Marketing Gut Health

Consumers want foods that aid gut health, but brands face a major challenge. How can they educate buyers about microbiome health benefits without getting into trouble with regulators?

“It’s no longer enough to just say ‘healthy,’” says Alon Chen, CEO and co-founder of Tastewise, an “AI platform for food brands.” “We are absolutely more critical of health claims in general. We want to know how, we want to know why and we want it backed by science.”

The term “healthy” is no longer resonating with consumers. Over 30% are looking for products with multifunctional benefits, according to research by Tastewise. They want more detail, on topics such as gut health, sleep improvement, brain function, anti-bloating and energy.

“Food is no longer just about nutrition, nor is it about general health,” says Flora Southey, editor at Food Navigator. “Consumers want more from the food they consume – and they want to be specific about it.”

What are the challenges and opportunities for brands trying to deliver gut health? A panel of food and nutrition experts tackled the issue during a Food Navigator webinar: “From Fermentation to Fortification: How is Industry Supporting Gut Health and Immunity?” Here are highlights.

Regulation Woes

There are trillions of microbes in our gut, but science has only scratched the surface of their power. Gut health is an ambiguous – and often confusing – subject for consumers.

Regulations on gut health claims are evolving. A year ago, the European Food Standard Authority asked food producers to help evaluate microbiome-based product claims.

“In order for us to assert ourselves in the industry, we have to be able to defend and support these claims,” says Anthony Finbow, CEO of Eagle Genomics, a software company incorporating microbiome research into their data analysis.

It’s “the dawn of a new age,” according to Finbow. Major food companies are now valued for delivering nutrition in addition to caloric content. “There is greater consumer understanding that food is a mechanism for better health.”

Southey feels brands need to do more for consumer education “I’m not convinced [the message is] getting to the consumer as well as it should be.”

Nutrition drink brand MOJU is attempting to tackle the regulatory stumbling block of health benefits on a label. Strict rules requiring detailed substantiation have resulted in few gut health claims“We’ve got a long way to go from an education point of view,” says Ross Austen, research and nutrition lead at MOJU.

MOJU can’t use the term “gut health,” but they can say a drink contains vitamin C or D, which have been proven to boost the immune system. They can’t say their drink is anti-inflammatory, but they can say it contains turmeric, known for its anti-inflammatory properties.

Marketing -Biotics

More consumers want the presumed gut health benefits of probiotics, prebiotics and postbiotics to power their microbiome. Probiotics “have largely stolen the headlines over the past few years,” Austen says, but prebiotics are appearing in more and more products. MOJU puts prebiotic fiber in their drinks because probiotics are a challenge for packaged food products. Because probiotics contain live and active cultures, they must be refrigerated and their efficacy tested.

Ashok Dubey, Phd, senior scientist and lead for nutrition sciences at TATA Chemicals (a supplier of chemical ingredients to food and drink producers), agrees. Dubey feels that the benefits of probiotics have been diminished in the minds of consumers. He notes that when probiotics first began appearing in foods 20 years ago, they were claimed to be able to solve any and all health ailments.

“There’s a greater understanding that our gut microbiota is so complex, if the food we eat is so complex, then the solution we should provide should be a combination of all of this,” he says. Dubey is seeing more patents combining probiotics and prebiotics, a complex solution that he says looks at whole health.

But, he notes, any claim with -biotics must be validated by scientific research.

Traditional Foods vs. Clinical Trials

Hannah Crum, president of Kombucha Brewers International (KBI), takes issue with the need to validate every health claim with scientific research. “We shouldn’t displace a huge body of traditional knowledge in favor of pharmaceuticals,” she says.

Making health claims around -biotics has been challenging for the kombucha industry. “It doesn’t honor what food does for us nutritionally,” she adds. Today’s food industry is so heavily regulated that foods traditionally consumed by humans for centuries – like kombucha – can’t put a health claim on a label without proving benefits in a human clincal trial.

“It’s frustrating,” Crum says. ““In fact, because there is no definition of the word probiotic from a legal perspective, it leaves our brands vulnerable to be attacked by parasitic lawyers who just want to extract value from large corporations because they can.”

“In my opinion, we need to honor the fact that all traditionally fermented foods are probiotic by nature instead of saying ‘Well you need the research to prove it,’” she says.

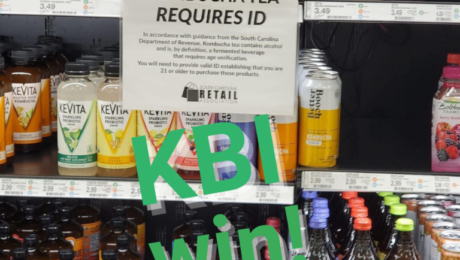

Kombucha Regulations Corrected in South Carolina

A win for kombucha brewers — after a confusing month for those trying to sell their products in South Carolina, they can now sell kombucha as a non-alcoholic beverage in the state.

South Carolina’s Department of Revenue (DOR) had categorized all kombuchas as alcoholic beverages. The state.’s regulations set a maximum alcohol content for beverages but no minimum, so any fermented beverage with any alcohol content would be considered alcoholic. Since kombucha fermentation produces a trace amount of alcohol, a brewer

would need to apply for a state alcohol license, and kombucha could not be sold to anyone under the age of 21.

S.C.’s law contradicts the U.S. legal definition of an alcoholic beverage, which is any product with 0.5% or more alcohol by volume (ABV).

After kombucha industry leaders contacted the state’s DOR and the South Carolina Retail Association (SCRA) to share advice and resources, the regulation was amended to exempt kombucha. Kombucha Brewers International’s leadership and legal counsel, along with producers Buchi Kombucha, GT’s Synergy Kombucha, Health Ade, Humm and Brew Dr., were involved.

“Every time we are called to support commercial producers to advocate on their behalf with government agencies, we validate the category,” said Zane Adams, chair of KBI’s board and co-CEO of Buchi Kombucha and FedUp Foods. “Our very existence means that kombucha is not a fad rather it is a necessary beverage segment that will only continue to grow. We appreciate every opportunity to interface with regulators to help them better understand our product and processes.”

“Crisis creates community,” adds Hannah Crum, KBI president. “Our mission is to advocate and protect kombucha and that’s exactly what we were able to do here thanks to the cooperation of several KBI member and non-member brands. We also appreciate that we were able to create new relationships with the SCRA and the S.C. DOR as we worked together to create a harmonious resolution.”

Most retail stores sell kombucha in the refrigerated juice section. In a press release, KBI shared three points for food regulators who may be unsure in what beverage category kombucha fits:

- Kombucha is not beer. Tax codes that lump kombucha with malt beverages are incorrect.

- Kombucha is an acetic acid ferment. Its fermentation process is similar to that for vinegar. Trace amounts of ethanol will be left in the final ferment, and they act as a natural preservative.

- Hard kombucha is an exception to non-alcoholic kombucha. Hard kombucha is intentionally made with a higher alcohol content, with the purpose to be sold and consumed as an alcoholic beverage.

KBI is currently lobbying for legislation that would exempt kombucha from excise taxes intended for alcoholic beverages. The KOMBUCHA Act, currently in Congress, proposes to raise the ABV threshold for kombucha taxation from its current level of 0.5% to 1.25%. KBI is encouraging the public to sign a petition in support of the act.

While KBI notes it would be ideal to create a new beverage category, “the process is long and arduous and requires a lot of financing for education and lobbying.”

- Published in Business

A Nutrition Pro’s Fermentation Guide

Nutrition professionals need to share the details when recommending fermented products to clients. What are the health benefits of the specific food or beverage ? Does the product contain probiotics? Live microbes?

“There are a vast array of fermented foods. This is important because it means there can be tasty, culturally appropriate options for everyone,” says Hannah Holscher, PhD and registered dietitian (RD). But, she adds, remember that these are complex products.

Holscher spoke at a webinar produced by the International Scientific Association for Probiotics and Prebiotics (ISAPP) and Today’s Dietitian. Joined by Jennifer Burton, RD and licensed dietitian/nutritionist (LDN), the two addressed the topic Fermented Foods and Health — Does Today’s Science Support Yesterday’s Tradition? Hosted by Mary Ellen Sanders, executive director of ISAPP, the presentation touched on the foundational elements of fermented foods, their differences from probiotics, the role of microbes in fermentation, current scientific evidence supporting health claims and how to help clients incorporate fermented foods in their diets.

Sanders called fermented foods “one of today’s hottest food categories.” Today’s Dietitian surveys show they are a top interest to dietitians, as the general public often turns to them with questions about fermented foods and digestive health.

Here are three factors highlighted in the webinar that dietitians should consider before recommending fermented foods and beverages.

Does It Contain Live Microbes?

Fermentation is a metabolic process – microorganisms convert food components into other substances.

In the past decade, scientists have applied genomic sequencing to the microbial communities in fermented foods. They’ve found there’s not just one microbe involved in fermentation, Holscher explained, there may be many. The most common microbes in fermented foods are streptococcus, lactobacillaceae, lactococcus and saccharomyces.

But deciphering which fermented food or beverages contains live microbes can be difficult.

Live microorganisms are present in foods like yogurt, miso, fermented vegetables and many kombuchas. But they are absent in foods that were fermented then heat-treated through baking and pasteurization (like bread, soy sauce, most vinegars and some kombucha). They’re also absent in fermented products that are filtered (most wine and beers) or roasted (coffee and cacao). And there are foods that are mistakenly considered fermented but are not, like chemically-leavened bread, vegetables pickled in vinegar and non-fermented cured meats and fish.

“The main take-home message is that it’s not always easy to tell if a food is a fermented food or not. So you may need to do more digging, either by reading the label more carefully or potentially contacting the food manufacturer,” Holscher said. “When we just think of if live microbes are present or not, a good rule of thumb is if that food is on the shelf at your grocery store, it’s very likely that it does not contain live microbes.”

Does It Contain Probiotics?

The dietitians stressed: probiotics are not the same as fermented foods.

“Probiotics are researched as to the strains and the dosages to be able to connect consumption of a probiotic to a health outcome,” Holscher said. “These strains are taxonomically defined, they’ve been sequenced, we know what these microorganisms can do. They also have to be provided in doses of adequate amounts of the live microbes so foods and supplements are sources of probiotics.”

Though fermented foods can be a source of probiotics, Holscher notes: “In most fermented foods, we don’t know the strain level designation.”

“For most of the microbes in fermented foods, we’ve just really been doing the genomic sequencing of those over the last 10 years and so we may only know them to the genus level right,” she said. For example, we know lactic acid bacteria are present in kimchi and sauerkraut.

Holscher suggests, if a client has a specific health need, a probiotic strain should be recommended based on its evidence-based benefits. For example, the probiotic strain saccharomyces boulardii is known to help prevent travel-related diarrhea, and so would be good for a patient to take before a trip.

“If you’re looking to support health and just in general, fermented foods are a great way to go,” Holscher says.

The speakers recommended looking for probiotic foods in the Functional Food Section of the U.S. Probiotic Guide.

Does Research Support Health Claims?

Fermentation contributes to the functional and nutritional characteristics of foods and beverages. Fermented foods can: inhibit pathogens and food spoilage microbes, improve digestibility, increase vitamins and bioactives in food, remove or reduce toxic substances or anti-nutrients in food and have health benefits.

But research into fermented foods has been minimal, mostly limited to fermented dairy. Dietitians should be careful making strong recommendations based on health claims unless those claims are supported by research. And food labels should always be scrutinized.

“There’s a lot of voices out there that are trying to answer this question [Are fermented foods good for us?],” says Burton. “Many food manufacturers have published health claims on their labels talking about these benefits and, while those claims are regulated, they’re not always enforced. Just because it has a food health claim on it, that claim may not be evidence-based. There’s a lot of anecdotal accounts of benefits coming from eating fermented foods and the research is suggesting some exciting potential mechanisms. But overall we know as dietitians we have an ethical responsibility to practice on the basis of sound evidence and to not make strong recommendations if those are not yet supported by research.”

Reputable health claims are documented in randomized control trials. But only “possible benefits” can be linked to nonrandomized controlled trials. And non-controlled trials are the least conclusive studies of all.

For example, Burton puts miso in the “possible benefits” category because, with its high sodium content, there’s not enough research indicating it’s safe for patients with heart disease. Similarly, she does not recommend kombucha because of its extremely limited clinical research and evidence.

“We have to use caution in making these recommendations,” Burton says.

This is why Burton advises dietitians to be as specific as possible. Don’t just tell patients “eat fermented foods” — list the type of fermented food and its brand name. She also says to give patients the “why” — what is the benefit of this fermented food? Does it increase fiber or boost bioavailability of nutrients?

“Are fermented foods good for us? It’s safe to say yes,” Burton says. “There’s a lot that we don’t know, but the body of evidence suggests that fermentation can improve the beneficial properties of a food.”

Growing the Hard Kombucha Category

Hard kombucha is one of the fastest growing alcohol categories. Could it become the next cider, craft beer or even hard seltzer?

“That’s the big question, isn’t it. It’s up to us to do it,” says Joshua Rood, CEO and managing director of Dr Hops hard kombucha. “If we could make it so good that beer people get excited about it and wine people get excited about it, well now there’s potential for something really, really big. That’s how craft beer did it — they focused so much on quality that they just blew regular beer out of the water on quality and everyone went for it because it was just so much better. We’re committed to what’s possible.”

Declared the “drink of summer” in both 2020 and 2021, hard kombucha continues to grow this year. While still only a small segment (~$58 million) of the overall alcoholic beverage market, hard kombucha’s dollar sales growth is big at 60%. And this performance is at a time when sales are declining for both cider and hard seltzer.

“Seltzer is really homogenous, there’s no differentiation for the most part, whereas kombucha, every brand is very different,” says Joe Carmichael, co-founder of Local Roots Kombucha. “A lot more than craft beer, there’s a lot you can do with it.”

The two spoke on a hard kombucha panel at KombuchaKon, joined byJames Conery, manager of innovation at Sierra Nevada Brewing Co., and Steve Dickman, owner and brewmaster of Rocky Mountain Cultures and High Country Kombucha. The brewers agreed: hard kombucha can become as great as the craft beer category.

“For us, fermentation is part of the process,” Rood says.”There are live lactobacillus cultures still alive up to 11% ABV [Dr Hops ABV]. We chose that [alcohol level] because, for us, it was an expression of craft. It was a great style.”

The acidity of kombucha masks the taste of alcohol, making hard kombucha a smoother, tangier drink. While beer is made from grain, hard kombucha is made from tea leaves. This gives it its “better-for-you” profile, drawing on the antioxidants, vitamins and minerals in tea.

Kombucha brewers hoping to add a hard kombucha line need to realize that it is a “totally different business than non-alcoholic,” Rood says. The regulations are strict.

“If you’ve never done an alcohol booch and you’re going to get into it, some of the things we’re going to touch on, like probiotics or health claims, the TTB (Alcohol and Tobacco Tax and Trade Bureau) has very big issues with health claims,” says Steve. “You cannot make health claims with alcohol. …There are a lot of regulations that come with it, a lot of ingredients you can’t use.”

Adds Conery, who runs the Strainge Beast brand for Sierra Nevada: “If you’re thinking about doing hard kombucha, you really need to research all the regulations before you start to do anything, before you even make it, so you know what you need to do.”

Even brewing hard kombucha is not without its challenges, too. Similar to beer, it requires the monitoring of key parameters — acidity, temperature, yeast strain, nutrients, time. But yeast is a delicate organism that can be difficult to manage, but which can alter the flavors of a brew.

Creating their first non-beer line came with growing pains for Sierra Nevada, one of the largest brewers in the U.S. Strainge Beast’s launch in 2020 required the company to make a substantial investment in its Chico, Calif., brewery, to seal off and isolate its beer operations from the hard kombucha line.

“As a brewer, I’ve spent my entire life making sure what kombucha is does not get into my brewery, because everything in kombucha is what you’d consider a beer spoilage organism,” Conery said. “We have to be very good about keeping what we’re doing with our kombucha segregated. As you scale up — especially with alcohol — there are a lot of things that can go wrong.”

Working with yeast is always a growing experience, “I’m still in the trial and error process,” Conery said. It took Sierra Nevada “quite a long time to find the correct yeast strain when we were fermenting to make our alcohol.” Yeast can create unique flavors — or funky, bad-tasting brews. A brewery will spend months exploring what yeast they want to use.

“It is the most interesting and horrible part of the production side, which is how to get the flavors you want, effectively,” Rood said. “When you’re dealing with a very acidic environment, that’s one of the biggest challenges and you want that acidity, which is part of the challenge. But you want your yeast to do a good, clean, healthy job of fermenting the alcohol.”

While both Sierra Nevada and Dr Hops approached hard kombucha with backgrounds in craft beer, Dickman at High Country Kombucha came from the kombucha world.When making hard kombucha, he brews the kombucha flavor he wants, then creates a neutral seltzer-like base. He blends the two together for the ABV value he desires, and says he likes this method as a way to experiment with acidity profiles.

“Kombucha was always a cool beverage, but now it’s bringing the party,” Dickman said.

- Published in Food & Flavor

South Carolina Classifies Kombucha as Alcoholic

Kombucha can no longer be legally sold as non-alcoholic in the state of South Carolina. A new rule change in state code set a maximum alcohol content for beers and other fermented beverages, but did not set a minimum alcohol level. Any fermented beverage with an alcohol content above 0.0% — any trace of alcohol — is now considered alcoholic by default.

Last month, TFA wrote about a decades-old South Carolina law that threatened kombucha and non-alcoholic beverage producers selling their fermented drinks in the state. Kombucha, which typically contains less than 0.5% alcohol [the legal definition of an alcoholic beverage in the U.S.], has always been deemed non-alcoholic, sold on grocery store shelves next to refrigerated juices.

Now, any brand selling a fermented beverage in the state must apply for an alcohol license, and their drink cannot be sold to anyone under the age of 21.

“Effective immediately, all of these producers and retailers will have to cease business until they receive the proper licensing, which will take several months to get if they’re located in South Carolina and the money to get their facilities up to code,” said Brook Bristow, an attorney specializing in beverage law, in a statement about the rule change. “So, until then, no sales, i.e., no money.”

Adds Gabriel Coggins, owner of the S.C.-based Kava Konnection:“Of all the things lawmakers could focus on to restrict and take away from the public, kombucha was the last thing I expected. It’s a healthy product, and the only logical reason I can see beyond some strange maliciousness toward it is that they just didn’t understand what they were doing.”

Read more (Greenville Journal)

- Published in Business

Are Alt Proteins GMO?

America is full speed ahead in the regulation of precision-fermentation-derived food, but Europe has yet to approve its first company. Why the difference?

Alternative protein regulatory expert Hannah Lester (from Amgen Regulatory Consulting) says the precision fermentation landscape is hugely unbalanced between the two regions. The U.S. Food and Drug Administration (FDA) has approved various fermentation-derived products through the “generally regarded as safe” (GRAS) distinction.

The European Food Safety Authority (EFSA), though, says proteins made using precision fermentation aren’t pure. The EU labels them as genetically modified organisms (GMOs).Alt protein companies disagree with this description.

For example, one of the largest precision-fermented products, Impossible Burger, was required to submit a GMO dossier to the EFSA. Lester says labeling these products as GMO has become “highly political” and is full of gray areas.. She adds that both areas will face pushback on how precision fermentation products are named.

“There is going to be opposition about what we call these products,” Lester says. “There may be a battle ahead with the traditional farming stakeholders and more conservative member states who have their own agenda and want us to call these proteins derived by precision fermentation [something else].”

Read more (Food Navigator)

- Published in Business

Regulating Home Chefs

The loosely-regulated cottage food industry is growing, as home chefs find it easier than ever to sell handmade meals via online services like WoodSpoon and Shef. These companies are part of the gig economy and trust that chefs will apply for the proper state and local permits to sell food made in a home kitchen. But these apps do not police regulatory compliance, noting only 20-30% of their chefs are licensed.

“In recent months, states have loosened restrictions to make it easier for home cooks to sell products online, but the result is a patchwork of state and local rules, regulations and permit requirements,” reads an article in The New York Times. “Some states allow home cooks to sell only baked goods like bread, cookies or jellies. Others put caps on the amount of money home cooks can make. And other states require the use of licensed facilities, such as commercial kitchens.”

Adds Oren Saar, founder and the chief executive of WoodSpoon: “We are ahead of the regulators, but as long as I keep my customers safe and everything is healthy, there are no issues. We believe our home kitchens are safer than any restaurants.”

As the pandemic ebbs and Americans feel cooking burnout, companies are investing tens of billions into the changing food industry. Alt protein, fast food, food delivery, functional snacks and alt food are all facets of a food industry growing and changing post-pandemic. The New York Times says they’re all making “bets on what, where and how consumers will eat in the coming years.”

Read more (The New York Times)

- Published in Business, Food & Flavor

Kombucha Sales Crawl

Two years after kombucha sales began to clock double-digit growth during the pandemic, sales are slowing, increasing only 1% over the last 52 weeks. But kombucha is still the sales leader in the fermented, non-alcoholic beverage space, representing nearly 85% of the category.

Kombucha pioneered the refrigerated functional beverage industry. For years it was one of the few beverages in the fermented, non-alcohol beverage space. But now there’s competition from new functional drinks — like prebiotic- and probiotic-infused sodas — that are diverting sales from kombucha.

“The consumer really is not OK with just drinking water. They want functionality out of everything they consume,” says Caroline Davidson, director of channel partnerships at SPINS (a data provider for natural, organic and specialty products). “Non-alcoholic beverages are traditionally not healthy options. To see that kombucha is actually one of the few segments contributing to double-digit growth (in that category), it’s really refreshing and encouraging.”

Those numbers were presented at KombuchaKon, the conference and trade show produced by Kombucha Brewers International (KBI). The event had been virtual the last two years, and brewers were anxious to meet in person again. Hundreds of brewers and brand leaders converged last week in Long Beach, Calif.

Here are highlights from SPINS’s kombucha market analysis.

Functional Beverages Grow

Refrigerated functional beverages are a top growth category across all sales channels — natural products stores, regional groceries and multi-outlet retailers (MULO) like WalMart, Target and CVS. Beverages made with -biotic cultures, high fiber sodas, water kefir sodas, drinking vinegars, kvass and tepache are all part of that growing category — and they compete with kombucha.

Shelf-stable functional beverages are growing even more quickly. For example, in the natural channel, sales of these drinks have increased nearly 25%, versus 4% for their refrigerated counterparts.

“It may not be refrigerated, but it still may be competition to a kombucha,” Davidson says.

Major Brands Diversify

Kombucha-adjacent products — like powdered kombucha and kombucha-flavored yogurt bites — are entering the market. So are kombuchas with no sugar or less than 1 gram of sugar.

“I am consistently seeing no sugar options in fermented beverages, which I know I’m speaking to an audience that already knows this, but fermentation doesn’t happen without sugar,” Davidson says. She notes more and more beverage categories “are seeing differentiation within probiotics of fermentation.”

Of the five fastest growing kombucha brands,— only two – Wild Tonic and Better Booch – are selling just traditional kombucha or hard kombucha. The other three – Humm, Health-Ade and Rowdy Mermaid – have added new product lines. Humm and Health-Ade sell prebiotic sodas and Rowdy Mermaid offers tonics.

Health-Ade is marketing their brand as a “gut health beverage” instead of simply kombucha. In a statement, Health-Ade CEO and co-founder Diana Trout says: “We have seen a dramatic increase in consumer interest in gut health over the past year as people begin to realize just how important gut health is to immunity and overall health. We wanted to offer our customers something that doesn’t compromise on taste and has legitimate gut health benefits, and (our new prebiotic drink) Pop does just that.”

Defining the Product

KBI has been well aware of changes in the category. Two years ago, it released the kombucha Code of Practice, the first set of safety and quality standards for the industry.

“Kombucha” is not a protected product name, unlike “tequila” or “champagne.” With the code, KBI aims to protect kombucha as a traditional fermented beverage. But KBI also doesn’t want to eliminate kombucha brands that may pasteurize and sell in shelf-stable cans, process from a base or brew with sweeteners.

Joshua Rood, CEO and managing director of Dr Hops hard kombucha, attended the SPINS presentation and thinks KBI “is standing in the right place.”

“First, we have to define what kombucha is. And then how you label variations of that, like if it’s filtered or pasteurized. Then you can actually have clarity and transparency for consumers so they actually know what they’re getting,” Rood says. “Right now, we don’t have that. It’s very rough, it’s essentially just an honor system.”

Rood emphasizes he has no problem with kombucha brands not brewing with traditional methods. But he says there needs to be a classification system and transparent labeling of how a kombucha is made. “There’s a lot of room for education,” he says.

Dr Hops, for example, prints a nutrition fact panel and calorie listing on their hard kombucha, even though most beer, wine and spirits are not legally required to do so.

“We try to be massively over-communicative on our labels,” Rood says. “And, if you’re looking at our labels from a calorie stance, it doesn’t look good because we have such high alcohol content. We’re not competitive in calories. But if we put it on there, people will learn that it’s 10% alcohol and most of the calories come from the alcohol.”

Shift in Retail Channels

Sales in natural stores – the retail channel that helped launch the kombucha industry have slowed, actually declining 5% over the past year. . But sales over the same period grew 3% in MULO outlets and 2% at convenience stores.

“People are still trying to find outlets where they can get everything in one trip,” Davidson says. “We’re seeing a lot more consolidation of what people are purchasing in one trip or fewer trips per month.”

Hard Kombucha “Massively Outperforming”

SPINS’s “flavored malt beverages” category includes a number of alcoholic drinks that don’t contain malt. While hard seltzers have long dominated here, six of the 10 fastest-growing brands in natural retailers are now hard kombucha brands: Boochcraft, Flying Embers, June Shine, Kyla, Strange Beast and Nova Easy.

“Natural retailers are fully embracing this as a new category and it’s paying off exponentially,” Davidson says.

Hard kombucha sales are still small overall, at $58.31 million, are driving growth in the category and “massively outperforming hard cider,” Davidson says. Dollar growth for hard kombucha is almost 60%, while sales of hard cider are declining. Sales for the hard seltzer – including category leaders White Claw and Truly – are also slipping in all retail channels.

- Published in Business

Could Outdated Law Force Fermented Drinks Off Shelves?

A decades-old South Carolina law is threatening kombucha and non-alcoholic beverage producers who sell their fermented drinks in the state.

The current statute dictates that a permit is needed to sell beer and other fermented beverages. But the law lists no minimum ABV, forcing kombucha brewers and non-alcoholic beer producers to follow the same permitting regulations as alcoholic brands.

Though the statute is loosely enforced, it came to a head recently (pun intended). Non-alcohol beer company Athletic Brewing Co. announced it would no longer sell their products in South Carolina due to ““the recent legal interpretation by state officials on the unique definition of non-alcoholic beer.” The state’s Department of Revenue began investigating Athletic Brewing Co. after receiving a complaint about the brewer.

“This is definitely going to create a lot of uncertainty for a lot of different types of businesses and, you know, ultimately, the question is, ‘Are we going to apply the alcohol rules to companies who don’t necessarily, you know, the alcohol is so minimal?’” said Brook Bristow, an attorney at Bristow Beverage Law, who served as Executive Director of the state’s Brewers Guild for seven years.

Brewers that want to comply with the current law have to apply for an expensive license. SouthCarolina’s General Assembly currently has no bills under discussion that would modify the regulations.

Read more (The Free Times)

- Published in Business

Do Alt Protein Brands Tarnish Food Shows?

Does allowing alternative protein or bio-tech brands into Natural Products Expo West distort the natural foods industry? An article in Forbes argues that the show producers’ decision to allow lab-created, animal-free products into this year’s event is “troubling,” “confusing” and “harmful.”

Expo West has long been the “it” show for established and startup companies in the natural and organic products industry. Forbes says allowing an alternative dairy brand to exhibit next to a legitimate plant-based product that uses organic ingredients is hurting higher-quality brands, “especially when biotech brands are claiming to be superior to plant-based, even as they attempt to co-opt plant-based messaging, as some do.”

Read more (Forbes)

- Published in Business