Though the March Natural Products Expo West conference and trade show were cancelled this year because of the coronavirus pandemic, New Hope Network (producers of the event) hosted a virtual webinar this month to share their annual report on industry trends. Leaders from New Hope Network, SPINS and Whipstitch Capital shared insights on natural product sales trends.

“We definitely believe that this unfortunate health crisis is going to bring the bright spot of making health and wellness more mainstream,” says Kathryn Peters, executive vice president of business development at SPINS (who also are scheduled to present at TFA’s FERMENTATION 2021 conference next May).

The report typically encompasses sales numbers for the previous year, but SPINS included insights from short- and mid-term consumer behaviors during the COVID-19 crisis.

Read on for five takeaways for the fermentation industry from the data.

1. Thanks to Mass Market Saturation, Natural Sales Slow in 2019

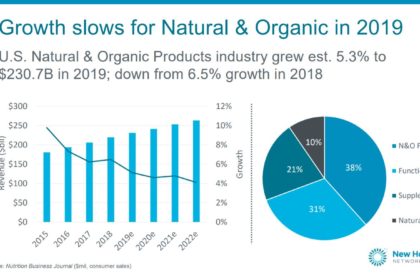

Sales of the natural and organic industry in the United States slowed in 2019, growing 5.3% to $230.7 billion in sales.

The slowing growth signals an optimistic takeaway: mass market saturation. There are more natural products on retailer’s shelves than ever before.

“Despite the slower growth, the mass market channel – which includes big box retailers, large grocers like Walmart – that channel added 6.5 billion in new sales last year, which is very significant,” says Carlotta Mast, senior vice president for New Hope Network.

Sales data over the last decade shows the natural industry has grown from being a small player in the consumer products industry with only 11% of sales to a larger player with 20% of sales.

“We’re not a little kid anymore – we’ve kind of grown up,” says Nick McCoy, the managing director and co-founder of Whipstitch Capital.

Natural brands are getting larger, McCoy notes, experiencing an average of 10% growth two years after their start date. Growth of smaller brands is outpacing growth of larger brands. Brands in the 1,000-2,000 sales spots grew at a rate of 6.1% in 2019, while the top 1,000 selling brands grew at a rate of 5.2% in 2019.

2. Americans Want Functional, Science-Backed Products

Despite slower industry growth, the natural, functional food and beverage industry grew two times faster than conventional food and beverages in 2019. Functional products improve overall health by providing additional nutrients. Fermented food and drink fall into the functional category.

Functional food and beverage sales grew 5.3% in 2019, hitting $71.4 billion in sales.

Consumers are purchasing products with ancient wisdom, a trend defining the nutrient-dense, time-honored food that is made of simple, clean ingredients.

“This has been an underlying driver of the industry for many years,” Mast says. Consumers are “seeking science-backed health and wellness offerings positioned to address modern conditions.”

Consumers want optimized products that address eye health, stress support and, especially in today’s health climate, immunity.

The natural industry experts expect functional foods to continue to grow, fueled this year by the COVID-19 pandemic.

3. Coronavirus Outbreak Causing Big Boost in Sales

During the week America went into quarantine during the coronavirus outbreak, 15 million additional buyers bought natural products.

“At the end of the day, virtually everything sold,” Peters says. A key trend: “Natural products were still in demand; they did outsell all products.”

Peters notes some of the natural products may have sold because they were the last available product on the shelf. Time is the best indicator if these shoppers will convert to regulars. But those products are now on consumer’s shelves – and a lot product trial is happening across the country, trial that is an expensive element of product development. “It’s a huge opportunity for this industry,” Peters says.

“What we’re finding as a real highlight for the industry is the consumer values that built and grew the natural and organic industry for years and years are holding strong in the face of COVID-19,” Mast says. “One hypothesis of what the world may look like in a post-COVID era is that consumers will increasingly prioritize health and wellness…A number of long term macro forces and trends that have driven growth of the natural and organic products industry up until now position us well for a world in which consumers increasingly prioritize health and wellness.”

As unemployment soars and consumers cut back on expenses, Peters does not expect economic pressures will slow down natural product sales.

“Our bodies are our best line of defense, and consumers are realizing this,” she adds. “While comfort food is important in this phase, we are still seeing a strong influence of health and nutrient-dense food.”

A survey of consumers during the week of April 13, 2020 found that 77% say personal health is most important to them today than it was in 2019. In addition, 43% say eating healthy food is more important today than it was in 2019.

Sales of kombucha, for example, plateaued in 2019, after years of positive growth. But during the peak coronavirus grocery stock up period, refrigerated kombucha sales were up 28%, refrigerated pickle and marinated vegetables were up 58% and refrigerated yogurt sales were up 39%.

The coronavirus is increasing challenges for the industry, too. Supply chains are disrupted, there is a lack of new product development and a dearth of investment capital.

“That is slowing the flow of innovation, which we can expect to affect the flow of offerings to the market later this year and into 2021,” Mast says.

4. E-Commerce Sales Growing Fast, Driven by Natural Shoppers

In 2019, e-commerce sales accounted for only 4% of total natural product sales. In 2020 so far, e-commerce has generated almost $10 billion in sales. Estimates put total e-commerce sales at 17% in 2020.

“E-commerce is the big story for 2020 with COVID-19 and the rapid increase of consumers buying online,” Mast says.

Interestingly, natural shoppers were using e-commerce channels at a higher rate than regular shoppers.

5. Sustainability is of Greater Importance

Early consumer research indicates an aspirational trend: COVID-19 may change consumer’s viewpoints to become more sustainability focused.

During the week of April 13, 2020, a survey of consumers found that 67% said environmental health is more important to them today than it was in 2019. Purchasing behaviors that support environmental causes are also on the rise. Of more importance to consumers in 2020 verses 2019: food waste (36%), buying plant-based foods (29%), buying responsibly sourced meat, seafood and dairy (26%), buying organic (22%), and buying products with environmentally-based packaging (18%).

Sustainable packaging “which is really the Achilles heel to the natural and CPG industry,” Mast says, is becoming of greater important to consumers as single-use packaging is demonized. Brands are also looking for ways to keep their waste out of landfills, upcycle ingredients and putting byproducts back into circulation.