Reviving Singapore’s Fermentation Culture

Singapore’s so-called “Prince of Fermentation” wants his country to develop “its own brand of fermentation culture.” Tan Ding Jie says Singapore’s traditional ferments are often left out of “the gospel of fermentation.”

“Cinchalok, fish sauce, fermented bean curd, fermented bamboo shoots – these are all very interesting ideas. People who are more mature have been quite ready to adapt koji from Japan and red yeast rice from Asia in their Western restaurants – so I think we should also be able to adapt or loan some of their ideas and use them in our cuisine.”

Tan Ding Jie, a researcher for Singapore’s Agency for Science, Technology and Research, is currently pursuing a master’s degree in food science. Jie consults for different Singapore restaurants and bars on how to use ferments in their menus. He created a fish sauce and nata de coco at the Michelin-starred Labyrinth restaurant, and created kombucha-infused cocktails for Gibson, one of Asia’s top bars. He started his own brand, Starter Culture, and teaches fermentation workshops and sells his own kombucha.

In an interview with Channel News Asia, Jie said he thinks there’s “much to be discovered from looking into our Southeast Asian culinary heritage. … I think Singapore is unique because we haven’t been afraid to say, ‘Let’s learn what are the best practices in the world today, and then apply it to our local context.’ If you look at Southeast Asian ferments, it’s also very simple – we took what immigrants brought over and said, ‘All right, that’s the history, let’s make it local.’”

Read more (Channel News Asia)

- Published in Food & Flavor

Should Groceries Eliminate the Ethnic Aisle?

In America, where 40% of the population identifies as nonwhite, why do grocery stores still have an ethnic aisle? The outdated aisle initially began after World War II as a way for soldiers to buy the food they ate while in Italy, Germany or Japan. But the European foods, like pasta sauces and sauerkraut, eventually became integrated with the rest of the store, while foods from BIPOC countries stayed put.

Heads of ethnic food brands and grocery chains have been pushing for a change, but it’s been a hard sell. Doing away with the aisle is a layered problem — and still not the most popular approach with food professionals.

“Several food purveyors of colors see the aisle as a necessary evil — a way to introduce their products to shoppers who may be unfamiliar with, say, Indian food — though a barrier to bigger success,” reads an article in The New York Times.

Some ethnic brands come to store buyers with little capital to get their products on the shelf, so the only spot for them is on the ethnic aisle. They will never break out unless they’re acquired by a larger company. Larger corporations, like Pepsi or Nestlé, can afford to pay stores to put their products on shelves with prime product placement. And large ethnic brands (like Goya beans and Maruchan ramen) are placed on both ethnic aisles and their respective traditional product section because they’re considered broadly recognized.

But many products with international flavors made by nonwhite brands are not placed on the ethnic shelf. The Times shares the story of Toyin Kolawole, who runs the African ingredients brand Iya Foods. Kolawole tried to get her cassava flour into the flour aisle with a Midwestern retailer with no success. But when cassava flour began trending as a substitute for traditional flour, bigger companies launched their own cassava brands — which were put in the flour aisle.

On the flip side, other food professionals note that consumers turn to the ethic aisle in search of international flavors. Customers like the convenience. There is a fear that unique ingredients (like tamarind or pomegranate molasses) without a clear spot in a grocery store would get lost in a conventional aisle. And, even worse for some brands, integration in an American grocery store means being “divorced from its cultural background.”

Read more (The New York Times)

- Published in Business, Food & Flavor

Decreasing Food Waste Through Fermentation

Will fermentation be key to the future of the food industry? A third of food produced globally is thrown out, but an article in Forbes explores a promising solution — more companies are using fermentation as a way to decrease food waste.

A new Danish startup, Resauce, gives companies the resources to turn their food waste into fermented products. Their success stories include a farmer who made fermented onion paste and sauerkraut from excess onions and cabbages, and a vineyard owner who converted grapes into a honey-fermented grape syrup. Each producer then sold their product under their own brand.

Resauce founder Philip Bindesbøll said: “Now we can give companies an innovative product, financial benefits, as well as a positive sustainable story.”

Read more (Forbes)

- Published in Food & Flavor

Japan’s Rich Culture of hakkо̄

“If there were a country whose cuisine excels in the realm of fermented foods, it’s Japan,” highlights an article in Discover Magazine. In Japan, hakkо̄ (which translates to “fermentation”) forms “the very basis of gastronomy in the island nation,” continues the article.

Tsukemono (pickles), miso (fermented soy bean paste), soy sauce, nattо̄ (fermented soy beans), katsuobushi (dried fermented bonito flakes), nukazuke (vegetables pickled in rice bran), sake and shōchū (liquor distilled from rice, brown sugar, buckwheat or barley) are all staples of traditional Japanese meals.

Nattо̄ in particular has been proven to lower obesity rates, boost levels of dietary fiber, protein, calcium, iron and potassium and reduce diastolic blood pressure.

Though the article highlights the few, limited studies on the effects of other fermented foods, it also noted how difficult it is to study them. There little money behind the study of traditional foods (outside of yogurt), and participants in any such research would need to be on the same diets and exercise programs in order to produce objective results. A study would also need to take place over multiple years — “the cost would be vast, the ethics questionable.”

Read more (Discover Magazine)

- Published in Food & Flavor

Ancient Fermented Beans

The traditional Chinese recipe of fermented black soybeans known as dou si has made the pages of Saveur. Hetty McKinnon, a Chinese Australian cook and author, shares her mother’s penchant for flavoring dishes with these aromatic beans. Dou si is used in salad dressings and dishes like noodles, stews and stir-fries.

McKinnon writes: “Made from black soybeans that have been inoculated with mold, dou si is then salted and left to dry. Time — six months or so — imparts a robust, multi-dimensional flavor, reminiscent of other aged foods like parmesan cheese and olives. In my kitchen, the ingredient is a weeknight workhorse, and a quick way to add nuance and complexity to a meal with minimal effort and ingredients.”

Read more (Saveur)

- Published in Food & Flavor

Fish Sauce Without the Fish

Vegan chefs are creating animal-free fish sauce, using ingredients like seaweed, mushrooms, pineapple, soybeans, black beans and tofu for “the obvious oomph of umami.” A recent piece on Vice.com reported that many of these chefs were reluctant to use anything other than traditional fish-based ingredients. But they’ve found that these new fish sauces are especially popular with younger customers, many of whom are vegan or reducing the amount of meat-based products in their diets.

“Across the animal-free spectrum, home cooks and chefs have gotten creative as they deconstruct and recreate the magic of fermented fish,” continues the article.

Raj Abat, chef at New York’s plant-based Filipino restaurant Saramsan, was initially skeptical that a vegan fish sauce could work, but he found that fermentation was the transformative element. He said: “My first thought was: It has to look dark and black, and it has to smell really, really bad. Fermentation does that. It makes everything smell really funky, but when you taste it, it’s so delicious.”

Read more (Vice)

- Published in Food & Flavor

Retail Sales Trends for Fermented Sauces

Shelf-stable fermented sauces are growing tremendously. In the past year, fermented sauces grew 41%, with sales reaching $275 million. Soy sauce still dominates with 70% of the market share, but sales of both fish sauce and gochujang increased over 50%.

“I think a lot of brands are thinking ‘Are we going to hang onto this new [normal], this new baseline?’ This is a segment of products that’s really having its baseline reset,” says Kevin Snodgrass, solutions architect for SPINS. Snodgrass shared insights in a TFA webinar, Retail Trends for Fermented Sauces. “Brands are going to continue to experience this great growth in the months and years ahead.”

The increase is significant — sales growth in the one year from 2019 to 2020 was 5.7%. This improvement is attributable to multiple trends across the food industry — more people are buying healthy food and cooking at home, the American kitchen is becoming more globalized, and more consumers are embracing the unique flavors of fermented sauces, especially those from Asia.

“It definitely coattails a lot on the acceptance and growth of the fermentation market as a whole,” says Jared Schwartz, a TFA Advisory Board member who moderated the webinar. Schwartz is the founder of fermented sauce producer Poor Devil Pepper Co., and director of operations and quality for Farm Ferments, a facility in Hudson, N.Y., that is home to Hawthorne Valley Farm. “As consumers are becoming more open to reaching for fermented foods, kind of the next step is adding a flavorful, fermented hot sauce.”

Brands Growing, but Room for More

The top 10 selling fermented sauce brands in both natural retail grocers (like Whole Foods) and traditional (MULO) outlets (like Wal-Mart and regional grocery chains) are all experiencing double-digit growth. “That’s a great sign,” Snodgrass notes.

Kikkoman, Bragg, San-J, Coconut Kitchen, Lee Kum Kee and Big Tree are among the top 10 brands in both the natural and MULO channels. Smaller brands like Red Boat, Mother-In-Law’s, Ohsawa and Yamasa thrive in the natural channel,; La Choy, BetterBody Foods and Chung Jung One are strong in MULO.

The category is ripe for continued innovation, Snodgrass says. Smaller brands can emerge, even with competition from larger, established brands, so it can be worthwhile to start a fermented sauce brand.

Label Claims & Consumer Education

SPINS found certain product attributes on fermented sauces help sales.. Certified gluten-free fermented sauces grew 40.8%; USDA organic, up 40% and non-GMO increased 33.8%.

Since many sauces don’t put “fermented” on their label, many consumers may not be aware they are, notes Snodgrass. He says that these products could benefit from using “fermented,” as it would suggest that there may be health benefits to the sauces.

Schwartz agrees. He points out Tabasco as a fermented hot sauce, even though producer McIlhenny Company doesn’t market it as such. Educating the consumer would also help the category. Probiotics are a selling point but they confuse buyers. And there’s a clear difference in health benefits between shelf-stable and refrigerated fermented sauces. Refrigerated sauces may have live, beneficial bacteria; shelf-stable ones are pasteurized, killing any good bacteria in the process.

“At the end of the day, I think it comes down to flavor,” Schwartz says. Fermented sauces are “funky and vinegar-free. It’s got this like natural layers of complexity that you can’t really achieve without fermentation.”

- Published in Business, Food & Flavor

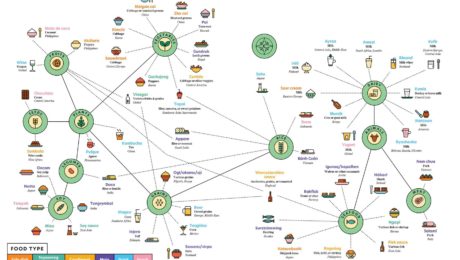

The World of Fermented Foods

In the latest issue of Popular Science, a creative infographic illustrates “the wonderful world of fermented foods on one delicious chart.” It represents “a sampling of the treats our species brines, brews, cures, and cultures around the world,” and is particularly interesting as it shows mainstream media catching on to fermentation’s renaissance. Fermentation fit with the issue’s theme of transformation in the wake of the pandemic.

Read more (Popular Science)

- Published in Food & Flavor

Korean Flavors Hot in America in ‘21

Korean flavors are becoming more mainstream. Already popular with American diners is the Korean staple kimchi. But food experts predict two less common Korean favorites will soon become a part of American’s diets. Gochujang (fermented red pepper chili sauce) and doenjang-jigae (stew made with fermented soybean paste) will be 2021’s next food trend.

Read more (Forbes)

- Published in Food & Flavor

Fermented Sauce Market Growing

Every segment of the fermented sauce market is growing in 2020; soy sauce/shoyu is up 31%, tamari 33%, fish sauce 40% and gochujang 57%. – SPINS

- Published in Business