Why are Sauerkraut and Kimchi Sales Up During the Pandemic?

People are turning to acidic dishes like sauerkraut and kimchi to protect themselves from the COVID-19 virus. Though there is no scientific evidence that foods like kimchi and sauerkraut will prevent spread of the virus, sales are booming. Health experts say it’s because cabbage is a superfood filled with antioxidants and vitamin C, and the fermented condiments are filled with probiotics that support the gut microbiome. Consumers are hypothesizing that coronavirus death rates in Germany and South Korea because sauerkraut and kimchi are traditional food staples in the two countries. In January, South Korea’s national health ministry issued a press release stressing that kimchi offers no protection against the virus. That hasn’t stopped Americans from buying it – sauerkraut sales surged 960% in March, while kimchi sales jumped 952% in February.

Doctors emphasize that the best way to prevent coronavirus infection is to avoid becoming exposed. Hand washing, social distancing and mask wearing are encouraged.

Read more (New York Post)

6 Ways Fermentation Brands & Restaurants Adapt

The current global health and economic situation is a far cry from business as usual. “Pivot” will be the new buzzword in the food and beverage industry, as fermentation brands and food service institutions must implement creative manufacturing and marketing solutions to maintain sales during the coronavirus pandemic.

“We are in a real-time focus group situation. …We’ve seen an acceleration of trends,” says Emmanuel LaRoche, vice president of marketing and consumer insights for Symrise, an international producer of flavors and fragrances. “This current situation will lead to new, large structural trends that are going to impact the next 15 years.”

Solving economic challenges posed by the coronavirus outbreak will be the “new normal” in the food and beverage industry. Here are six ways to adapt.

- Create More Online Instruction

As a brand, are you helping your consumer cook with your product? And what about the products you don’t sell. Canned goods and frozen foods are flying off grocery store shelves. Can consumers pair your product to create a meal with the pack of canned beans they panic bought or the pound of frozen berries?

“Consumers may be stockpiling shelf stable products, but it doesn’t mean that they know how to use them,” says Melanie Bartelme, global food analyst at Mintel. “Brands have an opportunity to help consumers who suddenly find themselves surrounded by dried foods and frozen foods. Direction and support, in the way of webinars, YouTube videos or Pinterest links, will help them feel confident cooking meals with these staples.”

2. Position Your Product into Consumer’s Home Routines

Though some states are lifting stay-at-home orders, allowing businesses to reopen, social distancing will alter regular business through 2020 – and likely beyond. Many people view dining in a restaurant, working in an office and exercising in a gym as too risky. Consumers are now eating, working and exercising at home. They’re also spending more time on self-care routines and home cleaning. How can businesses join the home-based routine?

“The formation of routine, it’s an action that typically takes 60 days to form. If we repeat something on a daily basis, we turn it into this new habit,” Laroche says. “So the question here is how quickly, if ever, will consumer behavior return to pre pandemic levels or are we at the beginning at a shift of how we spend our time?”

It’s unknown whether the affects likely becoming permanent. But brands should adapt to home living. Product delivery and e-commerce sales are essential to fermented food and beverage brands. But brands should also think outside the box. Marketing must pivot from “on the go” to “staying at home.” More than ever, consumers want their products to be convenient.

“The new normal at home may create many opportunities for companies and brands to provide a new and exciting product connected directly to what consumers are experience,” says Dylan Thompson, marketing and consumer insights manager with Symrise.

3. Create Business Opportunities for Consumer’s Shift in Spending

Many of the new consumer spending trends mirror what happened during the 2008 recession. During the Great Recession, consumers shifted their spending habits in the food and beverage industry. Consumers:

- Valued cost more than convenience.

- Switched from mainstream to value brands. There was a big increase in private label purchases especially, as consumers searched for better deals. Premium and top brands were more insulated as consumers sought affordable luxuries.

- Bought smaller, lower-priced food and beverage packages. Manufacturers switched to smaller packages as they downsized to improve margins.

- Shifted to purchasing at value channels, like big club stores (Costco, Sam’s Club).

- Stopping shopping frequently at gas station stores, correlating with dropping gas prices.

- Declined eating at restaurants, increasing eating at home.

Already, new shopping trends are emerging during the COVID-19 outbreak. These include:

- Decreasing brand loyalty. Consumers buy whatever brand is available when their favorites are out of stock.

- Revival of the center store. As consumers stock up and try to keep their pantry full of shelf-stable items, they’re shopping in the center of the store again.

- Stock up behavior. Sales at mass and club stores are increasing while sales at restaurants are decreasing.

- Increased sale of comfort items. Consumers are indulging in purchasing things they can enjoy from home.

- Greater shift to ecommerce. Online shopping and “click and collect” pick-up have become a popular option during the pandemic, especially in urban areas.

“There are opportunities for retailers to fill the void of what consumers are missing out on,” adds Thompson.

4. Restaurants Must Create a New Business Model

Restaurants have been dramatically hurt by the pandemic, especially non-chain restaurants. Estimates by Technomic show that, at the end of the pandemic, restaurants sales will decrease by 14-29%.

For comparison, at the end of the Great Recession from 2008-2009, restaurant sales only failed by 1.2%.

“We know that social distancing will have a long-lasting impact on food service,” Laroche says. “Social distancing has been particularly disastrous for on-premise beverage, alcohol sales as the dining, drinking side of the business has essentially disappeared.”

At the end of the pandemic, Technomic estimates 15% of restaurants will not reopen.

Restaurants must reformat their business model to allow takeout, curbside pickup, no contact delivery, cashless pickups and alcohol to-go. Some restaurants are even offering DIY kits, selling materials to recreate favorite restaurant dishes at home. Others have decreased dining space to expand the kitchen.

5. Capitalize on what People are Already Buying.

Shopping trends are falling into two categories: survival and sanity. There’s been explosive growth in the food and beverage category during the pandemic (74%), especially for alcoholic beverages (24%), according to IRI. Fermented products like foods like coffee (60.6%), spirits/liquor (37.3%), beer ale/cider (37.8%), chocolate (21.2%) are all top purchases. There are bigger trending categories where a fermented food or drink could get creative, like pasta (229.8%), soup (212.7%), salty snacks (51.5%) and cookies (50.3%).

Increased “beer and liquor at home is one of those sanity categories, and it’s always been well-known that it’s recession proof,” Thompson says. Alcohol flies off shelves during recessions. Consumers are looking for comfort and want a way to cope with uncertainty.”

Alcoholic drinks like hard seltzers and craft brew were not popular enough to track in 2008, but in 2020, are not proving to be a permanent part of consumer alcoholic beverage purchases.

6. Consider Consumer’s Storage Space

Storage at home has become a premium, especially for consumers in densely populated areas that have been hit the hardest by the pandemic. Think of younger, Millennial and Generation Z shoppers living in urban areas with limited storage space.

“The Propensity to stockpile food is a challenge to those without a place to store such products. There is an opportunity for condensed, dried foods, like bone broth soup and contemporary bouillon cubes, to be positioned as more viable alternatives,” says Dasha Short, a global food analyst with Mintel.

Fermented food and drink brands should consider selling items in single-service packages and snack sizes.

- Published in Business

Fermented Fruit Will Go Mainstream in 2020

Fermentation was the No. 2 trend on the North America Flavor Trend Report for 2020, but with a twist: sweet foods are the new star of fermentation. The trend report was released by Symrise, an international producer of flavors and fragrances.

“Over the past few years, we’ve seen fermentation has really come to dominate the condiment category with foods like kimchi, that have really led the charge,” says Julia Gorman, Symrise digital marketing specialist. Now, “fruit is getting funky.”

Pickling berries, fermenting tropical fruits, using sour fruits and incorporating pulp byproduct into fermented dishes are some of the key flavor trends among chefs. Adds Dylan Thompson, Symrise marketing and consumer insights manager: “It’s all about the evolution of fermentation.”

Fermentation was particularly high on the list because of gut health components. Fermentation encompasses some of the mega trends Symrise is seeing this year. Consumers are buying simple foods that benefit a healthy lifestyle. Fermentation’s “health benefits remain a huge bonus,” Gorman says.

Symrise polled chefs and mixologists for their survey, and found four fermented fruit flavor trends:

- Pickled Berries. Made popular through the cookbook “Noma’s Guide to Fermentation,” Scandinavian cuisine is making a major impact on America’s acceptance of fermented fruit.

- Tropical Fermentation. Mixologists have been particularly experimenting with tropical fruits in drinks. Fermented pineapple, for example, is used to “add flavor funk to what is otherwise a classic beach cocktail,” Gorman adds.

- Ume (and Ume Boshi). More chefs are using Ume, the salty, sour Japanese plum. It can be pickled, brined or traditionally served with rice.

- Fermented Cacao Pulp. Usually a wasted byproduct of cacao bean production, the pulp has an array of health benefits. Chefs are salvaging the pulp to use in a variety of dishes.

- Published in Business

The Science of Yeast, the Microbe in your Pandemic Bread

Humans have been baking fermented breads for at least 10,000 years, but commercial yeast and flour companies have never seen demand so high. National Geographic shares “a story for quarantined times, about extremely tiny organisms that do some of their best work by burping into uncooked dough.”

Scientists describe the microbes behind the work fermenting the bread. “It’s this wonderful living thing you’re working with,” says Anne Madden, a North Carolina State University adjunct biologist who studies microbes. She and partner scientists showed recently that when bakers in different locales use exactly the same ingredients for both starter and bread, their loaves come out smelling and tasting different. “Which I think is fantastic,” she says. “It’s evidence of the unseen. And as a microbiologist, you so rarely get to measure things about microbes with your nose and your taste buds.”

Read more (National Geographic)

- Published in Science

Craft Breweries Once Surging, Now Shuttering

Craft breweries, which were heading into their second decade of a major boom, are now shuttering during the coronavirus pandemic. “There’s going to be a lot of dead distilleries coming out of this,” said Paul Hletko, the founder and distiller of FEW Spirits, in Evanston, Ill. “Even if you survive, the new normal is going to be punishing for small brands.” Craft distilling relies on bars, tasting rooms, face-to-face sales and customers willing to pay a higher price for a premium product — all factors dramatically changing with social distancing and a global recession.

Read more (The New York Times)

- Published in Business

New Hope’s Report: 5 Trends for Fermentation Industry

Though the March Natural Products Expo West conference and trade show were cancelled this year because of the coronavirus pandemic, New Hope Network (producers of the event) hosted a virtual webinar this month to share their annual report on industry trends. Leaders from New Hope Network, SPINS and Whipstitch Capital shared insights on natural product sales trends.

“We definitely believe that this unfortunate health crisis is going to bring the bright spot of making health and wellness more mainstream,” says Kathryn Peters, executive vice president of business development at SPINS (who also are scheduled to present at TFA’s FERMENTATION 2021 conference next May).

The report typically encompasses sales numbers for the previous year, but SPINS included insights from short- and mid-term consumer behaviors during the COVID-19 crisis.

Read on for five takeaways for the fermentation industry from the data.

1. Thanks to Mass Market Saturation, Natural Sales Slow in 2019

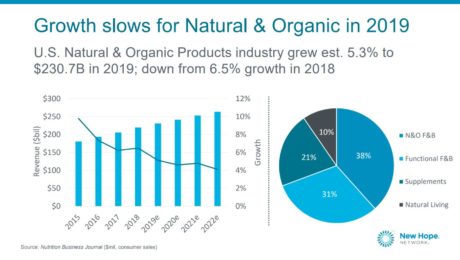

Sales of the natural and organic industry in the United States slowed in 2019, growing 5.3% to $230.7 billion in sales.

The slowing growth signals an optimistic takeaway: mass market saturation. There are more natural products on retailer’s shelves than ever before.

“Despite the slower growth, the mass market channel – which includes big box retailers, large grocers like Walmart – that channel added 6.5 billion in new sales last year, which is very significant,” says Carlotta Mast, senior vice president for New Hope Network.

Sales data over the last decade shows the natural industry has grown from being a small player in the consumer products industry with only 11% of sales to a larger player with 20% of sales.

“We’re not a little kid anymore – we’ve kind of grown up,” says Nick McCoy, the managing director and co-founder of Whipstitch Capital.

Natural brands are getting larger, McCoy notes, experiencing an average of 10% growth two years after their start date. Growth of smaller brands is outpacing growth of larger brands. Brands in the 1,000-2,000 sales spots grew at a rate of 6.1% in 2019, while the top 1,000 selling brands grew at a rate of 5.2% in 2019.

2. Americans Want Functional, Science-Backed Products

Despite slower industry growth, the natural, functional food and beverage industry grew two times faster than conventional food and beverages in 2019. Functional products improve overall health by providing additional nutrients. Fermented food and drink fall into the functional category.

Functional food and beverage sales grew 5.3% in 2019, hitting $71.4 billion in sales.

Consumers are purchasing products with ancient wisdom, a trend defining the nutrient-dense, time-honored food that is made of simple, clean ingredients.

“This has been an underlying driver of the industry for many years,” Mast says. Consumers are “seeking science-backed health and wellness offerings positioned to address modern conditions.”

Consumers want optimized products that address eye health, stress support and, especially in today’s health climate, immunity.

The natural industry experts expect functional foods to continue to grow, fueled this year by the COVID-19 pandemic.

3. Coronavirus Outbreak Causing Big Boost in Sales

During the week America went into quarantine during the coronavirus outbreak, 15 million additional buyers bought natural products.

“At the end of the day, virtually everything sold,” Peters says. A key trend: “Natural products were still in demand; they did outsell all products.”

Peters notes some of the natural products may have sold because they were the last available product on the shelf. Time is the best indicator if these shoppers will convert to regulars. But those products are now on consumer’s shelves – and a lot product trial is happening across the country, trial that is an expensive element of product development. “It’s a huge opportunity for this industry,” Peters says.

“What we’re finding as a real highlight for the industry is the consumer values that built and grew the natural and organic industry for years and years are holding strong in the face of COVID-19,” Mast says. “One hypothesis of what the world may look like in a post-COVID era is that consumers will increasingly prioritize health and wellness…A number of long term macro forces and trends that have driven growth of the natural and organic products industry up until now position us well for a world in which consumers increasingly prioritize health and wellness.”

As unemployment soars and consumers cut back on expenses, Peters does not expect economic pressures will slow down natural product sales.

“Our bodies are our best line of defense, and consumers are realizing this,” she adds. “While comfort food is important in this phase, we are still seeing a strong influence of health and nutrient-dense food.”

A survey of consumers during the week of April 13, 2020 found that 77% say personal health is most important to them today than it was in 2019. In addition, 43% say eating healthy food is more important today than it was in 2019.

Sales of kombucha, for example, plateaued in 2019, after years of positive growth. But during the peak coronavirus grocery stock up period, refrigerated kombucha sales were up 28%, refrigerated pickle and marinated vegetables were up 58% and refrigerated yogurt sales were up 39%.

The coronavirus is increasing challenges for the industry, too. Supply chains are disrupted, there is a lack of new product development and a dearth of investment capital.

“That is slowing the flow of innovation, which we can expect to affect the flow of offerings to the market later this year and into 2021,” Mast says.

4. E-Commerce Sales Growing Fast, Driven by Natural Shoppers

In 2019, e-commerce sales accounted for only 4% of total natural product sales. In 2020 so far, e-commerce has generated almost $10 billion in sales. Estimates put total e-commerce sales at 17% in 2020.

“E-commerce is the big story for 2020 with COVID-19 and the rapid increase of consumers buying online,” Mast says.

Interestingly, natural shoppers were using e-commerce channels at a higher rate than regular shoppers.

5. Sustainability is of Greater Importance

Early consumer research indicates an aspirational trend: COVID-19 may change consumer’s viewpoints to become more sustainability focused.

During the week of April 13, 2020, a survey of consumers found that 67% said environmental health is more important to them today than it was in 2019. Purchasing behaviors that support environmental causes are also on the rise. Of more importance to consumers in 2020 verses 2019: food waste (36%), buying plant-based foods (29%), buying responsibly sourced meat, seafood and dairy (26%), buying organic (22%), and buying products with environmentally-based packaging (18%).

Sustainable packaging “which is really the Achilles heel to the natural and CPG industry,” Mast says, is becoming of greater important to consumers as single-use packaging is demonized. Brands are also looking for ways to keep their waste out of landfills, upcycle ingredients and putting byproducts back into circulation.

- Published in Business

Bubbling Over: How to Prevent Mold in Sauerkraut

Three fermentation experts weigh in on one of the most common problems in fermenting vegetables: mold prevention. The fermenters include fermentation chef David Zilber (head of fermentation at Noma) and fermented sauerkraut producers Meg Chamberlain (co-owner of Fermenti Farm) and Courtlandt Jennings, (founder and CEO of Pickled Planet and TFA advisory board member).

How do you handle prevent mold in sauerkraut?

David Zilber, Noma: That is something you are constantly trying to fight back, especially when you lacto-ferment in something like a crock. There are so many variables that go into making a successful ferment. How clean was your vessel before you put the food in there? How clean were your hands, your utensils? How much salt did you use? How old was the cabbage you were even trying to ferment in the first place? Every little detail is basically another variable in the equation that leads to a fermented product being amazing or terrible. It’s a little bit like chaos theory, it’s a little bit like a butterfly flapping its wings in Thailand and causing a tornado in Ohio. But with lots of practice, you’ll begin to understand that, if it was 30 degrees that day, maybe things were getting a little too active, maybe the fermentation was happening a little bit too quickly. Maybe I opened it a couple times more than I should of and it was open to the air instead of being covered. So there’s lots of variables. But I would say that, if you’re having a lot of trouble with mold, just up the salt percentage by a couple percent. It will make for a saltier sauerkraut, but it will actually help to keep those microbes at bay. (Science Friday)

Meg Chamberlain, Fermenti Farm: You must allow the ferment to thrive by creating a favorable environment with “Good Kitchen Practices.” So, to prevent mold in your ferment start by using only purified water, like reverse osmosis, distilled or boiled and cooled and-no tap water(municipal). Only use vegetable-based soap that is NOT anti-bacterial, like a good castile soap. Finally, only use dry fine Sea Salt, no mineral/no gourmet or iodized. Keep Fermenting and do not get discouraged! #youcanfermentthat #diyfermentation #idfermentthat

Courtlandt Jennings, Pickled Planet: Preventing mold when making sauerkraut is all about a controlled atmosphere. How well you maintain your situational cleanliness and fermenting atmosphere is my best clue for you. There are many ways to control atmosphere and every situation will be different based on many factors but be dillegent and your ferments will improve with practice.

This may not seem like an answer but it’s directional… as is most advice unless dealing with a consultant. Good luck and may the ferment force be with you!

- Published in Food & Flavor, Science

Functional Foods Grew 5.3% in 2019

Sales of functional foods and beverages — products that provide additional nutrients — grew 5.3% to $71.4 billion in sales in 2019, at a growth rate two times faster than conventional products. Sales of function foods and beverages were $68 billion in 2018. (New Hope Network)

- Published in Business

Amazake Garners Popularity as Health Drink in Japan

Amazake — an ancient, fermented superdrink from Japan — is jumping in sales in Japan. Boyband Kanjani Eight was even hired as spokespeople for Hiyashi Amazake, a popular Japanese brand. Amazake was developed around 250 to 538 AD. It’s made by boiling rice, water and koji for 8-10 hours. It’s a sweet drink with a lumpy texture, and its name translates to “sweet sake” (thought it only has trace amounts of alcohol thanks to the fermentation process.) Amazake has earned the nickname “drinkable IV” because it’s packed with nutrients and gut-friendly bacteria. In Japan it’s considered a drink and a health product.

Read more (BBC)

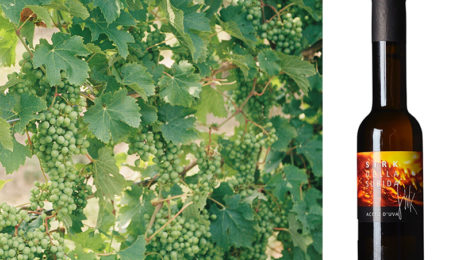

Fermented Grapes Make “Orange Wine” of Vinegars

The new innovation in vinegars is grape vinegars. Grape vinegar is made from grapes macerated and slowly allowed to ferment with their skins for a year. “The fermented juice then spends several years in small oak barrels to evolve into the delicately fruity pinkish vinegar,” according to the New York Times. The white grapes and skin contact is why the grape vinegar makers call it to the “orange wine” of vinegars. The latest grape vinegar collection comes from Sirk in Friuli, a region in northeast Italy. The grapes grown there, Ribolla Gialla white grapes, are prized for wine making.

Read more (New York Times)

- Published in Food & Flavor