New Supplier in Raw, Clean Pet Food Category: Fermented Pet Food

Raw, clean ingredient pet food is the fastest growing part of the pet food category. More pet food brands are inventing ways to feed their pets unprocessed, organic ingredients. A new article highlights Answer Pet Food, the first (and so far only) fermented raw pet food supplier. Answers Pet Food utilized kombucha, raw cultured whey, cultured raw goat’s milk and kefir in their pet food products. Their products include fermented chicken feet and fermented pig feet. Answers Pet Food says: “Fermentation is the most natural and effective way for us to make our products as safe and healthy as possible. … Our raw fermented pet foods are formulated to create a healthy gut. Fermentation supports healthy immune function by increasing the B-vitamins, digestive enzymes, antioxidants, and lactic acid that fight off harmful bacteria. It’s also the ultimate source of probiotics.”

Read more (Pet Product News)

- Published in Business

Female Entrepreneurs Turning Western North Carolina Into “Ferment City”

Western North Carolina is becoming “a hot spot for fermented goods” thanks to female entrepreneurs. These fermented product brand leaders credit the health-conscious culture of Asheville, N.C. with helping their businesses thrive in “Ferment City.” Sara Schomber of the Buchi Mamas tells Asheville’s Mountain Xpress: “Fermentation is all about the alchemy of ingredients normally found in the hearth and home where, for centuries, women have been the keepers. We believe fermentation is the expression of a natural tendency, the human spirit’s way of giving itself permission to heal and inviting all of us to extend beyond our own immediate mortality. It’s normal and natural for humans to want to preserve, put away and celebrate.” Local brands featured include: Shanti Elixirs Jun, Smiling Hara Tempeh, Yoga Bucha kombucha, Buchi Kombucha, Sister of Mother Earth cider and honey, Serotonin ferments ferments and Fermenti Foods ferments.

Read more (Mountain Xpress) http://bit.ly/2B61p0Q

- Published in Business

Q&A with Alex Corsini, Founder of a Sourdough Story

Ready-bake and frozen pizza is a market with little disruption. Processed ingredients, chemical-filled cheese and cardboard-like dough are the mainstay of a grocery store pizza.

But Alex Corsini wants to change that. After battling an autoimmune disease, quitting his rat race job in the tech industry and completing an apprenticeship at a Michelin-star restaurant, Corsini wondered why there wasn’t a delicious sourdough pizza in a consumer packaged goods brand. He started Sourdough Story in 2018 as the first USDA organic and Non GMO Verified pizza on the market.

“We wanted to hone in on ultra-thoughtful sourcing and really meticulous preparation, and celebrate slow sourdough fermentation” Corsini said. “I think there’s a lot of dogma in nutrition, and I want people to listen to their own bodies and also think about the roots of where their food is coming from. Pizza is an interesting canvas and platform to showcase this narrative and perspective.”

Below, a Q&A with Corsini, who believes food — especially fermented food — “is the foundation of healthy people.”

Q: Why did you start Sourdough Story?

Around 2016, I was working in the technology industry in startups. I developed this autoimmune condition out of nowhere. My doctors didn’t really have a name for what I was going through, they kept testing me and concluded this was something I’ll have for the rest of my life. I decided to turn to nutrition to mitigate symptoms. I read about the Whole 30 Diet and basically cut out every major allergen. I did it for 60 days, and all my symptoms went away. It was really powerful for me to overcome this through food and not really any medication at all.

Eventually, I started slowly adding back in foods. I started reading about wheat and the ancestral diet. My ancestors are from Sweden, and fermented dairy and sourdough is big there. I started baking sourdough and, the first loaf I ever made, me and my roommates just devoured the whole thing in minutes. And we still felt really good.

I had this epiphany that this whole anti-gluten movement I fell into, there’s definitely valid signs, some people have Celiac Disease. Some people can’t digest wheat as well as others. But there’s also this layer of dogma that I’ve succumbed to. Maybe this is about the ingredients and preparation than the reductive nutrition side of things that’s all too common in the media.

I started getting obsessed with sourdough baking. I decided I didn’t want to go back to the tech industry. I applied to sourdough bakeries and Michelin rated restaurants that focus on sourdough baking. I got an apprenticeship at Kadeau in Copenhagen and I literally walked into my tech job the next day and quit. I said I’m done with technology and I want to focus on food.

I spent a month apprenticing, learning about fermentation and the farm-to-table movement. Copenhagen is this booming food scene. There’s this identity and really strong sense in bakeries around California — it was even greater in Copenhagen. I had this realization — why is there not a sourdough pizza in a consumer packaged food brand? And why is there not a brand focused on sourdough as a general concept?

My whole thing was, let’s create a brand around sourdough. We started with pizza, but it’s a broad category. When I decided to do a CPG concept, I talked to the founder of my favorite natural food store in Sausalito. I asked to stock or work in product and get a sense of the retail store environment. I spent three months working in the grocery department, stocking at a natural food store. I told them about my sourdough pizza concept and asked if I could put a couple pizzas on the shelf and see how they sold. We have this idea of what our movement would be — we’d vacuum-seal pizza, we’d put them on the shelf in the deli section, people could take and back. We put out 12 pizzas, and in a few hours they were gone. The orders started getting bigger and bigger from there.

We officially launched in June 2018, making 50-70 pizzas a week for that location alone. We were written up in the local independent journal, and it started a domino effect. Now we’re in about 100 stores in the Bay Area and just throttling growth. We’re at the point where we’re ready to make a big footprint.

Q: You said when you were learning how important fermentation is to people’s diets, that pizza is a great platform to showcase that. Why?

My initial idea, going back to working at the Michelin star restaurant, I loved the idea of knowing where every ingredient came from. I love going to a customer with the menu and saying “This butter is from a grass-fed cow, its name is Mike.” Having that level of granularity was really important to me. With pizza, there are so many ingredients that make up pizza. It’s also a great creative product. It’s a product everyone is familiar with and everyone is passionate about it. If you ask somebody what their favorite type of crust is, you’ll get lots of different answers. They’ll fight you on their favorite pizza place in New York. They all have a favorite topping. It’s a passion product.

Our toppings, the tomato is the best organic tomatoes in the U.S. from DiNapoli, an hour away from us in California. Our flour is freshly milled flour by Central Milling Organics, an old family mill based out of Northern California. The cheese is from grass-fed cows from the Rumiano pasture, the oldest family-owned California dairy. I love the idea of partnering and showcasing with these companies, being on a first-name basis. Pizza is a great vehicle for that.

Q: Why is modern bread bad for the gut? What’s better about sourdough?

We think of modern bread making, conventional bread is a process of simply leavening bread, giving rise to the dough. They all use the same commercially manufactured yeast that was derived from a lab back in the late 1800s. The whole concept around this was to mass produce bread to make sure you can create an industrial product that you can scale to consistency. Before that, it was all sourdough-based bread products, dating back to ancient Egypt.

Sourdough is a process of not only leavening bread but acidifying bread. The key benefits come from the acidification. So you’re getting benefits like a lower glycemic index, more available vitamins and minerals from grain, some people think it’s easier to digest and you’re getting better preservation. The higher the acidity, the lower the propensity for bacteria or mold to affect the product.

The science of it — it mainly comes down to phytic acid, which is an organic, indigestible compound that all grains and seeds possess.

Unfortunately, humans don’t have the enzyme to break it down — it’s called phytase. Some animals have this, and can eat raw grains and nuts and benefit. So when we eat grain in modern bread today, there’s a ton of potential nutrients that we’re not absorbing. There are two primary ways of breaking this down. One way to break this down would be sprouting the bread, one would be sourdough fermentation. Lactic acid fermentation and the acidification process of sourdough, you are breaking down fidic acid. There are studies that show you can get up to 90% percent of the available nutrients in the dough, whereas conventional bread would get like 20%, according to clinical trials.

A lot of the indigestibility of bread is around phytic acid, but gluten is coming to the mainstream, it’s become the easy thing to blame.

It’s great to be able to say, with clinical backing, there’s more bio nutrients in sourdough. That’s powerful. What we’re trying to do now is be the first party and authority on validating the science around lactic acid fermentation. There really hasn’t been an interested party or corporation interested in investing in the science. Our goal is to work with these scientists.

Q: How do you ferment your sourdough?

Modern bread, industrial bread or pizza on the shelf, you probably see an hour to three hours of fermentation time. With us, we do a full three days of fermentation time. We constantly have this starter, this mother culture, that we feed twice a day. We slowly mix our batches, low and slow. We do a bunch of small batches rather than one large batch, we find we get better quality that way. We do a really slow batch, then we take our dough and ferment it in a proofing room for two full days and nights. It will vary a little bit, but each ferment goes above 70 hour.

We use 100% organic flour from Central Milling. The better the flour, the more microbial activity in the flour. We use a specific flour that’s grown three hours away in california, there’s a lot of whole grain in the flour. So the microbial activity is really active. What you get is a really healthy ferment with more lactic acid, so you get that classic sourdough tang and that’s what we’re going for.

Q: The flour seems really critical in fermentation to create a good dough.

It’s one of the important elements. You could have a company that says “We’re organic sourdough,” but they could be using terrible bleached flour and putting vinegar in it to make it taste sour, there are so many shortcuts.

Q: Tell me about the sourdough starter you use to create your dough.

For the starter, we use a local whole wheat starter and triple filtered water. Good water is super important with any ferment. We feed our starter local whole wheat, but our starter is decades old. It’s an heirloom starter from a natural foods business out here in Fairfax, California. It could be over 100 years old, we’re not sure. Feeding the starter is a constant point of stress. There’s a reason people mass manufacture bread, let’s put it that way. It’s like having a pet.

Q: What is the most challenging part of fermenting sourdough?

All the variables. It’s similar to any fermentation, where you need to measure the time and temperature. One thing that’s especially challenging is making estimates based on the temperature of the room and the seasonality. Thankfully we’re in San Francisco, so it’s not dramatic, but sometimes we’ll get a heat wave and it will change the dynamics of our operation, we’ll have to make adjustments on the fly.

Q: What flavor difference does sourdough bring to pizza?

The biggest difference is that, with any baked good with conventional yeast, you’re going to taste yeast. It’s a very distinct taste. Our sourdough specifically, what you’re going to taste is something that’s a little more nourishing and wholesome. You’re doing to get a little bit of the whole grain but not too much, it doesn’t taste like a whole-grain pizza. It’s something more artisan. You’re going to get a finish that’s slightly acidic, enough that you want to take another bite. It’s addicting — it makes you salivate. With any ferment, there’s this metabolic process where you’re salivating more, you’re wanting more, it’s your instinct.

Q: Sourdough Story was the first USDA organic and Non GMO verified pizza on the market. Why was that important to you to get those certifications?

This was a point of contention. Just because industrial organics and the fact that having this certifications does not inherently validate that you’re a thoughtful brand. The reason I would argue it was the right decision is it creates immediate consumer trust, and puts us in channels that we want to grow into quickly, whether its natural or conventional. It gives us a point of differentiation against brands that aren’t thoughtful at all. It helps us with our sales funnel, and through the sales process being able to go to buyers and check the box. It also gives us leverage in closing new accounts.

For consumers, if anything, having both shows we’ve done our due diligence and we’ve been vetted. Overarchingly, I think it was the right decision.

Q: Is there a lot of competition from the gluten-free market?

My whole thing is that, whether you’re gluten free or not, at the end of the day, people want to feel good about eating pizza. We’re providing people an avenue to feel good about eating pizza.

There’s so many new entrants in the gluten-free space. What really bugs me about gluten-free products is a lot of them don’t care how they’re sourcing their ingredients. They’ll get terrible rice flours you don’t even know where they’re coming from, or cauliflower from international markets, or processed cheeses making up crusts. Our thing: we’re going with tradition. We’re going to trust the heirloom staples, sourdough being one of them, that’s been around for thousands of years, that’s touching every culture. I think it’s good for us to be different.

Q: Where is your copacker, are they in Northern California?

Yes, they’re in Berkeley. It’s a copacker made up of artisan pizzaiolo from Italy. Every pizza is handmade and hand stretched. It’s a USDA organic facility. It’s only us and then their line of organic products. It’s a special little manufacturing facility.

Q: More and more retail news shows fermented pizza dough is an increasing trend. Why do you think so?

If I had to say one thing I’d start with flavor. You win people on taste. And I don’t think there’s anyway a modern bread can taste better than sourdough. The reason being it’s pure umami flavor. If you ferment dough correctly, you’re going to get this incredible flavor that’s unmimicked by conventional applications.

Q: Where do you see the future of Sourdough Story?

We want to have a national footprint in natural and conventional. More importantly, we want to be the authority for all things sourdough based. We want to provide research, we want to provide recipes and information on how to get people involved in traditional baking, we want to be the point on all things sourdough based, and really creating a category for it. And we see the brand expanding beyond pizza in the future, too.

Q: Do you think consumers awareness of fermented foods is increasing?

Wholeheartedly, yes. Almost all my friends have jars of kraut in their fridge now. The whole microbiome, all the understanding and science coming out on the importance of the microbiome, how it influences all elements of health from your mood to your skin to you name it. I think it’s an extremely exciting industry. Not to mention that fermented foods are popping up everywhere. Look at kombucha, look at fermented, plant-based yogurts. They’re everywhere. I think it’s one of the hottest trends.

Q: What challenges do fermented food producers face?

From the manufacturing side, it’s hard to scale a fermented food. It’s hard to scale any manufacturing product, but with fermented food, there’s value in having a smaller volume. It’s also a living organism, it’s really a living thing with a personality that you really need to really thoughtfully think of how to scale. You also just have to learn from your mistakes, it’s just a trial by error thing. It’s a growing category and there’s a ton of competition.

Q: What are the fermented food industry strengths?

I think the entire ecosystem of retail is going to healthy food, functional food, slow food. When you look at Wal-Mart being the largest seller of organic products, that’s exciting. That’s correlated to the fact that people want to eat healthy. Fermentation is a staple and tiller of health in every single culture, you name it. Every corner of the world has fermented food.

Q: Where do you see the future of the fermented food industry?

I think the future would be people being a household necessity to the point where people are trying to get a form of fermented food in their diet every single day. It’s becoming a preventative medicine, and that’s promising.

Q: What’s your advice to other entrepreneurs starting a fermentation brand?

Start small and don’t grow too fast. We’ve had some serious growing pains, and just really try to add value to the product, listen to your consumer, and you get in front of it as many consumers as you can and gather feedback so you can find your niche.

And also, tap into the community. What excites me the most about fermentation and food in general is there’s so many people willing to help and provide advice.

Q: What can the fermentation industry do to better educate the public about fermented foods?

The onus is on, the brands. this was one of the reasons I started a food company, people vote with their dollars. And the best was to educate is to create a really good product.

- Published in Business, Food & Flavor

Average Supermarket Carries 306 Different Yogurt Varieties

Though overall U.S. yogurt sales fell 6%, the average U.S. supermarket carries 306 different yogurt varieties. Consumers are embracing new flavors and vegan, plant-based yogurt styles.

-Nielsen Data

- Published in Business

6 Trends for the Fermentation Industry from Natural Products Expo East

Good news for fermented food and drink brands. Today’s increasingly disruptive, consumer-driven economy is favoring brands that are craft and artisanal, source responsibly, reduce waste, nourish their microbiome and aim for better treatment of the planet. These are already core operating values for many fermentation brands.

“Consumer values are shifting in the marketplace; businesses are working hard to find ways to use their business as a force of good. Consumers are increasingly engaged in supporting the businesses that are looking to disrupt the status quo, that are looking to change,” said Eric Pierce, vice president of strategy and insights for New Hope Network. “Our market is moving in this direction with more innovation, with more access, with more options for consumers that are easier for them to get a hold of…we will find more and more people opting into the products we are bringing to the marketplace.”

The top trends driving the natural products industry were shared at a “What’s Next” session for industry leaders at Expo East. Here are six trends the fermentation industry can use to grow their company.

1. Brands Supporting the Planet

From the treatment of animals on the farm, the soil used to grow the vegetables and the type of packaging used, the environment is on the top of consumer’s minds. Consumers want to support brands that practice regenerative farming, zero waste production and responsible supply chain sourcing.

“The top three trends fell under purpose-driven commerce,” said Amanda Hart, market research manager for NEXT Data & Insights. She said consumers want brands to be more mindful, proactive and “really dive in and solve for community health and issues where government regulation is lagging or lacking.”

2. Selling Outside the Health Food Crowd

Since the start of the natural food industry, natural and organic foods were mostly purchased by a demographic of shoppers SPINS market research defines as “Core Natural/Organic.” These “true believers” and “enlightened environmentalists” make up the majority of natural industry shoppers.

Meanwhile, the mainstream consumer has traditionally been a harder group for brands to reach. These “indifferent traditionalists,” “struggling switchers” and “resistant non-believers” make up the smallest part of natural product sales.

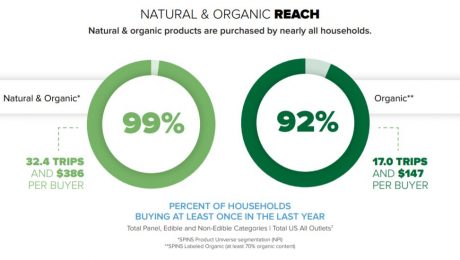

That gap is closing – today 92 percent of all households buy organic products, and 99 percent buy natural products.

Pierce noted he was surprised when studying these groups that the reason they purchase natural products is now the same.

“What this means to us is their level of commitments to products in the industry, their level of commitment to brands is dramatically different,” Pierce said. “But consumers across our economy value similar things what it comes to what they’re looking for from us.”

“Increasingly, these products are resonating with mass retailers,” he continued.

The findings also showed the food trends that resonate with consumers were not influenced by their political leaning. Whether Democrat or Republican, consumers care about the same food values.

The top five food trends these groups care about: waste reduction, responsible sourcing, responsible meat and dairy, craft and artisanal and responsible packaging.

3. Expanding Knowledge of Microbiome

Probiotics – which has topped SPINS trend lists for years — is no longer claiming a top spot. This doesn’t mean consumers don’t care about gut health, though. Consumers are looking at different beneficial options for their microbiome.

“How can consumers cultivate a health microbiome, to make us our strongest selves as we navigate the forces of modern life?” Hart said.

There is lots of research on nourishing a healthy microbiome. Brands should market gut health to consumers, especially with scientifically-backed claims on how fermented foods aid the gut bacteria.

4. No Added Sugar

Sugar – especially added sugar – has long been the nemesis of natural food shoppers. But consumers now want blatant communication from brands on product flavoring.

“Sugar and sweetener are different, so some brands now are starting to leverage both of those terms and really communicate how they’re adding a sweet flavor to their product – or not adding,” Hart said.

Botanical flavoring is starting to become a sweetner alternative for brands.

5. Alcohol-Free Drinks

Concerned with their health and focused on mindful drinking, Americans are purchasing less alcohol. Data from industry tracker IWSR found that U.S. alcohol volumes are dropping every year. Beer was the lowest, with volumes down 1.5 percent in 2018 and 1.1 percent decline in 2017. Growth in wine and spirits also slowed. This is especially true among younger, millenial consumers.

The taste for a fermented craft beer or cocktail is not waning, though.

This trend was seen on the show floor, where more and more alcohol-free brands are marketing alcohol-free drinks, like non-alcoholic beers, sugar-free mocktails and sparkling vinegars.

6. DIY Rules

Consumers want to be part of the creative process, “like they’re building products for themselves,” Hart said. Pierce added: “consumers value innovation efforts…that engage their sense of adventure and exploration.”

Fermentation brands are catering to consumers DIY nature by offering recipes to experiment with their product, like kefir smoothies, kombucha cocktails or sauerkraut omelets. Some fermentation brands are even selling fermentation kits for home use.

- Published in Business

More Brands Aim to Create Community Around Fermentation

More fermentation brands are creating ways to connect with their customers, face-to-face. Harvest Roots Ferments started in 2012 as a small farm in Birmingham, Ala. “At the time, Lindsay was fermenting kraut and kombucha for our farmers market table. Our customers wanted ferments way more than kale,” said Pete Halupka, who runs Harvest Roots Ferments with Lindsay Whiteaker. “About three of four years ago, we committed fully to fermentation. Now we produce kombucha, kraut, kimchi and other fermented vegetables and sell them across Alabama.” Now Harvest Roots Ferments is opening Birmingham’s first kombucha taproom. No longer traditional farmers (they source from local farmers, buying 75,000 pounds of produce since 2015), Harvest Roots Ferments is looking to build and connect to the Birmingham community that has helped their business grow. Halupka continues: “We love community in all forms—from the microbial community in action fermenting our products to the community found in our Southern forests and our human community across Birmingham—and we want our space to be a reflection of this.”

Read more (BHam Now)

- Published in Business

New Trend: Fermented Pizza Dough

Enhanced flavor, tangy dough and gluten-sensitive ingredients are making fermented pizza dough a new trend. Slow, fermented pizza dough is starting to appear on more pizzeria menus. Chef Max Balliet of Lupo in Kentucky said “The sourness is the biggest variable that you can affect with time. But what I like, instead of going full-force sour, is more of a balance. That way, there’s a bit of intrigue there. When that’s done properly, it gives you a dough that’s got complexity.”

Read more (The Manual)

- Published in Food & Flavor

Natural is the New Mainstream; 4 Trends for Fermented Food Producers

Today, everyone is a natural and organic shopper. The natural products industry has experienced incredible growth over the past 20 years that, today, 99 percent of American consumers buy natural products.

“More than ever now, we’re hearing people talk about seeking top products, seeking unique products, seeking trending products and even seeking quote unquote ‘better’ products,” says Christine Kapperman, senior content director with New Hope Network.

SPINS released their latest State of the Natural Industry report in August, sharing industry trends and highlighting areas of growth. Leaders with SPINS (a data provider for natural, organic and specialty products) hosted a webinar discussing the report.

The natural products industry has seen incredible growth and evolution over the 20 years, more than doubling in dollar volume in the past decade,” says Molly Hjelm, vice president of marketing at SPINS.

Hjelm notes the current natural foods movements is increasingly personalized to consumer’s lifestyles. Consumers want their specific version of natural, like plant-based, grain-free, paleo or free form.

“In this moment in natural, consumers have the power and they’re increasingly personalized preferences have become a movement, disrupting previously untouchable boundaries like milk, immediate consumption beverage and pasta,” she says. “Products once relegated to specific retail outlets are now proliferating to the mainstream.”

Here are four trends in the natural food industry for fermented food brands to implement.

1. Natural Products Driving Market Growth

The latest statistics (tracking three years from May 2017 to May 2019), show the natural industry is selling $47.2 billion a year, growing 5 percent year over year. The conventional food marketplace is selling $448.2 billion a year, but only growing at 1.7 percent year over year. Natural foods have a 10.5 percent sales volume, and 29.3 percent of total market growth.

“Looking back at recent years, the trend is clear – natural products have been outpacing their conventional counterparts for some time in terms of dollar growth,” says Jessica Hochman, the senior manager for natural insights for SPINS.

The top 10 natural product categories: produce, refrigerated yogurt and kefir, shelf-stable chips, pretzels and snacks, refrigerated eggs, refrigerated juices and functional beverages, shelf-stable wellness bars and gels, shelf-stable water, frozen desserts, refrigerated milk and frozen and refrigerated meat, poultry and seafood.

Fermented products are exhibiting some of the strongest dollar share growth. Yogurt and kefir and functional beverages both over index in their respective categories.

2. Convenience Channel Growing

Conventional retailers are embracing natural products – and their returns are incredibly strong. The convenience channel stocks a small volume of natural products, but sales of natural products are growing three times faster than natural and specialty gourmet channels. Natural products are just 4.6 percent of volume in convenience channels, but contribute 15.9 percent of dollar growth.

“The real growth fueling the top line trend comes from the support received by the vendor community,” says Jeff Crumpton, SPINS’ retail solutions manager. The convenience channel is growing at a whopping 10 percent year over year. “Natural products have migrated from the innovation channels all the way to convenience.”

3. Consumers Want Grab-n-Go Options

Why is the convenience channel overdelivering in high amounts? Consumers want grab-n-go options in convenient locations.

“(It) aligns with our knowledge that consumers purchase natural products where it’s easier for them,” Crumpton says. “Retailers and other outlets should be mindful that the competitive pressure to their business means adjusting their assortment with innovative products and monitoring categories and items cross channel, which ensures they’re paying attention to the migration and planning accordingly.”

Traditional retailers are experiencing high growth in food service options, “they’re looking to it as a competitive edge,” Kapperman says.

Fifty-seven percent of retailers said strong sales come from their food service, like hot bars, grab-n-go shelves and in-store deli and cafes.

4. Mainstream Consumer

“Everybody to some extend is buying natural organic,” says Patrick Knight, SPINSprincipal of consumer insights. “And in that regard, we are truly mainstreaming. But not all natural consumers are created the same.”

The core of the natural segment is dominated by consumers defined as true believers and enlightened environmentalists, who make up 28 percent of natural/organic product sales. Next, aspiring natural shoppers defined as healthy realists and strapped seekers make up 16 percent of sales. Mainstream consumers, defined as indifferent traditionalists, struggling switchers and resistant non-believers, total 56 percent of natural/organic sales.

The mainstream category, Knight says, is where the greatest potential resides for the natural market growth.

“Our hypothesis is that mainstream consumers are starting to grow more than core natural organic consumers in purchasing of paleo position products,” Knight says. “Core natural/organic consumers are the first on the latest trends in the marketplace, and therefore can be a barometer for what’s coming.”

- Published in Business

Farmhouse Culture Retools Packaging, Embrace “Organic” but Move Away “Probiotic”

Farmhouse Culture is retooling their packaging, moving away from what the CEO calls “natural food cliches.” Using consumer research as their guide, the fermentation brand is using “always organic” on their labels, indicating quality to shoppers. Farmhouse Culture is also decreasing their emphasis on probiotics because, though shoppers want products with digestive health benefits, they’re confused over how to achieve digestive health. The Wisconsin-based brand makes sauerkraut, fermented veggie drinks and sauerkraut chips.

Read more (Nosh)

- Published in Business

Gut Health Hot Food Trend, But Consumers Confused Over Science and Additives

As more people battle digestive problems, they’re turning to brands offering gut health solutions. Digestive health is the third most sought after health benefit in the latest International Food Information Council Food & Health Survey, behind weight loss and energy.

Though it’s a hot topic, it’s a space challenged with unsupported health claims and confusing ingredient additives. During a panel hosted by Food Navigator, four industry leaders shared insight into the growing gut health category.

“What we’ve learned is that many of our consumers come into our brand typically with serious, long term digestive health challenges. Bloating, regularity challenges, IBS,” said Mitchell Kruesi, senior brand manager for Goodbelly, which creates probiotic drinks and snacks. “They’ve tried supplements in the past, but weren’t super enthusiastic about them because often times taking a supplement felt medicinal to them. After that, they continue to seek out other probiotic options that are both effective, but also food-based so that it’s easy to fit in their routine.”

Demystifying Probiotics

Plagued with health issues and fed-up with pills, consumers are desiring food brands that aid digestive health. Flavor, though, is key.

“That delicious taste…it sets up an everyday usage routine, which is critical with probiotics,” Kruesi said.

Probiotics is a confusing territory for consumers. Should probiotics be consumed in pills or as a strain added to food? How much should be taken?

Elaine Watson, Food Navigator editor, quoted GT Dave, founder of GT Kombucha: “In my mind, anything raw and fermented deserves to use the term ‘probiotic.” Watson asked the panelists if there’s a perception that all fermented foods contain probiotics because they contain live, active cultures – and should food advertising probiotics be verified by clinically proven studies?

“I think consumers are quite confused still around the whole topic, in all honestly. Live, active cultures are used to make fermented food beverages – but unlink probiotics, they’re typically not studied and shown to provide a health benefit,” said Angela Grist, Activia US marketing director. Really in order to be considered a probiotic, they would need to meet the criteria of survival and research-validated health benefits and also this point around strain specificity.”

Grist said probiotics need to survive the passage through the digestive track to the colon. Activia has five survival studies showing the benefits of probiotics.

Ben Goodwin, co-founder of Olipop, added he’s conducted genetic assays around the underlying culture banks of fermented food and beverages and “there have definitely been organisms in the culture banks which are deleterious for human health. So not everything that’s fermented is automatically good for human health, there’s all sorts of different biological modes that organisms can interact with each other and some become parasitic or become determinantal to your probiotic when consumed, so something to keep in mind.”

Note that the panel did not feature a raw, fermented food brand; the companies included on the panel all add probiotic strains to their food and drink product.

In a separate interview with The Fermentation Association, Maria Marco, professor in the Department of Food Science and Technology at the University of California, Davis, said there is a lot of confusion around probiotics, even among industry representatives. Marco, though, agrees with Grist and Goodwin. She says clinical studies on fermented foods are necessary.

“Although it might be possible to separate out the individual components of foods for known health benefits (e.g. vitamin C), the benefits of many foods are likely the result of multiple components that are not easily separated,” Marco said. “Yogurt consumption is a great example of a fermented food that, through longitudinal studies, was shown to be inversely associated with CVD risk.”

In one of Marco’s studies at UC Davis titled “Health benefits of fermented foods: microbiota and beyond,” Marco and her research associates concluded that fermented foods: are “phylogenetically related to probiotic strains,” “an important dietary source of live microorganisms,” and the microbes in fermented foods “may contribute to human health in a manner similar to probiotics.” The study adds: “Although only a limited number of clinical studies on fermented foods have been performed, there is evidence that these foods provide health benefits well-beyond the starting food materials.”

Educating Consumers

The panel said that the food industry is responsible for displaying integrity in their marketing on probiotic benefits.

“We believe it’s critical for leading brands in the space…to really educate consumers on, first, what probiotics are,” said Kruesi with Goodbelly. Consumers are seeking out probiotics for a specific health benefit, but most don’t know what strain they need to address their issue, he noted.

Probiotics are live microorganisms that aid the digestive system by balancing gut bacteria.

Currently, the demographic of consumers buying products geared toward gut health are millennial females in coastal cities. Both Activia and Olipop sell to more women than men (Activia customers are 60 percent female and 40 percent male; Olipop customers are 55 percent female and 45 percent male).

Goodwin said Olipop is hoping to tap into the rapidly declining soda market. Soda is a $65 billion industry, with 90 percent household penetration. But more consumers are turning to healthier options than unnatural, sugar-filled soda.

“We’ve tried to take on the extra responsibility as a brand of formulating something that’s spun forward, delicious and really approachable so that we can meet a real health need in a way that’s actually supported by research,” Goodwin said. “(Olipop) is not only low sugar, low calorie, it also has this digestive health function but obviously doesn’t taste like vinegar because it’s not a kombucha.”

Solving Digestive Stress

Products by Activia, Goodbelly, Olipop and Uplift Food (the fourth panel member) are “meant to be a mass solution for the lack of fiber prebiotics and nutritional diversity in the modern diet,” Goodwin said. Fiber contains prebiotics, which aid probiotics.

The USDA’s dietary guidelines recommend adult men require 34 grams of fiber, while adult women require 28 grams of fiber (depending on age). The reality, though, is that most Americans get about half the recommended fiber a day, only 15 grams. According to the National Institute of Diabetes and Digestive and Kidney Diseases, 60-70 million Americans are affected by digestive diseases.

Compare that to the diet of hunter-gatherers, who eat about 100-150 grams of fiber each day and maintain incredibly healthy guts or microbiome. The microbiome is the community of commensal microorganisms in our intestines, fed by fiber, probiotics and prebiotics.

“As it stands now, basically we’re putting in a starvation system for a lot of the microorganisms currently in your gut,” Goodwin said. “The average industrialized consumer has about 50 percent less diversity and abundance of beneficial microorganisms than the hunger-gatherers alive on the planet tonight.”

Future of Gut Health Products

Grist with Activia said probiotics need to be consumed in adequate, regular amounts to provide health benefits, or else probiotics will not consume the digestive track.

Kara Landau, dietitian and founder for Uplift Foods which makes prebiotic foods, added that each individual has a unique bacterial make-up, and providing diverse food to support the microbiome is critical.

Landau said the future of gut health probiotics will be selling a specific probiotic strain, one that a consumer can target for their desired health benefit. Prebiotics – “the fuel for the probiotics” – are also key, and a new part of the digestive health puzzle that brands need to communicate and simplify for consumers.

“Prebiotics are still very much in their infancy when it comes to consumer understanding,” Landau said. “Seeing them alongside probiotics enhances the clarity of their benefits.”

- Published in Science