional fermentation accounts for a smaller piece of the category (14%). There were more than 260 investors in the category in 2020 alone.

“It’s really coming onto the radar for a lot of folks in the food and beverage industry and within the alternative protein industry in a very big way, particularly over the past couple of years,” Weston says. “This is an area that the industry is paying attention too. They’re starting to modify working some of its products that have traditionally maybe been focused on dairy animal-based dairy substrates to work with plant protein substrates.”

Can Alternative Protein Help the Food System?

Fermentation has been so appealing, he adds, because “it’s a mature technology that’s been proven at different scales. It’s maybe different microbes or different processes, but there’s a proof of concept that gives us a reason to think that that there’s a lot of hope for this to be a viable technology that makes economic sense.”

GFI predicts more companies will experiment with a hybrid approach to fermented alternative proteins, using different production methods.

Though plant-based is still the more popular alternative protein source, plant-based meat has some barriers that fermentation resolves. Plant-based meat products can be dry, lacking the juiciness of meat; the flavor can be bean-like and leave an unpleasant aftertaste; and the texture can be off, either too compact or too mushy.

Fermented alternative proteins, though, have been more successful at mimicking a meat-like texture and imparting a robust flavor profile. Weston says taste, price, accessibility and convenience all drive consumer behavior — and fermented alternative proteins deliver in these regards.

And, compared to animal meat, alternative proteins are customizable and easily controlled from start to finish. Though the category is still in its early days, Weston sees improvements coming quickly in nutritional profiles, sensory attributes, shelf life, food safety and price points coming quickly.

“What excites us about the category is that we’ve seen a very strong consumer response, in spite of the fact that this is a very novel category for a lot of consumers,” Weston says. “We are fundamentally reassembling meat and dairy products from the ground up.”

- Published in Business, Food & Flavor, Health, Science

State of the Natural & Organic Industry

The Covid-19 pandemic powered strong food and beverage sales last year. But natural and organic brands grew even faster than conventional ones, with sales growing 12.7% to $259 billion.

“Natural products throughout the last year have really been outpacing all product growth. Natural and clean products are now about $1 out of every $10 spent, which is really significant,” says Kathryn Peters, executive vice president of SPINS, a retail data provider. Peters presented sales trends at the virtual Natural Products Expo West.

Data from SPINS and Nutrition Business Journal documents that there was a “dramatic shift” in consumer behavior during the pandemic, as more people cooked at home and bought healthier foods.

“2020 was a record year for the U.S. natural and organic product industry,” says Carlotta Mast, senior vice president and market leader for New Hope Network, producers of the Natural Products Expos. “The industry has so much to celebrate, despite the very challenging time we’ve been through the past 14 months.”

Natural and organic sales are expected to pass the $300 billion mark by 2023.

Food as Medicine

Functional food and beverage sales grew 9.4% to $78 billion in 2020, a surprisingly high figure since grab-n-go offerings — the category in which many functional products are tracked — were reduced significantly during the pandemic.

“And yet that strong growth, nearly 10% experienced in that category, demonstrates that people continue to embrace the food as medicine trend,” Mast says.

Products that claim to offer immune-boosting, functional ingredients are selling well. Consumers are “shifting from reactive to preventative and from cold and flu season to year-round protection.” Ingredients and supplements like elderberry, vitamins C and D, antioxidants, collagen and cider vinegar are increasing in sales.

Sales of animal welfare-positioned products grew 17% in 2020, and sales of grass-fed and free-range products increased more than 13%. Other key wellness attributes that appeared to drive significant dollar growth included paleo (up 32%), plant-based (21%) and grain-free (18%).

“Consumers are expecting more from the products they buy,” Peters said. “Whether it’s because of a limited budget or health and wellness considerations to build a stronger body, people are seeking nutritional benefits.”

Mission-Driven

Consumers are seeking to buy from brands with a purpose. These are products that, for example, want to save the environment, create a sustainable food system, champion a social justice cause or support a minority group.

Nick McCoy, co-founder and managing director at Whipstitch Capital, a food-focused investment bank, calls these brands “better for people and the planet” and says they are “doing good while making money at the same time.” The amount of ESG (Environmental Social Governance) investment funds has increased tenfold over the past two years.

Brands that are mission- and community-minded are experiencing the strongest sales growth.

“This demonstrates that our industry is home to brands that do a lot more than just sell a product — they’re a force for better, better health and better outcomes for humans, animals and the environment,” Mast says. “Our industry shoppers expect more than a transaction from the brands they do business with.”

In a SPINS survey, consumers said they want to support brands that are LGBTQ owned (19%), BIPOC owned (28%) and/or woman owned (18%).

Vegetarian and vegan products are also increasing in sales. Plant-based and meat alternatives grew 21% last year, at a rate of two-times their mainstream counterparts.

“In many cases, plant-based is bringing more nutrient density than the original animal-based analog,” Peters says . “Plant-based support is growing beyond just health benefits to earth-based benefits like lower greenhouse gas emissions, water conservation and biodiversity.”

E-Commerce

Not surprisingly, e-commerce sales fast-tracked during the pandemic, accounting for 58% of natural and organic sales last year. E-commerce also became the main channel where new brands were launched. Though sales in brick-and-mortar stores are not predicted to return to pre-pandemic levels, physical retail locations are still expected to account for 30% of all natural and organic products sales in 2023.

Speakers at the event advised brands to take an omnichannel approach, tackling marketing through brick-and-mortar stores as well as e-commerce channels. Sashee Chandran, founder and CEO of Tea Drops (a producer of organic tea pressed and preserved in different shapes), spoke at the conference about her experience following this marketing approach.

“Even though things are opening up, consumers still want that flexibility to be able to shop online but also in store,” she says.

- Published in Business