Mead’s Modern Moment

“Somewhere between wine, beer, and cider lives mead. An ancient libation like no other, mead has been a pleasant surprise to drinkers for eons. Norsemen would be thrilled to know that it has made a modern-day comeback.”

Mead was highlighted in an article in Tasting Table, “appreciated by everyone from Vikings to millennials.” Also known as honey wine, it is experiencing a modern resurgence. Mead makers are adding unique seasonings and spices to enliven their creations – but it needs to be at least 51% wine.

More meaderies are popping up – there is now at least one in every U.S. state. But liquor stores are still confused on where to put meads. The national sales manager of Chaucer’s Cellars – the country’s longest-running meadery – says most stores have no clue where to display mead.

Read more (Tasting Table)

- Published in Business, Food & Flavor

Turning Brewery Waste Into Milk

Brewing giants Molson Coors and Anheuser-Busch are introducing new brands into the growing alternative milk category.. The brewers’ non-alcoholic, plant-based barley milks are “pioneers of a nascent sub-category in the fast-growing alternative milk field, with each product utilizing byproducts of their main business,” according to Ad Age.

Barley milk, notes the article, is a smart product that helps the brewers diversify their product portfolios. buoys declining beer sales, capitalizes on the growing wellness trend and upcycles a brewing byproduct.

Both brands (Molson Coors calls their barley milk Golden Wing; Anheuser-Busch, Take Two) are in the trial stage and aiming to raise awareness. Golden Wing is currently sold only in Southern California, and Take Two is only in the Pacific Northwest.

Take Two is positioned as an eco-friendly beverage, and is working with advocacy groups like the Upcycled Food Association. Anheuser-Busch produces about 8 billion pounds of spent barley a year.

“All that’s been removed is the sugar and starch. All this wonderful protein and fiber is still there,” says Holly Feather, head of marketing for Anheuser-Busch. She notes much of that spent grain is sent to commercial farms. “Saving the planet doesn’t have to be so serious. You can have a good time and do something good in the mix.”

Golden Milk, on the other hand, is aiming to be the “badass” alt milk alternative, and is marketing to health-conscious men.

“We want to invoke curiosity in consumers when they see our packaging and our bold voice, and ultimately get them to try our great-tasting products,” says Brian Schmidt, marketing manager for Molson Coors. “Longer-term, we want Golden Wing to unlock barley milk as the next big thing in the plant-based milk category, and we believe it can do just that.”

Read more (Ad Age)

- Published in Business

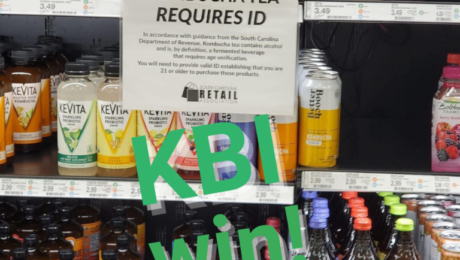

Kombucha Regulations Corrected in South Carolina

A win for kombucha brewers — after a confusing month for those trying to sell their products in South Carolina, they can now sell kombucha as a non-alcoholic beverage in the state.

South Carolina’s Department of Revenue (DOR) had categorized all kombuchas as alcoholic beverages. The state.’s regulations set a maximum alcohol content for beverages but no minimum, so any fermented beverage with any alcohol content would be considered alcoholic. Since kombucha fermentation produces a trace amount of alcohol, a brewer

would need to apply for a state alcohol license, and kombucha could not be sold to anyone under the age of 21.

S.C.’s law contradicts the U.S. legal definition of an alcoholic beverage, which is any product with 0.5% or more alcohol by volume (ABV).

After kombucha industry leaders contacted the state’s DOR and the South Carolina Retail Association (SCRA) to share advice and resources, the regulation was amended to exempt kombucha. Kombucha Brewers International’s leadership and legal counsel, along with producers Buchi Kombucha, GT’s Synergy Kombucha, Health Ade, Humm and Brew Dr., were involved.

“Every time we are called to support commercial producers to advocate on their behalf with government agencies, we validate the category,” said Zane Adams, chair of KBI’s board and co-CEO of Buchi Kombucha and FedUp Foods. “Our very existence means that kombucha is not a fad rather it is a necessary beverage segment that will only continue to grow. We appreciate every opportunity to interface with regulators to help them better understand our product and processes.”

“Crisis creates community,” adds Hannah Crum, KBI president. “Our mission is to advocate and protect kombucha and that’s exactly what we were able to do here thanks to the cooperation of several KBI member and non-member brands. We also appreciate that we were able to create new relationships with the SCRA and the S.C. DOR as we worked together to create a harmonious resolution.”

Most retail stores sell kombucha in the refrigerated juice section. In a press release, KBI shared three points for food regulators who may be unsure in what beverage category kombucha fits:

- Kombucha is not beer. Tax codes that lump kombucha with malt beverages are incorrect.

- Kombucha is an acetic acid ferment. Its fermentation process is similar to that for vinegar. Trace amounts of ethanol will be left in the final ferment, and they act as a natural preservative.

- Hard kombucha is an exception to non-alcoholic kombucha. Hard kombucha is intentionally made with a higher alcohol content, with the purpose to be sold and consumed as an alcoholic beverage.

KBI is currently lobbying for legislation that would exempt kombucha from excise taxes intended for alcoholic beverages. The KOMBUCHA Act, currently in Congress, proposes to raise the ABV threshold for kombucha taxation from its current level of 0.5% to 1.25%. KBI is encouraging the public to sign a petition in support of the act.

While KBI notes it would be ideal to create a new beverage category, “the process is long and arduous and requires a lot of financing for education and lobbying.”

- Published in Business

Scaling Artisanal Fermentation

Fungi fermenter Shared Cultures was the featured cover story in a recent Food & Wine section of the San Francisco Chronicle. Company co-owners Elena Hsu and Kevin Gondo make small-batch fermented soy sauce, miso, and sauces and marinades using koji and wild, foraged mushrooms.

The article calls Shared Cultures “the darling of the Bay Area food scene.” It details how they use traditional techniques with unexpected ingredients, like a shoyu with quinoa and lentils, a miso with cacao nib and a koji salt with leek flowers.

Hsu and Gondo also open up about the challenges of scaling artisanal fermentation. They are the only employees at the companys and can’t keep up with the demand. Their ferments require a lot of time, some fermenting for eight months in a closet-size room in their rented commercial kitchen. They note that it is too expensive to rent or purchase their own warehouse in the Bay Area.

Multiple California chefs use Shared Cultures products for an added umami punch. Hsu encourages home cooks to experiment with their products, too, “You don’t have to have a $300 tasting menu to try these flavors,” she says. “You can be the chef.”

Read more (San Francisco Chronicle)

- Published in Business, Food & Flavor

AI-Generated Wine Reviews?

New artificial intelligence software writes wine and beer reviews said to be indistinguishable from those by human critics. Researchers hope this tool will help wine and beer producers aggregate more reviews, and also provide human reviewers with a template. But the software has a major limitation: it cannot accurately predict the flavor profile of a beverage, something that can only be sampled and described by human taste buds.

Keith Carlson of Dartmouth College, who co-developed the algorithm, said wine and beer are perfect for AI-generated text because of the variety of their descriptors. Fermentation style, growing region, grape or wheat variety and year of production are all mentioned in reviews, aiding the AI algorithm. Reviews also tend to use the same vocabulary — words like “oaky,” “floral” and “dry.”

“People talk about wine in the same way, using the same set of words,” Carlson said, adding “it was just a very unique data set.”

The research team — interdisciplinary scientists from Dartmouth, Indiana University and The Santa Fe Institute — used more than a decade’s worth of reviews (over 125,000) from Wine Enthusiast, and 143,000 beer reviews from the website RateBeer. Results were published in the International Journal of Research in Marketing.

Next, they envision using the software for other experiential products, such as coffee or cars.

Read more (Scientific American)

- Published in Business

Alt Protein Hype Missing Bigger Food Industry Solution

Will alternative proteins save the planet? A report by the International Panel of Experts on Sustainable Food Systems (IPES-Food) says alt proteins – or what they call “lab meat” – aren’t the answer. In a new report, these experts say major reforms need to be put in place to increase biodiversity of food, improve access to better nutrition and limit Big Food’s control over the food system.

Companies, governments and investors are turning to alternative proteins as a way to feed a rapidly growing population but, the panel notes, they don’t address the world hunger crisis.

“In reality they lead us back to the same problems of our industrial food system: giant agribusiness firms, standardized diets and industrial supply chains that harm people and the planet,” announces a video created by IPES-Food. “We need to change the system, not the product.”

Adds Phil Howard, lead author of the report: “It’s easy to see why people would be drawn to the marketing and hype, but meat techno-fixes will not save the planet. In many cases, they will make the problems with our industrial food system worse — fossil fuel dependence, industrial monocultures, pollution, poor work conditions, unhealthy diets, and control by massive corporations. Just as electric cars are not a silver bullet to fix climate change, these solutions are not going to fix our damaging industrial food system..”

The report suggests that, to feed a growing population, the food industry should focus on sustainable food systems, not a transition to alternative proteins. A healthy food system should be regional, nutritious and focused on how real food is produced.

Read more (IPES-FOOD)

- Published in Business

South Carolina Classifies Kombucha as Alcoholic

Kombucha can no longer be legally sold as non-alcoholic in the state of South Carolina. A new rule change in state code set a maximum alcohol content for beers and other fermented beverages, but did not set a minimum alcohol level. Any fermented beverage with an alcohol content above 0.0% — any trace of alcohol — is now considered alcoholic by default.

Last month, TFA wrote about a decades-old South Carolina law that threatened kombucha and non-alcoholic beverage producers selling their fermented drinks in the state. Kombucha, which typically contains less than 0.5% alcohol [the legal definition of an alcoholic beverage in the U.S.], has always been deemed non-alcoholic, sold on grocery store shelves next to refrigerated juices.

Now, any brand selling a fermented beverage in the state must apply for an alcohol license, and their drink cannot be sold to anyone under the age of 21.

“Effective immediately, all of these producers and retailers will have to cease business until they receive the proper licensing, which will take several months to get if they’re located in South Carolina and the money to get their facilities up to code,” said Brook Bristow, an attorney specializing in beverage law, in a statement about the rule change. “So, until then, no sales, i.e., no money.”

Adds Gabriel Coggins, owner of the S.C.-based Kava Konnection:“Of all the things lawmakers could focus on to restrict and take away from the public, kombucha was the last thing I expected. It’s a healthy product, and the only logical reason I can see beyond some strange maliciousness toward it is that they just didn’t understand what they were doing.”

Read more (Greenville Journal)

- Published in Business

Color of Food Culture

The United States is becoming more diverse, with 4 of every 10 Americans identifying as non-white. But grocery stores have been a poor reflection of that mix of cultures. Now, a group of BIPOC food entrepreneurs are encouraging buyers and retailers to expand the range of products featured on store shelves.

“It has to start with leadership at the top saying, ‘We have to champion emerging brands because it’s good business,’” says Clara Paye, founder of UNiTE Foods, a maker of protein bars with international flavors. “Let’s face it. Your customers are diverse. They’re looking for diverse products. Create the incentive structures for buyers out there to have those placements and do it confidently.”

Paye was part of a panel at Natural Products Expo West discussing the challenges and opportunities for founders of color. The U.S. food system, the panelists lamented, is far from equitable. For example, though foods like kimchi and miso are staples in Asian countries, shoppers are hard-pressed to find a broad and deep array of multicultural food products at a typical American grocery.

“There wasn’t an avenue if you weren’t born and raised in America,” Paye explains.

Reclaiming Food Culture

The panel stressed that they could never find the traditional foods they ate growing up when they went to American grocery stores. First- and second-generation immigrants have never been the focus of major retail food brands. Underserved in this way, these BIPOC founders say they started their companies to reconnect with the flavors of their cultures.

“We felt it was a travesty that the second largest continent in the world [Africa] didn’t have any reflection in mainstream grocery,” says Perteet Spencer, founder of Ayo Foods, which sells West African frozen dishes and jarred sauces. (Spencer — a former employee of SPINS, a retail sales data provider for natural products — spoke at a TFA webinar in 2021).

But she notes the food system is changing: “It’s clear that the market has shifted over the last several years and is embracing global flavors.”

Expanding the flavor of Mexican cuisine is the goal of Miguel Leal, co-founder and CEO of Somos, maker of Mexican meal kits.

“There’s stereotypically this (belief) that ethnic food has to be cheap,” he says. “It can be beautiful or clean or premium.”

Vanessa Pham agrees, adding there’s a narrative that authentic ethnic food should only be served in hole-in-the-wall restaurants. Pham is co-founder of Omsom, which makes chef-created Asian dishes. “Authentic” is a complicated term, she says.

“Authenticity sometimes pegs and limits food founders and chefs to a nostalgic idea, ‘How my grandma made it’ or ‘The traditional way,’” she explains. “We believe BIPOC chefs should be able to innovate. Cultural integrity is much more about doing your research, involving the right people and compensating ethically.”

Ethnic Aisle: Integrate or Celebrate?

The ethnic aisle in groceries is a debated topic among BIPOC food leaders. Some say it’s an easy way for shoppers to find international products; others argue it’s an antiquated and offensive placement.

“I like the ethnic aisle, I just don’t like the way it’s showing us today,” Leal says. “It’s a little bit of a caricature.”

A recent survey by Adobe found 66% of African Americans and 53% of Latinos feel their ethnicity is portrayed stereotypically in food advertisements.

Pham views a future where the hodgepodge of products in the ethnic aisle disappears, and rice noodles are sold next to spaghetti. Paye agrees. “I think it will be a thing of the past, a funny thing where we put candles and beans and matzo balls.”.

- Published in Business, Food & Flavor

Are Alt Proteins GMO?

America is full speed ahead in the regulation of precision-fermentation-derived food, but Europe has yet to approve its first company. Why the difference?

Alternative protein regulatory expert Hannah Lester (from Amgen Regulatory Consulting) says the precision fermentation landscape is hugely unbalanced between the two regions. The U.S. Food and Drug Administration (FDA) has approved various fermentation-derived products through the “generally regarded as safe” (GRAS) distinction.

The European Food Safety Authority (EFSA), though, says proteins made using precision fermentation aren’t pure. The EU labels them as genetically modified organisms (GMOs).Alt protein companies disagree with this description.

For example, one of the largest precision-fermented products, Impossible Burger, was required to submit a GMO dossier to the EFSA. Lester says labeling these products as GMO has become “highly political” and is full of gray areas.. She adds that both areas will face pushback on how precision fermentation products are named.

“There is going to be opposition about what we call these products,” Lester says. “There may be a battle ahead with the traditional farming stakeholders and more conservative member states who have their own agenda and want us to call these proteins derived by precision fermentation [something else].”

Read more (Food Navigator)

- Published in Business

Ukraine Cidery Destroyed by Russia

Berryland, an award-winning Ukranian cider and mead producer, was destroyed by a bomb in a Russian air raid. The employees escaped and were uninjured.

Owner and oenologist Vitalli Karvyha built his facility six years ago in the Makariv District of Kyiv. Karvyha makes his ciders and meads from local fruits and berries, and raised bees on site for the honey for his mead. His fermented beverages have earned him awards at Vintage Cider World in Germany and the Mazer Cup in Colorado.

Karvyha says he plans to rebuild, updating his status through Berryland Cidery’s Facebook page.

Read more (Broken Palate)

- Published in Business