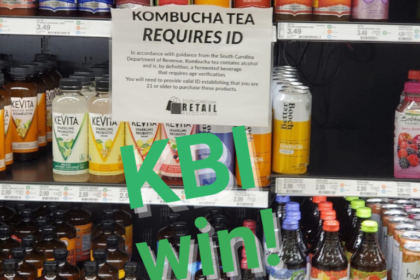

A win for kombucha brewers — after a confusing month for those trying to sell their products in South Carolina, they can now sell kombucha as a non-alcoholic beverage in the state.

South Carolina’s Department of Revenue (DOR) had categorized all kombuchas as alcoholic beverages. The state.’s regulations set a maximum alcohol content for beverages but no minimum, so any fermented beverage with any alcohol content would be considered alcoholic. Since kombucha fermentation produces a trace amount of alcohol, a brewer

would need to apply for a state alcohol license, and kombucha could not be sold to anyone under the age of 21.

S.C.’s law contradicts the U.S. legal definition of an alcoholic beverage, which is any product with 0.5% or more alcohol by volume (ABV).

After kombucha industry leaders contacted the state’s DOR and the South Carolina Retail Association (SCRA) to share advice and resources, the regulation was amended to exempt kombucha. Kombucha Brewers International’s leadership and legal counsel, along with producers Buchi Kombucha, GT’s Synergy Kombucha, Health Ade, Humm and Brew Dr., were involved.

“Every time we are called to support commercial producers to advocate on their behalf with government agencies, we validate the category,” said Zane Adams, chair of KBI’s board and co-CEO of Buchi Kombucha and FedUp Foods. “Our very existence means that kombucha is not a fad rather it is a necessary beverage segment that will only continue to grow. We appreciate every opportunity to interface with regulators to help them better understand our product and processes.”

“Crisis creates community,” adds Hannah Crum, KBI president. “Our mission is to advocate and protect kombucha and that’s exactly what we were able to do here thanks to the cooperation of several KBI member and non-member brands. We also appreciate that we were able to create new relationships with the SCRA and the S.C. DOR as we worked together to create a harmonious resolution.”

Most retail stores sell kombucha in the refrigerated juice section. In a press release, KBI shared three points for food regulators who may be unsure in what beverage category kombucha fits:

- Kombucha is not beer. Tax codes that lump kombucha with malt beverages are incorrect.

- Kombucha is an acetic acid ferment. Its fermentation process is similar to that for vinegar. Trace amounts of ethanol will be left in the final ferment, and they act as a natural preservative.

- Hard kombucha is an exception to non-alcoholic kombucha. Hard kombucha is intentionally made with a higher alcohol content, with the purpose to be sold and consumed as an alcoholic beverage.

KBI is currently lobbying for legislation that would exempt kombucha from excise taxes intended for alcoholic beverages. The KOMBUCHA Act, currently in Congress, proposes to raise the ABV threshold for kombucha taxation from its current level of 0.5% to 1.25%. KBI is encouraging the public to sign a petition in support of the act.

While KBI notes it would be ideal to create a new beverage category, “the process is long and arduous and requires a lot of financing for education and lobbying.”