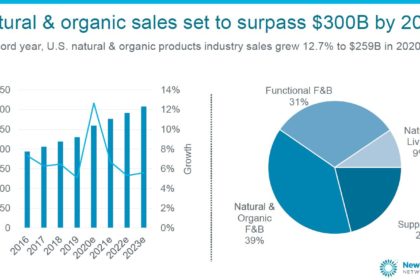

Sales of natural and organic products grew nearly 13% to $259 billion in 2020 , “despite the pandemic and, in some ways, because of the pandemic.”

“It’s very strong and, in many ways, it’s never been stronger,” says Carlotta Mast, senior vice president of the New Hope Network (producers of the event). Between pandemic-driven pantry loading, new brand exploration and the drive to purchase healthier, natural products, “people tried those new brands and, in many cases, they stuck with them, especially across the food and beverage categories.”

Mast shared these stats during the State of the Natural & Organic presentation at Natural Products Expo East. But forecasts show sales growing at a slower pace this year, to $271 billion. By 2023, sales are projected to surpass $300 billion.

Natural foods and beverages (including most fermented products) account for 70% of all natural product sales (the rest includes items like supplements and home and pet care products). Natural products are growing three times as fast as their mainstream counterparts.

“Not only were we growing quickly, we were outpacing the rest of the store…not only did our sales accelerate, they drove the whole (food) industry forward,” says Kathryn Peters, executive vice president at SPINS (a data provider for natural, organic and specialty products). “We’re finding consumers are coming and staying and continuing to buy more.”

Expo East Returns In-Person

Expo East is the first major food trade show to meet in-person since the Covid-19 pandemic shuttered events in March 2020. New Hope Network used a hybrid virtual and in-person model to produce the show, live-streaming the conference portion to virtual attendees.

“It was really exciting and satisfying to be back on a live show floor, interacting with people again. There was a real buzz,” says Chris Nemchek, TFA’s buyer relations director. “On day 1, you could tell there was a lot of pent-up demand.”

Health precautions were increased. Attendees had to show a Covid-19 vaccination card or a negative Covid-19 test administered within 72 hours. Masks were mandatory. Badges were no longer distributed to all attendees, only being printed upon request.

Food sampling, too, was much different than at a typical pre-pandemic trade show. Samples were only given by a gloved brand representative at an exhibitor’s booth. Food was stored behind sneeze guards, and surfaces were wiped down frequently.

“Exhibitors gave away less product, but the product they did give away was for more productive reasons — the people who took the sample really wanted it,” Nemchek notes.

“It was a good step back towards normal, but it wasn’t normal,” he adds. The size of the crowd at the show was not close to pre-pandemic levels (attendance numbers have not been released). But Nemchek notes that New Hope should still be pleased. “There’s now more confidence in the industry in putting on a food show again.”

Immune Health Driving Purchases

The natural and organic industry’s most popular products continue to be ones supporting immunity, health and wellness. Those attributes were consumer’s top purchase priorities in 2020, and remain strong in 2021.

Paleo (+25%), grain-free (+17%) and plant-based (+13%) foods and beverages registered the strongest sales growth. Plant-based products have seen especially strong sales over the past two years.

“Covid was a major driver for this boost in sales growth,” Mast says. Now “it’s our opportunity to keep those consumers.”

Consumers are exploring how they can use their diet as the first line of defense against illness, Peters adds. Immunity-related ingredients traditionally found on the supplement aisle, like cider vinegar, collagen, elderberry, moringa and ashwagandha,are now in grocery and refrigerated products.

“It’s revolutionizing the aisles in the store,” Peters says.

Changing Grocery Store Shelves

The U.S. is diversifying faster than predicted as well, and those demographic changes are influencing what’s selling. International foods are outperforming in grocery sales, growing at a 21% rate (compared with U.S. food at 16%).

“This is a huge shift for our country,” Mast says. “We’re seeing that, across our industry, more consumers are looking for that multicultural food.”

Mast notes, though, that leadership of the natural and organic products industry does not reflect the U.S. population.More BIPOC representation is needed on i company boards and leadership teams.

Shopping with Values

Consumers’ social and environmental values are also driving purchasing behavior. A survey by Nutrition Business Journal and SPINS found 76% of natural shoppers pay more for high-quality ingredients, 57% avoid buying food grown on industrial feedlots or chemical-intensive farms and 53% will pay more to support businesses that are socially- or environmentally-responsible. Consumers want companies to take social and political stances that reflect their own values.

“Our industry, because of our size, our scale and our influence, we could truly help create solutions to these problems and be part of building that new future,” Mast adds. “Think about the changes that we could help create for people, animal, planet — but it’s if we chose to do so.”