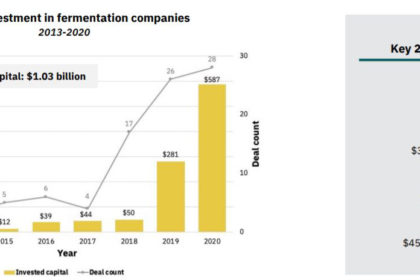

Investments in alternative protein hit their highest level in 2020: $3.1 billion, double the amount invested from 2010-2019. Over $1 billion of that was in fermentation-powered protein alternatives.

It’s a time of huge growth for the industry — the alternative protein market is projected to reach $290 billion by 2035 — but it represents only a tiny segment of the larger meat and dairy industries.

Approximately 350 million metric tons of meat are produced globally every year. For reference, that’s about 1 million Volkswagen Beetles of meat a day. Meat consumption is expected to increase to 500 million metric tons by 2050 — but alternative proteins are expected to account for just 1 million.

“The world has a very large demand for meat and that meat demand is expected to go up,” says Zak Weston, foodservice and supply chain manager for the Good Food Institute (GFI). Weston shared details on fermented alternative proteins during the GFI presentation The State of the Industry: Fermentation for Alternative Proteins. “We think the solution lies in creating alternatives that are competitive with animal-based meat and dairy.”

Why is Alternative Protein Growing?

Animal meat is environmentally inefficient. It requires significant resources, from the amount of agricultural land needed to raise animals, to the fertilizers, pesticides and hormones used for feed, to the carbon emissions from the animals.

Globally, 83% of agricultural land is used to produce animal-based meat, dairy or eggs. Two-thirds of the global supply of protein comes from traditional animal protein.

The caloric conversion ratios — the calories it takes to grow an animal versus the calories that the animal provides when consumed — is extremely unbalanced. It takes 8 calories in to get 1 calorie out of a chicken, 11 calories to get 1 calorie out of a pig and 34 calories to get 1 calorie out of a cow. Alternative protein sources, on the other hand, have an average of a 1:1 calorie conversion. It takes years to grow animals but only hours to grow microbes.

“This is the underlying weakness in the animal protein system that leads to a lot of the negative externalities that we focus on and really need to be solved as part of our protein system,” Weston says. “We have to ameliorate these effects, we have to find ways to mitigate these risks and avoid some of these negative externalities associated with the way in which we currently produce industrialized animal proteins.”

What are Fermented Alternative Proteins?

Alternative proteins are either plant-based and fermented using microbes or cultivated directly from animal cells. Fermented proteins are made using one of three production types: traditional fermentation, biomass fermentation or precision fermentation.

“Fermentation is something familiar to most of us, it’s been used for thousands and thousands of years across a wide variety of cultures for a wide variety of foods,” Weston says, citing foods like cheese, bread, beer, wine and kimchi. “That indeed is one of the benefits for this technology, it’s relatively familiar and well known to a lot of different consumers globally.”

- Traditional fermentation refers to the ancient practice of using microbes in food. To make protein alternatives, this process uses “live microorganisms to modulate and process plant-derived ingredients.” Examples are fermenting soybeans for tempeh or Miyoko’s Creamery using lactic acid bacteria to make cheese.

- Biomass fermentation involves growing naturally occurring, protein-dense, fast-growing organisms. Microorganisms like algae or fungi are often used. For example, Nature’s Fynd and Quorn …mycelium-based steak.

- Precision fermentation uses microbial hosts as “cell factories” to produce specific ingredients. It is a type of biology that allows DNA sequences from a mammal to create alternative proteins. Examples are the heme protein in an Impossible Foods’ burger or the whey protein in Perfect Day’s vegan dairy products.

Despite fermentation’s roots in ancient food processing traditions, using it to create alternative proteins is a relatively new activity. About 80% of the new companies in the fermented alternative protein space have formed since 2015. New startups have focused on precision fermentation (45%) and biomass fermentation (41%). Traditional fermentation accounts for a smaller piece of the category (14%). There were more than 260 investors in the category in 2020 alone.

“It’s really coming onto the radar for a lot of folks in the food and beverage industry and within the alternative protein industry in a very big way, particularly over the past couple of years,” Weston says. “This is an area that the industry is paying attention too. They’re starting to modify working some of its products that have traditionally maybe been focused on dairy animal-based dairy substrates to work with plant protein substrates.”

Can Alternative Protein Help the Food System?

Fermentation has been so appealing, he adds, because “it’s a mature technology that’s been proven at different scales. It’s maybe different microbes or different processes, but there’s a proof of concept that gives us a reason to think that that there’s a lot of hope for this to be a viable technology that makes economic sense.”

GFI predicts more companies will experiment with a hybrid approach to fermented alternative proteins, using different production methods.

Though plant-based is still the more popular alternative protein source, plant-based meat has some barriers that fermentation resolves. Plant-based meat products can be dry, lacking the juiciness of meat; the flavor can be bean-like and leave an unpleasant aftertaste; and the texture can be off, either too compact or too mushy.

Fermented alternative proteins, though, have been more successful at mimicking a meat-like texture and imparting a robust flavor profile. Weston says taste, price, accessibility and convenience all drive consumer behavior — and fermented alternative proteins deliver in these regards.

And, compared to animal meat, alternative proteins are customizable and easily controlled from start to finish. Though the category is still in its early days, Weston sees improvements coming quickly in nutritional profiles, sensory attributes, shelf life, food safety and price points coming quickly.

“What excites us about the category is that we’ve seen a very strong consumer response, in spite of the fact that this is a very novel category for a lot of consumers,” Weston says. “We are fundamentally reassembling meat and dairy products from the ground up.”