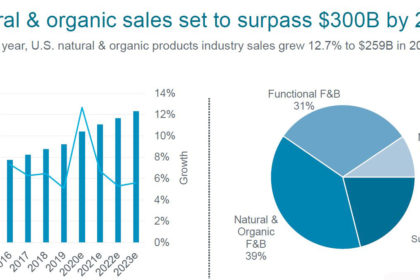

The Covid-19 pandemic powered strong food and beverage sales last year. But natural and organic brands grew even faster than conventional ones, with sales growing 12.7% to $259 billion.

“Natural products throughout the last year have really been outpacing all product growth. Natural and clean products are now about $1 out of every $10 spent, which is really significant,” says Kathryn Peters, executive vice president of SPINS, a retail data provider. Peters presented sales trends at the virtual Natural Products Expo West.

Data from SPINS and Nutrition Business Journal documents that there was a “dramatic shift” in consumer behavior during the pandemic, as more people cooked at home and bought healthier foods.

“2020 was a record year for the U.S. natural and organic product industry,” says Carlotta Mast, senior vice president and market leader for New Hope Network, producers of the Natural Products Expos. “The industry has so much to celebrate, despite the very challenging time we’ve been through the past 14 months.”

Natural and organic sales are expected to pass the $300 billion mark by 2023.

Food as Medicine

Functional food and beverage sales grew 9.4% to $78 billion in 2020, a surprisingly high figure since grab-n-go offerings — the category in which many functional products are tracked — were reduced significantly during the pandemic.

“And yet that strong growth, nearly 10% experienced in that category, demonstrates that people continue to embrace the food as medicine trend,” Mast says.

Products that claim to offer immune-boosting, functional ingredients are selling well. Consumers are “shifting from reactive to preventative and from cold and flu season to year-round protection.” Ingredients and supplements like elderberry, vitamins C and D, antioxidants, collagen and cider vinegar are increasing in sales.

Sales of animal welfare-positioned products grew 17% in 2020, and sales of grass-fed and free-range products increased more than 13%. Other key wellness attributes that appeared to drive significant dollar growth included paleo (up 32%), plant-based (21%) and grain-free (18%).

“Consumers are expecting more from the products they buy,” Peters said. “Whether it’s because of a limited budget or health and wellness considerations to build a stronger body, people are seeking nutritional benefits.”

Mission-Driven

Consumers are seeking to buy from brands with a purpose. These are products that, for example, want to save the environment, create a sustainable food system, champion a social justice cause or support a minority group.

Nick McCoy, co-founder and managing director at Whipstitch Capital, a food-focused investment bank, calls these brands “better for people and the planet” and says they are “doing good while making money at the same time.” The amount of ESG (Environmental Social Governance) investment funds has increased tenfold over the past two years.

Brands that are mission- and community-minded are experiencing the strongest sales growth.

“This demonstrates that our industry is home to brands that do a lot more than just sell a product — they’re a force for better, better health and better outcomes for humans, animals and the environment,” Mast says. “Our industry shoppers expect more than a transaction from the brands they do business with.”

In a SPINS survey, consumers said they want to support brands that are LGBTQ owned (19%), BIPOC owned (28%) and/or woman owned (18%).

Vegetarian and vegan products are also increasing in sales. Plant-based and meat alternatives grew 21% last year, at a rate of two-times their mainstream counterparts.

“In many cases, plant-based is bringing more nutrient density than the original animal-based analog,” Peters says . “Plant-based support is growing beyond just health benefits to earth-based benefits like lower greenhouse gas emissions, water conservation and biodiversity.”

E-Commerce

Not surprisingly, e-commerce sales fast-tracked during the pandemic, accounting for 58% of natural and organic sales last year. E-commerce also became the main channel where new brands were launched. Though sales in brick-and-mortar stores are not predicted to return to pre-pandemic levels, physical retail locations are still expected to account for 30% of all natural and organic products sales in 2023.

Speakers at the event advised brands to take an omnichannel approach, tackling marketing through brick-and-mortar stores as well as e-commerce channels. Sashee Chandran, founder and CEO of Tea Drops (a producer of organic tea pressed and preserved in different shapes), spoke at the conference about her experience following this marketing approach.

“Even though things are opening up, consumers still want that flexibility to be able to shop online but also in store,” she says.