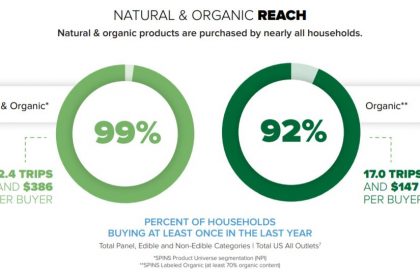

Today, everyone is a natural and organic shopper. The natural products industry has experienced incredible growth over the past 20 years that, today, 99 percent of American consumers buy natural products.

“More than ever now, we’re hearing people talk about seeking top products, seeking unique products, seeking trending products and even seeking quote unquote ‘better’ products,” says Christine Kapperman, senior content director with New Hope Network.

SPINS released their latest State of the Natural Industry report in August, sharing industry trends and highlighting areas of growth. Leaders with SPINS (a data provider for natural, organic and specialty products) hosted a webinar discussing the report.

The natural products industry has seen incredible growth and evolution over the 20 years, more than doubling in dollar volume in the past decade,” says Molly Hjelm, vice president of marketing at SPINS.

Hjelm notes the current natural foods movements is increasingly personalized to consumer’s lifestyles. Consumers want their specific version of natural, like plant-based, grain-free, paleo or free form.

“In this moment in natural, consumers have the power and they’re increasingly personalized preferences have become a movement, disrupting previously untouchable boundaries like milk, immediate consumption beverage and pasta,” she says. “Products once relegated to specific retail outlets are now proliferating to the mainstream.”

Here are four trends in the natural food industry for fermented food brands to implement.

1. Natural Products Driving Market Growth

The latest statistics (tracking three years from May 2017 to May 2019), show the natural industry is selling $47.2 billion a year, growing 5 percent year over year. The conventional food marketplace is selling $448.2 billion a year, but only growing at 1.7 percent year over year. Natural foods have a 10.5 percent sales volume, and 29.3 percent of total market growth.

“Looking back at recent years, the trend is clear – natural products have been outpacing their conventional counterparts for some time in terms of dollar growth,” says Jessica Hochman, the senior manager for natural insights for SPINS.

The top 10 natural product categories: produce, refrigerated yogurt and kefir, shelf-stable chips, pretzels and snacks, refrigerated eggs, refrigerated juices and functional beverages, shelf-stable wellness bars and gels, shelf-stable water, frozen desserts, refrigerated milk and frozen and refrigerated meat, poultry and seafood.

Fermented products are exhibiting some of the strongest dollar share growth. Yogurt and kefir and functional beverages both over index in their respective categories.

2. Convenience Channel Growing

Conventional retailers are embracing natural products – and their returns are incredibly strong. The convenience channel stocks a small volume of natural products, but sales of natural products are growing three times faster than natural and specialty gourmet channels. Natural products are just 4.6 percent of volume in convenience channels, but contribute 15.9 percent of dollar growth.

“The real growth fueling the top line trend comes from the support received by the vendor community,” says Jeff Crumpton, SPINS’ retail solutions manager. The convenience channel is growing at a whopping 10 percent year over year. “Natural products have migrated from the innovation channels all the way to convenience.”

3. Consumers Want Grab-n-Go Options

Why is the convenience channel overdelivering in high amounts? Consumers want grab-n-go options in convenient locations.

“(It) aligns with our knowledge that consumers purchase natural products where it’s easier for them,” Crumpton says. “Retailers and other outlets should be mindful that the competitive pressure to their business means adjusting their assortment with innovative products and monitoring categories and items cross channel, which ensures they’re paying attention to the migration and planning accordingly.”

Traditional retailers are experiencing high growth in food service options, “they’re looking to it as a competitive edge,” Kapperman says.

Fifty-seven percent of retailers said strong sales come from their food service, like hot bars, grab-n-go shelves and in-store deli and cafes.

4. Mainstream Consumer

“Everybody to some extend is buying natural organic,” says Patrick Knight, SPINSprincipal of consumer insights. “And in that regard, we are truly mainstreaming. But not all natural consumers are created the same.”

The core of the natural segment is dominated by consumers defined as true believers and enlightened environmentalists, who make up 28 percent of natural/organic product sales. Next, aspiring natural shoppers defined as healthy realists and strapped seekers make up 16 percent of sales. Mainstream consumers, defined as indifferent traditionalists, struggling switchers and resistant non-believers, total 56 percent of natural/organic sales.

The mainstream category, Knight says, is where the greatest potential resides for the natural market growth.

“Our hypothesis is that mainstream consumers are starting to grow more than core natural organic consumers in purchasing of paleo position products,” Knight says. “Core natural/organic consumers are the first on the latest trends in the marketplace, and therefore can be a barometer for what’s coming.”