Natural & Organic Sales Grow Big in 2020

Natural and organic products had a record year in 2020, growing 12.7% to $259 billion in sales. Sales were fast-tracked by the pandemic, as consumers cooked more meals at home in quarantine and developed a greater interest in healthier food and beverages.

“2020 was a challenging year. But natural and organic brands face a bright future. We are positioned where a growing number of consumers are headed,” says Carlotta Mast, senior vice president and market leader at New Hope Network. Mast shared industry highlights during her State of Natural & Organic address at New Hope’s Spark Change virtual conference earlier this month.

Natural and organic food and beverages (39%of total sales) and functional food and beverages (31%) dominate the industry. The natural and organic category alone grew 13% to $186 billion in sales. Produce accounted for 24% of those sales. Beverages were 17% of the total; dairy, 15%; packaged/prepared foods, 13%; breads and grains, 11%; snacks, 8%; meat, fish and poultry,7% and condiments, 5%.

Here are some key trends from this banner sales year:

- Consumers Prioritize Health

Consumers want immunity-boosting foods. Brands should consider adding vitamins and minerals to their products, as nutrient-dense food will be core to the future of food production.

Nutrient density “is very difficult to market,” says Nick McCoy, managing director and co-founder of Whipstitch Capital, a food-focused investment bank. “It manifests itself as superfoods over time, but it’s one of these things, if you’re in a natural grocery store, historically not many shoppers are going to take the time to read the label. It’s really encouraging to see that this is reversing.”

Adds Kathryn Peters, executive vice president at SPINS, a data company for the natural and organic industry: “Consumers are expecting more from the products they buy. But another key piece is consumers are expecting more density of nutrition in the products they buy.”

- Wellness is Challenging to Maintain

Consumers are focusing on health and wellness more than ever — 77% of New Hope Network survey respondents said personal health is more important to them now than it was in 2019.

But research shows consumers are struggling to maintain healthy lifestyles. People said they ate more junk food, exercised less, felt more anxious and slept less during 2020. Binge drinking is up an alarming 41% among women since the start of the pandemic.

Brands, Mast says, can help people fix bad habits.

“I think this is our big opportunity for 2021 and beyond,” Mast says.

- Diet as Lifestyle

SPINS’ Peters says she anticipates that, “as we look to resurrect our former selves,” shoppers will look for new eating plans, ones they can personalize to their needs.

She highlighted a few trends. Consumers want less sugar and fewer carbs and additives. They’re also shifting buying habits based on the trend to Paleo and Keto diets. Plant-based products, too, are estimated to grow at twice the rate of their traditional counterparts. Plant-based products grew 30% from 2019 to 2020, hitting $5.7 billion in sales.

Pantry staples, frozen foods, meat/fish/poultry and plant-based alternatives experienced the highest growth rates. Snack foods and packaged and prepared foods — which had previously experienced large sales gains — took big hits in 2020 as fewer people chose grab-n-go offerings during quarantine.

“How is your brand interacting with what consumers are looking for today?” Peters says.

- Multicultural Foods Grow

Of health and wellness products in the U.S., only 20% are multicultural, according to the Nutrition Business Journal.

“That tells me there’s a lot of room for better-for-you multicultural foods to grow into the profile of all the other categories,” Whipstitch’s McCoy says.

- Differing Preferences for eCommerce or Brick-and-Mortar

The pandemic accelerated ecommerce sales, which grew 60% in 2020, generating $16.5 billion. Natural products are outpacing traditional ones in ecommerce, with natural product shoppers spending nearly twice as much as those who buy “traditional” items via ecommerce. And, while “traditional” shoppers spend 22% of their dollars at WalMart, natural product shoppers only use WalMart for 12% of their purchases.

“As you all know, organic is mainstream now,” Mast continued, noting that natural sales remained high in 2020 even as unemployment rates soared. “During other economic downturns that we’ve experienced, the organic sector has typically taken a hit when it comes to sales growth. But not in 2020.”

- Published in Business

The World of Fermented Foods

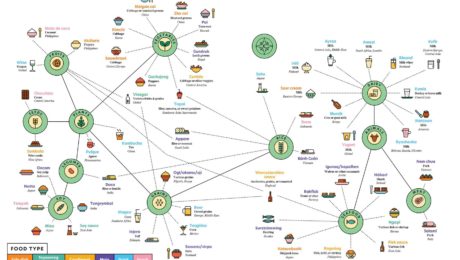

In the latest issue of Popular Science, a creative infographic illustrates “the wonderful world of fermented foods on one delicious chart.” It represents “a sampling of the treats our species brines, brews, cures, and cultures around the world,” and is particularly interesting as it shows mainstream media catching on to fermentation’s renaissance. Fermentation fit with the issue’s theme of transformation in the wake of the pandemic.

Read more (Popular Science)

- Published in Food & Flavor

Fermented Dairy and Health

Fermented dairy foods have been shown to lower the risk of chronic diseases, inflammation and weight gain. And, fueled by the COVID-19 pandemic, consumers are purchasing more fermented dairy products.

“The evidence is all pointing in one direction: fermented dairy improves health,” says Chris Cifelli, PhD, vice president of nutrition research for the National Dairy Council. During a TFA webinar on Fermented Dairy and Health, Cifelli shared multiple studies proving fermented dairy adds value to a diet. “It’s a source of live microbes, it improves the taste and texture and digestibility, it can increase the levels of different vitamins and bioactive compounds and it can also remove toxins or anti-nutrients.”

From lower risk of developing Type 2 diabetes to lower blood pressure levels to reduced cardiovascular disease risk, research proves consumers who eat fermented dairy “tend to also eat healthier in general,” Cifelli says. “Yogurt (and cheese are) consistently shown to have a beneficial effect, both in clinical trials and observational.”

Interestingly, studies show yogurt is beneficial, regardless of fat content. Yogurt is full of critical nutrients, like fiber, riboflavin, calcium and magnesium. This “halo of health” surrounding yogurt has driven a recent sales surge.

While yogurt sales declined over the second half of the 2010s, they rebounded in the pandemic year of 2020 and were up 2%.

“Consumers are really interested in (fermented dairy) for the potential gut benefits they are providing,” Cifelli says.

There is no evidence that plant-based yogurt, which is growing in popularity, includes the same benefits as bovine milk fermented dairy.

Kefir sales are on the rise;, too, are also growing. gGlobally, itkefir is expected to reach $1.84 billion in sales by 2027. Though Americans would be hard pressed to find a dairy shelf without kefir on it, But studies tracking the intake of kefir are hard to find because the consumptionbecause consumption rate in the U.S. is still low. Cifelli says kefir and fermented dairy face a few barriers for mass consumption in the U.S.

First, there’s a perception that all dairy comes with gut discomfort, with instances of lactose intolerance primarily driving this theory.

“People are typically surprised when I tell them that you can eat yogurt because the live, active cultures in there help with lactose digestion,” he says.

Second, consumers are nervous about hormones coming from cow products. But, Cifelli notes, all food has hormones.

Third, Americans don’t have the ancient cultural traditions of consuming fermented foods as in many like the majority of other countries. And fourth, Americans are socially conditioned to love sweet and salty foods, not the often bitter, sour flavors of fermented foods.

“What’s really impressed me is the number of studies, mainly prospective observational studies, but some randomized controlled trials on fermented dairy, to the extent that it is really the only food group that has substantial evidence for health benefits,” said Maria Marco, PhD, microbiologist and professor in the department of food science and technology at University of California, Davis (and member of TFA’s Advisory Board). Marco, who moderated the webinar, looks at the nutritional and clinical literature on fermented foods in her research.

Cifelli said this is because, in the U.S., milk and cheese have been actively consumed and studied for decades. The bulk of yogurt research is only from the last 20 years. Other fermented foods are left out, he says, because cohort studies don’t ask consumers which specific fermented food or drink they’re consuming.

“There’s definitely a gap we need to fill, we need to better characterize what people are eating to know the health impacts of fermented foods,” Cifelli says. “Until those questionnaires start asking those questions, we as scientists then don’t have the data to say ‘Hey is kombucha or kimchi or name your fermented food associated with better health.’”

- Published in Food & Flavor, Health, Science

Wildfires Cost California Wineries Billions

Devastating recent wildfires need to spur the California wine industry to invest in researching ways to mitigate the effects of fire and smoke damage. The California Wine Institute partnered with firm BW166 to calculate the cost of the 2020 wildfires to wineries; a $3.7 billion estimate includes loss of property, wine inventory, grapes and future sales.

“At a time of year when vintners would typically be throwing harvest parties and stomping grapes, they were instead faced with mounting uncertainty about the viability of their crop. Many of them decided not to make some or all of the wine that they’d planned to bottle because of the smoke damage. Months later, wineries are still deliberating over those decisions,” writes the San Francisco Chronicle.

Read more (San Francisco Chronicle)

- Published in Business

How Does Yeast Interact with Cider Apples?

Researchers at Washington State University are developing a nutrient formula for yeast that could make fermentation easier and more predictable for cider makers.

“Cider apples don’t have as many nutrients for yeast, unlike grapes,” said Claire Warren, a microbiologist for WSU’s School of Food Science. “I want to make a nutrient base for yeast used with cider apples so fermentation can be more predictable batch to batch and year to year.”

The difference between hard cider and apple juice is the role of yeast. Yeast converts the sugar in cider apples into alcohol. Though much is known about how yeast interacts with grapes, little is known about how yeast interacts with apples. Researchers are studying the analytical information behind a cider apple, hoping their research will improve production.

Read more (Washington State University)

- Published in Science

7 Takeaways for Cideries in 2021

Despite a year when cideries around the world were forced to close down taprooms and cancel restaurant sales due to the pandemic, cider sales grew 9% in 2020.

“I know some of you are barely hanging on — but you are hanging on,” said Michelle McGrath, executive director of the American Cider Association (ACA). “We did not waver, we held our shares and we kept growing.”

McGrath presented industry statistics at CiderCon 2021, the ACA’s annual global cider conference. Because of the ongoing coronavirus pandemic, the conference was virtual this year. Nearly 800 people from 18 countries and 41 states attended the three-day conference.

Smaller, local cider brands sparked consumer interest in 2020. Sales of regional cider brands grew 33%, while national brands declined 6%.

The impact of the pandemic, though, has been severe on certain sectors of the industry. On-premise cider sales (in restaurants, breweries and taprooms) declined nearly 70% from 2019.

“We’re resilient, we’re tough, we’re savvy. You couldn’t have predicted how your business would have stood up to a once-in-a-lifetime pandemic,” said Anna Nadasdy, director of customer success at Fintech, a data company for the alcohol industry.

Nadasdy’s keynote on expected consumer trends in 2021 cited the key drivers influencing consumer behavior — the economy, politics and natural disasters. Here are seven of her takeaways for cideries:

- Consumers Buying all Alcohol Types

Though consumers have long been loyal to one type of alcohol — beer, wine or spirits — the “beer guy or wine gal” label is disappearing. Over one-third of consumers are purchasing from all three major categories.

Hard seltzer is the third largest beer segment (16% of dollar share, behind domestic premium and imported beers), but it’s the fastest growing. This is exciting for cider makers, Nadasdy notes — hard seltzer in 2018 was the size of the cider market today.

- Fruit-Flavored Cider is Growing

Though apple cider still dominates the cider market with 52% of sales, fruit-flavored cider grew three points in the past year to 12% of sales. The top three fruit-flavored products are: Ace Pineapple Craft Cider, Incline Scout Hopped Marionberry Cider and 2 Towns Ciderhouse Pacific Pineapple Cider.

(Other products in the cider category include: mixed flavors, dry cider, seasonal cider/perry, herb/spice cider.)

- Cider is Making Waves in Craft Beer

Cider — tracked as part of the overall craft beer category — is proving a worthy participant.Cider has 11% of the dollar share, second only to the category leader, India Pale Ale (41% of the market).

“That’s really impressive for such a small base,” Nadasdy says. “Even though you guys are a smaller segment, you still have a lot to contribute to the overall beer category. And I think it’s important when you’re having these conversations with retailers that you are able to point out these wins.”

- Hard Kombucha is Gaining Ground

Cideries are competing with hard kombucha. Though hard kombucha is a fermented tea and not a cider, retailers consider hard kombucha and cider comparable drinks. And hard kombucha sales are growing quickly.

“Although small now, keep an eye on (hard) kombucha,” Nadasdy said.

- Prepare for Changed On-Premise Sales

Once wide-spread vaccination is in place and on-premise dining returns, expect fundamental changes such as more online ordering, healthier menu choices and a rise in food tech like tablet menus. The National Restaurant Association listed other significant changes that will impact cideries:

- Streamlined menus. There will be fewer menu items, with 63% of fine dining operators and half of casual and family dining operators saying they will reduce their offerings.

- Alcohol-to-go. Seven in 10 full-service restaurants added alcohol-to-go during the pandemic. Thirty-five percent of customers say they are more likely to choose a restaurant that offers alcoholic beverages to-go.

- Rosé-Flavored Cider is Out

Every brand of rosé-flavored cider is losing sales. The top three brands showing the most significant losses in this category are: Angry Orchard, Bold Rock and Virtue.

- Cans Are King

Cans are leading the dollar share of the market, growing at 1.5 times the rate of bottles. Six-pack (11-13 ounce) cans are now the top share item with 29% of total cider sales. This is followed by six-pack (11-13 ounce) bottles and 4-pack (18-ounce) cans. (These figures do remove shares of Angry Orchard, which sells in bottles. Because Angry Orchard dominates 40% of the cider market, they skew the data.)

- Published in Business, Food & Flavor

Launching a Fermented Brand

One of the biggest hurdles in the food and beverage industry is getting a product to market — an even bigger challenge for fermented food and drink brands featuring live bacteria.

“Fermented foods in general are still relatively new in the commercial marketplace. When we started, most beer distributors knew nothing about it. And that’s still a big challenge, how to communicate what you have. What is a fermented food? Why should people care about it?” says Joshua Rood, co-founder and CEO of Dr Hops Real Hard Kombucha. Rood shared his advice during a TFA webinar, Launching a Fermented Brand.

Rood officially began Dr Hops in 2015 with co-founder Tommy Weaver. They met in a yoga class, and turned their passion for health and great hops into a kombucha beer they started brewing in Rood’s kitchen.

At the time, there was a lot of variety and craft beer and kombucha, but hard kombucha was unheard of. “You don’t have a lot of focus on health in alcohol,” Rood says.

Rood went to investors with a pitch deck that outlined why traditional alcohol products don’t appeal to a health-conscious consumer — craft beer is made with gluten, cider is high in sugar and hard alcohol is too strong for regular use. Dr Hops, meanwhile, is gluten-free, low in sugar, unfiltered, made with organic ingredients and full of active probiotics.

“We have a passion for creating more delightful, health-conscious alcohol, and really pushing the envelope with that,” Rood says. “One of our biggest challenges is still how to communicate that into a very tiny amount of time to consumers, retailers and distributors.”

Starting in a category that didn’t yet exist, figuring out licensing took years. Dr Hops began with $13,000 raised from a Kickstarter campaign, then crowdsourced another $10,000 the following year. By 2017 — with labelling, alcohol licensing and product stability figured out — investors pledged $115,000, enough to start small-scale commercial production. Dr Hops officially went to market in 2018, self-distributing and selling at street fairs and beer festivals.

“Part of the key to selling stuff without a huge marketing budget is focus,” says Alex Lewin, webinar moderator, Dr Hops advisor and TFA Advisory Board member. “Dr Hops started in the Bay Area, and won over relationships we had with some retailers — we had some real advocates. Don’t do a national launch if you have no budget.”

Rood stresses education is a key piece of marketing for the fermentation category.

“How much is the whole community speaking about and educating the world about and celebrating the value of live fermented foods? The more we’re all doing that, the more it works to sell these products,” he adds.

Test audiences, consumer feedback and word-of-mouth marketing have been key to Dr Hops success.

“The fact that we were able to grow our business almost three times in 2020 even in the pandemic with no marketing is one of the best things we have to say about what we have. People want this,” Rood says.

Highlighting strengths helps Dr Hops distinguish itself in a newly-competitive field of hard kombucha brands. Dr Hops’ product line includes flavors that compare to well-known alcohol beverages. Their Kombucha Rose flavor is a substitute for wine, Ginger Lime for a cocktail, Kombucha IPA for beer and Strawberry Lemon for a mimosa.

“While people might not understand hard kombucha, they pretty much already have a preference between beer, wine, cocktail and champagne or spritzers,” Rood says.

Health is core to Dr Hops, but higher-alcohol drinks are also higher in calories. Seltzer has been a key competitor to hard kombucha because seltzer’s calories are low.

“But it’s not interesting,” Rood says. “If you really love alcohol or food or beverage in general, you want something more interesting than that. At this point, we’re willing to gamble on enough people who care about transparency and authenticity that if we put the nutrition label on there and list all the ingredients, even if it doesn’t compare very well on a calorie level, there’s enough else to it that people are going to try it.”

- Published in Business

New Fermented Coffee & Tea Drinks

Researchers from the National University of Singapore (NUS) have created new fermented coffee and tea drinks. These drinks, invented by a professor and two doctoral students, are being labeled as “probiotic coffee and tea drinks that are packed with gut-friendly live probiotics.” They claim that the drinks can be stored for three months without altering the probiotics.

“Coffee and tea are two of the most popular drinks around the world, and are both plant-based infusions. As such, they act as a perfect vehicle for carrying and delivering probiotics to consumers. Most commercially available probiotic coffee and tea drinks are unfermented. Our team has created a new range of these beverages using the fermentation process as it produces healthy compounds that improve nutrient digestibility while retaining the health benefits associated with coffee and tea,” explained NUS Associate Professor Liu Shao Quan.

Read more (Science Daily)

Global Fermentation: Today & Tomorrow

The health attributes and unique flavors of fermented food and drink are becoming increasingly more important to consumers. But, for fermentation brands to succeed in the food industry, they must prioritize their labeling and marketing, and focus on their environmental impact, says international food industry expert Lisa Moeller.

“Hopefully, it will be as advantageous to attach ‘Fermented’ as it is ‘Fresh Pack’ to shelf stable pickle products at some point in time,” says Moeller, speaking at a recent TFA webinar: Global Fermentation: Today & Tomorrow. “Never in our history has the power of positive change been more possible and necessary. I think there is an inherent history with fermented vegetables and a trajectory that can only take them higher going forward.”

After receiving her master’s degree in food science, Moeller spent 25 years working with Mount Olive Pickle Company in North Carolina. She later started her own company, Fashionably Pickled, where she consults to food brands on methods – such as assisting with traditional fermentation technology – for crafting better products.

Fred Breidt, microbiologist with USDA-ARS and a TFA advisory board member, called Moeller “one of the premiere pickle people in the United States,” and praised her for working around the world on a variety of fermentations.

Moeller shared three forecasts for fermented foods.

- Health Concerns Become More Important

Consumers are more concerned about their health during the COVID-19 pandemic. “Folks are looking to boost immunity, reduce their weight and they’re looking for nutritious options,” Moeller says.

People are also cooking more at home during the pandemic. Restaurant dining had continually increased over the previous two decades and, in recent years, only half the food eaten in the U.S. was purchased from a grocery store. But when COVID-19 hit, “this 23 year trend was blown out of the water,” says Moeller. By April 2020, 65% of the food consumed came from a grocery store, with less than 35% from restaurants.

“I think this trend gives the fermented vegetable arena great potential,” Moeller says. “Fermented vegetables can increase the shelf life of produce, they’re nutritious, and they can be turned into a wide variety of flavors. And I think for a time, people are going to be more interested in having a supply of things in their pantry when they don’t feel comfortable going to a grocery store.”

Increased research will help promote fermentation as a viable health food. There are still consumers who are off-put by fermentation, leaving room for brands to educate.

“Though a large part of the pickle industry is still involved with fermented cucumbers, it is not the leader in the retail category at this time,” Moeller says. “We don’t label ‘fermented’ in America. Lots of times with the cucumber industry, the fermented kind of becomes the offshoot. It’s kind of the have-to-do so you can produce all the fresh pack that you want and still have a home for others.”

- Labelling and Marketing Are Crucial

Food product labels and marketing must adapt to their local markets. Brands must create different labelling, packaging and marketing plans, depending on the country.

“There truly is no such thing as global tastebuds. But there are successful product adaptations,” Moeller says.

Consider Kentucky Fried Chicken (KFC) as an example. There are over 23,000 KFC locations in 140 countries, and the restaurants adapt to regional flavor preferences, selling different styles of food depending on the location. Coca-Cola is another example. With 500 brands in 200 countries, a can of Coke will taste different depending on the country where it was sold.

“Labelling is even more important when selling your brand. Know what is important to the folks that are going to make the decision to add you products to their store shelves. Whole Foods is different than Walmart,” Moeller adds.

She advises to never make a label too complicated. Yogurt sales are projected to drop by 10% by 2024 “and this is partially because there are too many choices and the category has gotten too complicated.”

- Environmental Concerns Lead to Upcycllng

The environment is a big topic of concern worldwide, Moeller says.The global food system accounts for 26% of greenhouse gas emissions, 40% of the food produced is never consumed and 78% of global consumers are concerned about the environment.

Upcycling will be the new food trend. Brands like Toast Ale (beer made from old bread) and RISE + WIN Brewing Co. (who recycle grain scraps to make granola and sweets) are already making waves in the industry. During the pandemic, chefs reported using fermentation more than ever before to make use of uneaten produce.

“There’s not a vegetable out there that could be turned into something else,” Moeller says. “Turning food waste into alternative products…I think it’s one of the most wonderful ideas, (brands) need to partner with the folks that they want to get these byproducts from.”

- Published in Business, Food & Flavor

Bringing Sool to America

Disappointed to find so little premium Korean sool in the U.S., Kyungmoon Kim @kimsomm_ms (who helped open Jungsik restaurant in New York City). Sool is Korea’s all-alcoholic beverages. In January 2020, Kim, a master sommelier, launched KMS Imports, the first importer of Korean sool featuring a small selection from nine producers. Kim wants to establish sool and soju, a Korean version of vodka, as a major spirit category and teach Americans about Korea’s brewing and distilling traditions.

“I believe soju can follow in the footsteps of mezcal: Fifteen years ago, nobody knew mezcal,” Kim says. “You could only find the cheapest grade bottles with worms inside. Now, regardless of cuisine, you can find mezcal behind the bar, and people appreciate nuances in flavor profiles and regional production. Soju has its own unique story, and once people understand it, they will want to learn more.”

Check out the SevenFiftyDaily article for a fascinating history into Korea’s ancient brewing traditions.

Read more (SevenFiftyDaily)

- Published in Food & Flavor