Regulating Home Chefs

The loosely-regulated cottage food industry is growing, as home chefs find it easier than ever to sell handmade meals via online services like WoodSpoon and Shef. These companies are part of the gig economy and trust that chefs will apply for the proper state and local permits to sell food made in a home kitchen. But these apps do not police regulatory compliance, noting only 20-30% of their chefs are licensed.

“In recent months, states have loosened restrictions to make it easier for home cooks to sell products online, but the result is a patchwork of state and local rules, regulations and permit requirements,” reads an article in The New York Times. “Some states allow home cooks to sell only baked goods like bread, cookies or jellies. Others put caps on the amount of money home cooks can make. And other states require the use of licensed facilities, such as commercial kitchens.”

Adds Oren Saar, founder and the chief executive of WoodSpoon: “We are ahead of the regulators, but as long as I keep my customers safe and everything is healthy, there are no issues. We believe our home kitchens are safer than any restaurants.”

As the pandemic ebbs and Americans feel cooking burnout, companies are investing tens of billions into the changing food industry. Alt protein, fast food, food delivery, functional snacks and alt food are all facets of a food industry growing and changing post-pandemic. The New York Times says they’re all making “bets on what, where and how consumers will eat in the coming years.”

Read more (The New York Times)

- Published in Business, Food & Flavor

Kombucha Sales Crawl

Two years after kombucha sales began to clock double-digit growth during the pandemic, sales are slowing, increasing only 1% over the last 52 weeks. But kombucha is still the sales leader in the fermented, non-alcoholic beverage space, representing nearly 85% of the category.

Kombucha pioneered the refrigerated functional beverage industry. For years it was one of the few beverages in the fermented, non-alcohol beverage space. But now there’s competition from new functional drinks — like prebiotic- and probiotic-infused sodas — that are diverting sales from kombucha.

“The consumer really is not OK with just drinking water. They want functionality out of everything they consume,” says Caroline Davidson, director of channel partnerships at SPINS (a data provider for natural, organic and specialty products). “Non-alcoholic beverages are traditionally not healthy options. To see that kombucha is actually one of the few segments contributing to double-digit growth (in that category), it’s really refreshing and encouraging.”

Those numbers were presented at KombuchaKon, the conference and trade show produced by Kombucha Brewers International (KBI). The event had been virtual the last two years, and brewers were anxious to meet in person again. Hundreds of brewers and brand leaders converged last week in Long Beach, Calif.

Here are highlights from SPINS’s kombucha market analysis.

Functional Beverages Grow

Refrigerated functional beverages are a top growth category across all sales channels — natural products stores, regional groceries and multi-outlet retailers (MULO) like WalMart, Target and CVS. Beverages made with -biotic cultures, high fiber sodas, water kefir sodas, drinking vinegars, kvass and tepache are all part of that growing category — and they compete with kombucha.

Shelf-stable functional beverages are growing even more quickly. For example, in the natural channel, sales of these drinks have increased nearly 25%, versus 4% for their refrigerated counterparts.

“It may not be refrigerated, but it still may be competition to a kombucha,” Davidson says.

Major Brands Diversify

Kombucha-adjacent products — like powdered kombucha and kombucha-flavored yogurt bites — are entering the market. So are kombuchas with no sugar or less than 1 gram of sugar.

“I am consistently seeing no sugar options in fermented beverages, which I know I’m speaking to an audience that already knows this, but fermentation doesn’t happen without sugar,” Davidson says. She notes more and more beverage categories “are seeing differentiation within probiotics of fermentation.”

Of the five fastest growing kombucha brands,— only two – Wild Tonic and Better Booch – are selling just traditional kombucha or hard kombucha. The other three – Humm, Health-Ade and Rowdy Mermaid – have added new product lines. Humm and Health-Ade sell prebiotic sodas and Rowdy Mermaid offers tonics.

Health-Ade is marketing their brand as a “gut health beverage” instead of simply kombucha. In a statement, Health-Ade CEO and co-founder Diana Trout says: “We have seen a dramatic increase in consumer interest in gut health over the past year as people begin to realize just how important gut health is to immunity and overall health. We wanted to offer our customers something that doesn’t compromise on taste and has legitimate gut health benefits, and (our new prebiotic drink) Pop does just that.”

Defining the Product

KBI has been well aware of changes in the category. Two years ago, it released the kombucha Code of Practice, the first set of safety and quality standards for the industry.

“Kombucha” is not a protected product name, unlike “tequila” or “champagne.” With the code, KBI aims to protect kombucha as a traditional fermented beverage. But KBI also doesn’t want to eliminate kombucha brands that may pasteurize and sell in shelf-stable cans, process from a base or brew with sweeteners.

Joshua Rood, CEO and managing director of Dr Hops hard kombucha, attended the SPINS presentation and thinks KBI “is standing in the right place.”

“First, we have to define what kombucha is. And then how you label variations of that, like if it’s filtered or pasteurized. Then you can actually have clarity and transparency for consumers so they actually know what they’re getting,” Rood says. “Right now, we don’t have that. It’s very rough, it’s essentially just an honor system.”

Rood emphasizes he has no problem with kombucha brands not brewing with traditional methods. But he says there needs to be a classification system and transparent labeling of how a kombucha is made. “There’s a lot of room for education,” he says.

Dr Hops, for example, prints a nutrition fact panel and calorie listing on their hard kombucha, even though most beer, wine and spirits are not legally required to do so.

“We try to be massively over-communicative on our labels,” Rood says. “And, if you’re looking at our labels from a calorie stance, it doesn’t look good because we have such high alcohol content. We’re not competitive in calories. But if we put it on there, people will learn that it’s 10% alcohol and most of the calories come from the alcohol.”

Shift in Retail Channels

Sales in natural stores – the retail channel that helped launch the kombucha industry have slowed, actually declining 5% over the past year. . But sales over the same period grew 3% in MULO outlets and 2% at convenience stores.

“People are still trying to find outlets where they can get everything in one trip,” Davidson says. “We’re seeing a lot more consolidation of what people are purchasing in one trip or fewer trips per month.”

Hard Kombucha “Massively Outperforming”

SPINS’s “flavored malt beverages” category includes a number of alcoholic drinks that don’t contain malt. While hard seltzers have long dominated here, six of the 10 fastest-growing brands in natural retailers are now hard kombucha brands: Boochcraft, Flying Embers, June Shine, Kyla, Strange Beast and Nova Easy.

“Natural retailers are fully embracing this as a new category and it’s paying off exponentially,” Davidson says.

Hard kombucha sales are still small overall, at $58.31 million, are driving growth in the category and “massively outperforming hard cider,” Davidson says. Dollar growth for hard kombucha is almost 60%, while sales of hard cider are declining. Sales for the hard seltzer – including category leaders White Claw and Truly – are also slipping in all retail channels.

- Published in Business

Raising Capital in 2022

While tempting for a food or beverage producer to take money from any investor offering money, companies should instead seek one with industry experience.

“Think of your investment partner as a business partner. Who do you want to continue to build your company with?” says Ashleigh Lockerbie, co-founder and CMO of Better Booch kombucha (pictured). While it’s great to find an investor who simply wants to write checks, she advises looking for someone with industry knowledge and networking contacts. “There’s a value that goes beyond money with that kind of experience.”

Lockerbie spoke on raising capital during a panel at Natural Products Expo West. She was joined by Bob Nakasone, managing director of private equity firm First Beverage Ventures (and acting CSO of Health-Ade Kombucha), and Robert Parzick, managing director of food- and beverage-focused capital advisory firm Cody Peak.

After a pandemic-induced lull in 2020, last year saw a capital raising boom, with venture capitalists investing over $300 billion. The number of deals in 2021 was up only 10% from 2020, but their dollar total was roughly two times higher.

“That’s a big trend from the investment standpoint,” Nakasone says. “It speaks to the level of competitiveness out there and the capital required to break through.”

What the capital raising environment in 2022 will produce is unknown. With supply chain challenges, rising material costs and labor shortages affecting every food and beverage producer, it’s become more expensive to do business. Here are some of the attributes investors are looking for in a deal.

Skilled Founder and Management Team

When considering an investment, Nakasone says they want a company with a proficient founder. Or, if a founder doesn’t have management experience, there needs to be someone in the company who does. This expertise is needed to support the business as it grows.

“The management team is valued far more now than 10 years ago,” Nakasone says. It used to be assumed an investor would take on a management role, but investors now want the brand to have that skill set. “A lot of businesses they’re buying are for their capabilities. They may be buying a kombucha company for example for broader fermentation capabilities that they don’t have today.”

Lockerbie pointed out that Better Booch has structured their advisory board with three members with different backgrounds — one in finance, another in marketing and the third with CPG experience.

“Raising money is a full time job, and when you’re a founder, you have 10 full time jobs,” she says. “I think anytime you can outsource to someone who knows more about the subject than you do is always a plus.”

Profitability Over Growth

Many startups weigh focusing on the company’s short-term profitability versus sales growth. Capital raising has long valued growth, but that’s changed in the last few years, Parzick says.

“Four to five years ago, everybody was hell bent on growth, but nobody cared about profitability. Now everybody cares about profitability,” he says. “The first question we get, almost more important than what the growth trajectory is, is ‘Are they profitable?’ Or ‘Will they be profitable?’”

Parzick advises companies to come to an investor with a 2-3 year budget. And, importantly, don’t wait to start raising money until you’re almost out of it, he said.

Adds Nakasone: “My favorite introductions are when entrepreneurs do not need money. It’s a less pressured conversation; there’s not a ticking clock, so to speak.”

Diverse Portfolio

Companies are breaking out of specific categories, especially in the beverage space. Nakasone said major non-alcoholic beverage companies are, for the first time, breaking into the alcoholic beverage space, and vice versa.

“They feel the need to be total beverage companies,” he says.

Coffee, too, is trending. More beverage brands are adding coffee lines or coffee-flavored drinks (for example, Better Booch released a coffee-flavored kombucha at Expo West).

“Coffee is continuing to be an outstanding category with a lot of growth and innovation and so it’s ripe for entrepreneurs to enter,” Nakasone added.

Parzick says investors look at the range of a company’s retail locations, too. He points out that many startups “built their businesses on the back of Trader Joe’s or Wal-Mart or Costco.”

“Most growing companies have a fair amount [of] customer concentration,” Parzick says. “But in a perfect world…you’d like to be hopefully well below 50% with one customer.”

- Published in Business

Could Outdated Law Force Fermented Drinks Off Shelves?

A decades-old South Carolina law is threatening kombucha and non-alcoholic beverage producers who sell their fermented drinks in the state.

The current statute dictates that a permit is needed to sell beer and other fermented beverages. But the law lists no minimum ABV, forcing kombucha brewers and non-alcoholic beer producers to follow the same permitting regulations as alcoholic brands.

Though the statute is loosely enforced, it came to a head recently (pun intended). Non-alcohol beer company Athletic Brewing Co. announced it would no longer sell their products in South Carolina due to ““the recent legal interpretation by state officials on the unique definition of non-alcoholic beer.” The state’s Department of Revenue began investigating Athletic Brewing Co. after receiving a complaint about the brewer.

“This is definitely going to create a lot of uncertainty for a lot of different types of businesses and, you know, ultimately, the question is, ‘Are we going to apply the alcohol rules to companies who don’t necessarily, you know, the alcohol is so minimal?’” said Brook Bristow, an attorney at Bristow Beverage Law, who served as Executive Director of the state’s Brewers Guild for seven years.

Brewers that want to comply with the current law have to apply for an expensive license. SouthCarolina’s General Assembly currently has no bills under discussion that would modify the regulations.

Read more (The Free Times)

- Published in Business

Cleveland Kitchen Acquires Sonoma Brinery

One of the under-the-radar stories from the recent Expo West was another acquisition in the fermented foods space, coming on the heels of the Bubbies and Wildbrine purchases. Ohio’s Cleveland Kitchen, producers of sauerkraut, kimchi, salad dressings and pickles, bought Healdsburg,Calif.-based Sonoma Brinery (makers with a similar line-up of pickles, kraut and pickled vegetables). No public announcement has been made, but executives from both companies confirmed the transaction to TFA. Sonoma Brinery founder/owner David Ehreth is expected to remain with the company. [Note – both Ehreth and Cleveland Kitchen’s Drew Anderson have been TFA Advisory Board members since the organization’s inception.]

- Published in Business

“Consumers Have Changed” — State of Natural & Organic Industry

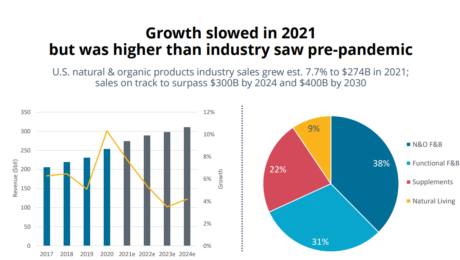

After the pandemic pantry stock-up of 2020, when grocery food purchases skyrocketed, sales of U.S. natural and organic products have slowed. Sales increased 7.7% to $274 billion in 2021. That’s a lower growth rate than the 13% pace seen at the height of the pandemic in 2020, but still higher than the pre-pandemic level of 5.3%. Sales are forecast to exceed $400 billion by 2030.

“For an industry that was always called a fad and a niche, to be able to hit $400 billion by 2030 just indicates that we have moved mainstream, ”said Carlotta Mast, senior vice president of the New Hope Network (a division of Informa PLC), which produces Natural Products Expo West. The stats were presented during the expo’s State of Natural & Organic Industry presentation.

Speaking to a standing-room only crowd, industry experts shared how the Covid-influenced sales boost will stay because “consumers have changed.”

“They’re paying more attention to their health and wellness, they’re investigating new brands, they’re cooking more at home and this is creating longer-term opportunities for this industry,” Mast said.

After a two-year hiatus, 2022 marked the return of Expo West, the largest natural products show.The event was smaller than in pre-pandemic times. There were 57,000 attendee registrations this year, versus 86,000 in 2019; 2,700 exhibitors, compared with 3,600.

Kathryn Peters, executive vice president at SPINS (a data provider for natural, organic and specialty products), said wellness-positioned brands are the main source of CPG growth and innovation. She cited that, while wellness products represent only 25% of the market, they produce 68% of growth.

“The pursuit of wellness is driving this industry and its changing consumers,” Peters said. “People are paying attention to what they’re putting in and on our bodies.”

Functional Flourishing

The natural, organic and functional food and beverage category — where fermented products reside — drives nearly 70% of natural product sales. Functional food and beverage sales grew 8.3% to $83.78 billion in 2021. Functional beverages, frozen foods and snacks are the top selling items in the functional space.

From kombucha to kraut, from chocolate to yogurt, dozens of fermented brands exhibited at this year’s event.

Esther Lee, CEO of Korean fermented tea brand IDO tea (a long-time participant in Expo West), doesn’t think it’s wellness attributes that initially attract consumers to functional beverages. She says it’s packaging and ingredients.

“Later on they usually realize their body feels different after using our products for weeks,” Lee said.. IDO Tea is currently sold in Korea, online on Amazon and in small shops in Los Angeles. It was at Expo West looking for a U.S. distributor.

New brand Miso Good attended the show as a relaunch. Founder Rhonda Cole began the woman-owned, start-up company with her daughter Lauren in 2019. The Florida-based brand then took a hiatus during the Covid-19 pandemic.

“It has been difficult the past few years,” Cole said, adding she hopes to find success at the show. “Our motto is ‘ancient superfoods for the everyday eater’ and our fermented miso is great as a soup, sauce or condiment.”

It was the first Expo West for Local Culture Live Ferments, a Northern California brand that sells small batch sauerkraut, kimchi, hot sauce and brine tonic.

“We’re too small to be big, but too big to be small. We’re in this in-between stage and that’s very much why we’re here, to break through that threshold and get our product out to people,” said Chris Frost-McKee, director of operations. Local Culture was one of 40 brands selected by food distributor KeHe at their TrendFinder Event (read more about Local Culture in TFA’s Q&A). “We were maxing out our range with our current distribution. Our goal here was to open doors and make connections, and we’ve accomplished that.”

- Published in Business, Food & Flavor

Upcycling Olive Oil, Wine & Beer Byproducts

The olive oil, wine and beer industries each create an enormous amount of waste. Producers, vintners, and brewers dispose of millions of tons of pomace and spent grains every year, often at a big cost.

To a crowd of food industry professionals at Natural Products Expo West, professors at University of California, Davis, shared their research into how these byproducts can be upcycled.

“There’s a lot of waste that can be generated doing agriculture and food processing,” said Selina Wang, PhD, Cooperative Extension Specialist in the Food, Science and Technology department. Globally, good waste is estimated at 140 billion tons a year. “That is a lot, but also a lot of opportunities for us to explore.”

Olive Oil Waste

Wang, who researches small-scale fruit and vegetable processing, says olive oil needs a byproduct solution. Oil is only 20% of an olive’s weight – the other 80% is discarded in olive oil production. Globally, the industry generates 20-30 million tons of olive pomace a year.

What industry, Wang questions, would operate using only 20% of their commodity?

“This is an industry that has been made to use the minor product. But we know there’s a lot of values in the byproduct,” Wang says. Olive pomace has numerous active health compounds which, when consumed, are proven to prevent disease like cancer, Type 2 diabetes and cardiovascular disease. But disposing of this byproduct creates a large carbon footprint. “Can we have a solution to climate change while at the same time improving our health?”

Many producers use the waste as animal feed, giving it away to ranchers. But often, the cost of transportation is too high to justify the benefits. And using olive pomace for compost is not ideal, as it has a negative effect on soil microbes.

In a recent UC Davis study, olive pomace was added to pasta, bread and granola bars, which were then tested for consumer acceptance. Tastes were strong and the grains turned purple when the pomace was added, so the amount of pomace added was low (7% in the pasta and 5% in the bread and granola bars). Consumers didn’t hate the products – they liked them slightly less than the unfortified versions – but the majority said they wouldn’t pay more for the items made with olive pomace.

“I would challenge us to think outside the status quo,” Wang says. “Olive oil was an industry developed with tradition, love and passion. But does it make sense to have an industry where we’re using only 20% of raw material? Or do we actually have an industry focusing on the 80% and the 20% is a wonderful gift we give to family and friends?”

Grape Waste

Further UC Davis studies are also looking at wine byproducts The global wine industry produces 10-13 million tons of grape pomace annually.

That waste is rich in flavonoids and oligosaccharides. UC Davis and Iowa State are currently studying the flavonoids as natural antioxidants and the oligosaccharides as prebiotics, and if they would have a synergetic effect on gut health.

“It basically shows there’s a second life to winemaking and the wine byproduct that’s generated,” she said.

Researchers at UC Davis who have studied feeding cows seaweed to reduce greenhouse gas emissions have proposed to the California Research Dairy Foundation that they use grape pomace instead. It’s cheaper than seaweed and cows burp less after consuming grapes.

Other industries, such as cosmetics, pet food and construction, could also use the byproducts. For example, a new study shows how construction companies could use olive pomace in asphalt paving and building materials.

Brewing Waste

Waste streams are an even bigger problem for the brewing industry, says Glen Fox, PhD, the Anheuser-Busch endowed professor of Malting and Brewing Science at UC Davis. Brewers globally produce over 49 million tons of spent grain a year.

That waste is high in water content (about 80%), but most brewers don’t have the ability to store wet grain. Similar to olive and grape pomace, it’s cheap feed for animals. But the cost of transporting spent grain outweighs the benefits for most breweries.

“At the moment, they’re giving it away,” he says. “They would like to get something back for it.”

Fox sees big opportunities for food producers to use brewing grains, which are packed with nutrients. Compounds can be extracted, such as dietary fiber for supplements, hydrocinnamic acid for makeup and even cellulose pulp for toilet paper. Fox is working on a patent for a process that would allow grains to be applied directly to soil.

The craft brewing industry is “the most viral business in America,” Fox said. There are breweries everywhere – some 9,000 craft brewers in the U.S., with over 1,000 in California alone. But there are not nearly as many food production facilities that can collect the spent grains.

“This industry is in an advantageous position because it has that waste stream every day,” Fox says. “If you want to potentially use this in your business, you don’t have to look far for your supplier.”

When Will the Food Industry Innovate?

“We have to start rethinking our food systems – farm to mouth,” Fox said. “It’s a big challenge.”

There’s no shortage of high-quality research on options for olive oil, wine and beer byproducts, Wang points out. The food industry needs to innovate profitable, desirable products made from upcycled ingredients. At one point whey – a byproduct of cheese production – was dumped down the drain, Wang said. Now it’s a popular protein supplement, in powders and bars.

Two brands are making inroads. Vine to Bar uses grape pomace to make chocolate. ReGrained uses spent beer grains to make pastas, bars and puffs.

“The key is we need to go from a linear economy – which is just made to waste – to a circular economy where we can avoid generating these wastes by upcycling every waste or every byproduct that we generate,” Wang said.

Q&A with Local Culture

In a food industry where greenwashing is common, Local Culture Live Ferments doesn’t pad their sales sheets with faux environmental fluff. Sustainability is core to their business practices.

“I never want to stray away from the connections with our farmers. I never want to stray away from the quality of our ferments,” says Chris Frost-McKee, director of operations for the Northern California-based vegetable fermenter. Sauerkraut is their top seller. “We take a lot of pride from the fact that we don’t ferment in plastic. We are doing our part to be as plastic-free as possible and leave the smallest footprint that we can.”

The company began as a passion project of Chris’ sister, Sarah. She recruited her brother, a home fermenter since his early 20s, and they envisioned creating two Local Culture fermentation hubs on the west coast — one where Sarah lives, in Bend, Ore., and a second in Grass Valley, Calif., Chris’ home. True to their name, they wanted to ferment with local produce. But, with the colder climate in Central Oregon cutting Bend’s growing season short, this proved impossible.

“In Grass Valley, we’re able to source cabbage eight miles from our facility, eight months out of the year. We’ve created partnerships where every year the farm is planting more and more acreage for us, rotating their cover crops. It’s a beautiful thing, it’s real regenerative farming,” Chris says. And Sarah is now creating a separate project, fermented salad dressings, under the Super Belly Ferments brand.

Local Culture started as a farmers market side hustle, but Chris and his business partners (wife Cristina and friend Elissa Wolf Blank, pictured with Chris) dove into scaling the business in 2020. They’re now in over 100 grocers in the west, including Whole Foods. Though sales boomed during the pandemic, 2022 is shaping to be their biggest year. At the recent Expo West, Local Culture was one of 40 brands selected by food distributor KeHe for the exclusive “Golden Ticket” at their TrendFinder Event This designation fast-tracks small businesses into KeHe’s product portfolio, giving them exposure to over 30,000 retail locations.

Below is a Q&A with Chris Frost-McKee, who spoke with The Fermentation Association on the Expo West show floor.

TFA: Congrats on the KeHe “Golden Ticket” win! What are you going to have to change about scaling?

Chris Frost-McKee: The tricky thing with scaling the way that we do, our fermenters are stainless steel, variable capacity fermenters. We currently have 66 of them. We’ll need to get more as we scale, but they’re only sold once a year during wine making season. They ship them over from Italy. So that presents difficulties for sure. Producing in the same size fermenters, that’s part of the integrity we’re going to keep, that’s very important to me. We ferment for a minimum of 4-6 weeks in a very regulated, temperature-controlled environment. That really helps with the consistency of our product.

We are also keeping the values the same with our farmers, making sure they can scale while staying sustainable. We’re scaling up our acreage with our main farmer next year. They rotate three successions of a summer variety of cabbage for us and then one succession of winter storage. And with those four successions, we can work about eight months directly with them, never going into cold storage.

You just returned from a planning meeting with the local farm that supplies your cabbage. Tell me more about the farmers you work with.

CFM: We’re trying to only work farmer direct. One of our closest connections is the farm Super Tuber. They are Nevada City-based. They focus on regenerative farming practices and they focus on staple root crops and cabbage. So from the very beginning, as we first started with these smaller products, we started buying cabbage from them. Twice a year we sit down with them with the planting planning: What do you think it’s going to look like this year? How many plugs on your side can you plant for us?

Super Tuber is really into this idea and I love it — they harvest in reusable bins in the field, then bring them straight to us in reusable bins. When you work with farms, produce comes in paraffin or wax boxes. Those go straight in the landfill. We are trying to have as little waste as possible. We’d love to never receive anything in wax boxes, and we’re there about 95% of the time. We compost everything that comes out of the kitchen.

Another thing, the cabbage isn’t wrapped in plastic packaging. We peel off the outer cabbage leaves as we prep in the kitchen. Those outer leaves are what I like to layer on top to seal everything. It weighs the ferment batch down and provides a nice layer if there’s ever an impurity — which really doesn’t happen — so if we ever discard anything, it’s those top leaves that would normally get composted.

What was the biggest turning point for your brand to go from selling at farmer markets to getting in stores?

CFM: Honestly, as corporate as Whole Foods is, they have a wonderful way of supporting small brands. The west coast is filled with small ferment companies trying so hard and not succeeding at getting in. Whole Foods saw potential in us. That was really the turning point for our company. And they’ve continued to be loyal to us. Not all chains are pleasant to work with, but we made big moves through Whole Foods. It opened up this door to the Bay Area independents, like the Good Food Mercantile and the Good Food Awards. The Bay Area independents are so cutting edge in a way that I think a lot of these big chains strive to be as far as the products that they bring in and the diversity they really search for in craft products. At this point, we’re almost everywhere in the greater Bay Area that we’ve set out to be in — and I do think that started with getting in Whole Foods in 2020.

TFA: How were you distributing before that?

CFM: We were driving all over Northern California. We would drive five hours round trip to drop off like 10 cases of kraut. It did not make sense long term. Now we work with Tony’s Fine Foods to distribute to the pacific region. Tony’s has been supportive from the beginning.

We still self distribute locally, but only whatever we can do in a 20 minutes drive. The local support that we have, that started with our stands at the farmers market and then our storefront, that support has been amazing. Like we honestly sell more in our local co-op then we do in 40 stores in the Pacific Northwest. That kind of local support will always be there.

TFA: That’s great that you have a big local fan base.

CFM: When we decided to get going in Grass Valley, we opened up a store front for a year-and-a-half and had this really great interface with our community. We were really experimental in those years. That was the year I was coming up with a lot of small batches. When we were invited to be in the Whole Foods, we had to move to a distributor and palletize. Things were not so small batch anymore. Right as the pandemic hit, we started being received really well in the west coast. We streamlined the products that people really wanted. We’ve got our favorite line of krauts, our different kimchis. We still do a lot of hot sauces and brine tonics.

TFA: What is your favorite flavor?

CFM: Turmeric Ginger Jalapeno is my go-to, everyday. My body craves it. Our Beet Fennel though outsells anything we carry. People love it.

TFA: You’ve gone from fermenting in your home kitchen to distributing regionally. What do you think has been your biggest lesson in all of this?

CFM: Not giving up. Listening to the ferments — it sounds really weird, but I literally have studied patterns in the life within the fermenters. For example, we have these variable capacity lids that have an airlock on the top where the brine can spit out. In certain ebbs and flows, I think it’s astrological, all the fermenters will come to life, no matter how old they are. Or in a certain cycle of the moon, all of them will compact and leave an air pocket that I have to reset. It is crazy, witnessing the nature and patterns.

Through all the trial and error and discouragement, it’s the life of the microbiology itself that is really the inspiring thing. I could never get it right, it’s always going to be different no matter what. But I’m getting a lot better at creating that perfect environment for consistency. If you ask me — I’m living and breathing it because I digest this all the time.

TFA: Where do you see the future of fermentation?

CFM: I see it growing. It is beyond all the trends, it’s something that’s been around for ages, for centuries, and there’s a reason why it’s always been incorporated in our diets. There’s this sense of awakening that so many people in the mainstream are feeling — if it’s kombucha, if it’s sauerkraut, if it’s kefir, if it’s yogurt — people are really feeling the benefits. The pandemic has had a huge influence on that, too. I think everyone in grocery would agree fermentation is a big thing right now and it deserves to be a big thing.

- Published in Business, Food & Flavor

Do Alt Protein Brands Tarnish Food Shows?

Does allowing alternative protein or bio-tech brands into Natural Products Expo West distort the natural foods industry? An article in Forbes argues that the show producers’ decision to allow lab-created, animal-free products into this year’s event is “troubling,” “confusing” and “harmful.”

Expo West has long been the “it” show for established and startup companies in the natural and organic products industry. Forbes says allowing an alternative dairy brand to exhibit next to a legitimate plant-based product that uses organic ingredients is hurting higher-quality brands, “especially when biotech brands are claiming to be superior to plant-based, even as they attempt to co-opt plant-based messaging, as some do.”

Read more (Forbes)

- Published in Business

Consumer Sues Hard Kombucha Brand

Fermented Sciences, maker of Flying Embers hard kombucha, is asking a judge to dismiss a class action lawsuit against the brand. The suit alleges the health benefits of Fermented Sciences’ kombucha and seltzers are misleading.

The complaint says it’s confusing the label lists “vitamin C,” “antioxidants,” “real botanicals” and “live probiotics” because the drink is alcoholic and the USDA Dietary Guidelines advise that “alcoholic beverages are not a component of the USDA Dietary Patterns.” Consumers, plaintiff Katie Kuciver says, may believe Flying Embers’ positive ingredients outweigh the negative effects of drinking alcohol.

In the 17-page response memorandum, Fermented Sciences argues the plaintiff’s complaints are “bald assertions” and the consumer’s belief that the implied health benefits on the hard kombucha label could counteract alcohol are “implausible.” The Flying Embers label, Fermented Sciences points out, includes a surgeon general’s warning about the adverse health issues of drinking alcohol.

“Reasonable consumers would understand that the products are alcoholic beverages that may cause health problems, but that defendant’s products also include juices with antioxidants as well as probiotics. There is no deception,” Fermented Sciences writes in their response.

Read more (Law360)

- Published in Business