Kombucha is Growing, But Retailers Are Ready to Axe Brands

The kombucha industry is exploding – sales were up 21 percent to $728.8 million last year. Kombucha and non-alcoholic fermented beverages are now the third largest beverage category, representing 10 percent of total refreshment beverage sales.

Distribution is high at conventional, natural and convenience stores. But velocities (sales) are declining.

“A word of caution – there’s going to be a reckoning,” said Bobbi Leahy, director of sales at SPINS, a natural products market research group. “All these retailers are taking all these lovely kombuchas … they will be evaluating you, probably far soon than you think is warranted. There will be some slashing going on.”

Leahy spoke at KombuchaKon, the Kombucha Brewers International (KBI) annual trade conference in Long Beach. The year’s KombuchaKon was the industry’s largest since the first conference six years ago, with 424 attendees from 17 countries.

“I applaud you all on the growth. I think that’s wonderful,” Leahy said. But “I would be ready with some materials to go in and defend your spaces.”

In her presentation on the kombucha market analysis and future trends, Leahy emphasized that refrigerated beverage shelves are expensive retail space. She shared advice with kombucha brands on how to survive the current high distribution wave. The SPINS analysis is based off 52 weeks of sales ending in February 2019. Her tips:

- Prepare with Sales Materials. If kombucha sales can’t keep up with distribution, retailers will have to answer to their higher-ups. Why is there so much kombucha on the shelf that isn’t selling? Leahy warned brands to be the ones educating retailers, advising brands to share data points and score cards. She added: “I encourage you to go and get ahead of that, be the one talking that message. You tell them what the right set is, you tell them what they should do, you know this industry. If they’re overstocked on something, then let them know. They’re looking to you to be the experts.”

- Conventional supermarkets reign. The bulk of kombucha and fermented beverage sales are coming from conventional supermarkets. “If you succeed in the conventional channel, you’ll have success overall because they represent 70 percent of sales,” Leahy said.

- Don’t ignore convenience stores. Convenience store (like 7-11 and gas stations) sales of kombucha and fermented beverage sales are growing 55 percent. “You have to make it a task to go after convenience,” Leahy noted. “You probably wouldn’t have said ‘That’s my low-hanging fruit, I’m going to go in there.’ But they’re certainly getting the message now … It’s certainly worth having a plan to go after convenience.”

- Craft different sales messages for each channel. Don’t go in to retailers with the same message. Between conventional, convenience, natural and specialty stores, each channel will care about different things.

- Know region’s sales trends. The west coast – especially California – has high kombucha sales. The south central, mid-south and Great Lakes regions are under-indexing in kombucha sales. Leahy pointed out that the west is a ready audience and a great spot to experiment with new flavors. The south and Great Lakes regions, though, need an education focus. Demos are a great idea in the area.

- Highlight brand’s best attributes. Boast about characteristics beyond the label. Features like: clean label, sustainability, brand mission, wellness goals, social impact and great ingredient sources.

- Top selling flavors are solid. Ginger and berry are the two top flavors across all channels. The “fruit – other” is also a top selling flavor and growing (135 percent), which is defined as unique fruit flavors like watermelon, guava and melon. The past year, there has been the strongest growth in flavors: apple (172 percent), grapefruit (155 percent), pomegranate (104 percent) and orange (98 percent).

- Tread lightly with unique flavors. Leahy pointed out, if a unique flavor only appeals to a small audience, a conventional retailer will notice only a small number of customers are buying it. “That small and that low is going to be kind of a perfect storm,” she said. “You really want to be careful.”

- Smaller size bottles sell best. The 14- to 17-ounce size kombucha make up the majority of sales.

- Start sales promotions. Coupons, mailers and sales are great options to get products off shelves.

- Use your social network. Let people know which stores you’re at.

- Maintain a good store locator. Brand’s websites should feature a good store locator detailing which stores carry which flavors of kombucha.

- Top kombucha brands dominate the market. GT Kombucha, Kevita, Health Ade, Humm Kombucha and Brew Dr. account for 88 percent of kombucha sales at conventional retailers and 89 percent of kombucha sales at convenience stores. GT Kombucha, Kevita, Health Ade and Brew Dr. account for 77 percent of kombucha sales at natural stores and 82 percent of kombucha sales at specialty gourmet stores. Those same top brands likely will not change, Leahy noted.

- Know beverage trends. “The trends you are seeing in kombucha are special and unique,” Leahy said. “…as you’re sitting across a buyer or a category manager or retailer, you want to be well-versed in what other beverages are on the shelf and which ones they’re probably going to protect.”

- Natural beverages are contributing more to the growth of the refreshment beverage category than non-natural. The conventional, shelf-stable beverages (like Coke and Pepsi products) account for 63 percent of the refreshment beverage industry, but only 53 percent of growth. Diet soda is especially losing favor among consumers. Specialty and wellness beverages (like energy drinks and Gatorade) make up 29 percent of sales and 35 percent of growth, especially driven by energy drinks. Natural drinks (like kombucha and La Croix) make up 8 percent of sales, but natural is driving 13 percent of growth.

- Of the natural beverage subcategories, shelf-stable performance beverages (like Body Armor) are experiencing the biggest growth at 87 percent. Declining categories include shelf-stable coconut water (-12 percent) and juices (-3 percent).

- Emphasize growth of natural products industry. Natural products are no longer a niche market. The natural products industry is estimated to reach $140 billion in sales in 2019. In 2003, natural products were a $52 billion industry.

When SPINS began tracking kombucha sales years ago, Leahy noted kombucha was “barely a blip on the map.” Current Kombucha sales numbers are also likely higher than noted – major retailers Costco and Whole Foods do not share sales data with SPINS.

“In a way, it’s a good problem to have – you can’t sell if you’re not on the shelf,” Leahy said. “ou’re on the shelf – now it’s time to sell.”

- Published in Business

75% U.S. Consumers Will Pay More for Clean Label

Clean labeling is important for modern consumers; 75% of U.S. consumers will pay more for a food or drink product made with ingredients they recognize and trust.

Ingredient Communications

- Published in Business

Consumer Education Critical to Success of Fermented Foods

Fermented foods are making a comeback, but an education gap needs addressing for fermentation to move “from fashionable buzzword to become a sustainable long-term trend.” A group of panelists spoke at the UK The Ingredients Show on what’s driving and developing the fermentation market. The panel agreed there is a disconnect — people want fermented foods, but few understand what they are. Tom Lee, editor of Food Spark, said fermented food producers should look at supermarkets as part of the solution. Supermarkets are “keen to explore fermented products.” Lee said: “A lot of developers and buyers we speak to at the supermarkets are looking for products around things like plant-based fermentation. They are constantly on the look out for exciting products in this area because they are emerging trends and therefore maybe less affected than more traditional items by range trimmings.”

Read more (Food Navigator)

Photo by: The Ingredients Show

- Published in Business

KombuchaKon 2019 Kicks Off Largest Conference in History

KombuchaKon 2019 starts today in Long Beach! The 6th annual conference by Kombucha Brewers International is the association’s largest-ever conference. Kombucha is a rapidly growing beverage category, projected to grow at a CAGR of 13% to $3.5 billion in sales by 2025. For more information, check out KBI.

- Published in Business

Japanese Sake Sales Surging as More Americans Enjoy the Rice Wine

Sake is sliding from the sushi bar to the dinner table. The Japanese sake industry is exporting more of the popular rice wine to America than ever before. More sake brands are putting English descriptions on their labels, which has surged sales growth. Kristin Breshears, a Certified Sake Professional and distributor for Vine Connections, says most Americans drink sake hot, served in a small ceramic cup along with sushi or dropped in a beer. Breshears, though, says sake is “a really beautiful beverage that should be served chilled and hopefully out of a wine glass so you can smell the aromas.”

Read more (New Orleans Gambit)

- Published in Business

Global Kimchi Market Valued at $3 Billion

The global kimchi market was valued at $3 billion in 2018 and is projected to grow to $4.28 billion by 2025, growing at a CAGR of 5.2% through 2025.

- Published in Business

NOMA’s David Zilber Says Fermentation “Undergoing an Understanding”

The head of the fermentation lab at NOMA, David Zilber, says fermentation is not making a comeback — fermentation is “undergoing an understanding.” He adds: “Fermentation is definitely a commitment. It is committing to something. It’s being responsible for life and watching it grow. It’s a slow and patient process. But it’s also being rewarded.” The Guardian’s recent interview with Zilber offers insight into the chef’s background in fermentation and NOMA’s lab, which houses 10 fermentation rooms at varying temperatures. He says his food is an artist’s statement.

Read more (The Guardian)

- Published in Business

Functional Food & Beverage Sales Growing, Probiotics Popular Ingredient

Functional food and beverage sales grew 7.5% to $68 billion in 2018. Beverages and snacks are the biggest growth categories, while probiotics are one of the most popular functional ingredients.

Nutrition Business Journal

- Published in Food & Flavor

6 Takeaways for the Fermentation Industry from Expo West

The fermentation industry is on the cusp of a renaissance. Engaged consumers are seeking functional food and drink with health benefits. And fermented products provide the nutritional value and unique flavors today’s consumers crave.

Staff at The Fermentation Association attended Natural Products Expo West in Anaheim, Calif. this month. Expo West is the world’s largest organic and natural healthy products event, and we spent four days with 88,000 other attendees listening to industry experts in education sessions and meeting fermented food and beverage brands on the show floor.

Here are six takeaways from Expo West for the fermentation industry:

- Natural Products are King. Natural food and beverages grew 6.6 percent in 2018, for a total of $152 billion in sales, according to info from the Nutrition Business Journal. The category is growing so much that organic supply is lagging behind consumer demand. Meanwhile, for the first time in history, the conventional food and beverage category began to shrink last year.

- Major Focus on Gut and Microbiome Health. Once terms only used by scientists, prebiotics and probiotics are at the forefront of consumer’s grocery list. Digestive health is critical for modern consumers, as more nutritionists focus on the gastrointestinal tract’s critical immune system support. Consumers want food and drinks that nourish their microbiome. Sales numbers show people are moving away from purchasing pills and supplements to aid their gut; they’re instead looking for prebiotics and probiotics in actual food.

- Ancient Foods are Experiencing a Revival. The future of food is in practices of the past. From turmeric, ashwagandha, ghee and fermentation, the foods of our ancestors are back on our plates. These old-world cooking styles and ingredients are standing the test of time and coming back in modern cuisine.

- Industry is Selling to Educated Consumers. Today’s consumers know more about the food they eat than ever before. Consumers are studying ingredient lists, seeking product sources and researching brands. Clean food and clean labels are not a trend; they’re a movement. People are becoming more aware of the dangers of eating processed food. They want nutritious ingredients from ethical brands. The functional health benefits of fermented products are piquing consumer interest.

- Snacking Trumps Mealtime. Snacking today is a $1.2 trillion-dollar industry. The modern consumer is busy, and convenience food readily accessible in a grab-and-go format is a grocery store staple. Snacking in 2019 is not filling up on a soda and a bag of fried chips. Consumers want healthy, fresh snacks, especially refrigerated snacks in the produce aisle. This is great news for fermented brands. Grabbing a bottle of kombucha or kefir and a bag of snacking pickles or miso soup fits into the convenient dining lifestyle.

- Brands Need More Plant-Based Products. A major shift in food philosophy, more consumers are buying plant-based products – whether or not they’re vegetarian or vegan. Plant-based options are becoming tastier and readily available. Brands are experimenting with fermenting vegetables for plant-based cheeses, spreads, sauces and drinks.

It’s an exciting time for fermented food and beverage producers. The aromatic, tangy flavors and healthy, live bacteria in fermented products are qualities propelling fermentation to become one of the most popular food categories.

- Published in Business

The New Mainstream: Natural & Organic “Defining the Future of Food”

The New Mainstream: Natural & Organic “Defining the Future of Food”

Once specialty items only found in small nutrition shops, today natural products are the new normal for consumers. Annual consumer sales in 2018 were $219 billion across the natural and organic products industry, a 7 percent increase.

“Natural and organic has tipped into the mainstream and is now defining the future for food, nutrition and CPG,” said Carlotta Mast, senior vice president of content and insights for the New Hope Network which. Mast shared an overview of 2018 sales and growth at “The State of Natural and Organic” education session during the 2019 Natural Products Expo West.

The 39th Expo West hosted 88,000 attendees and 3,600 exhibitors. Mast shared sales and growth numbers from the Nutrition Business Journal, research that estimates the natural products industry will surpass $250 billion in sales by 2021.

That’s rapid growth – and amazing news for the fermentation industry. Food and beverages remain the largest category for the industry (numbers include food and beverage, supplements and natural living). Food and beverage make up 70 percent of the industry.

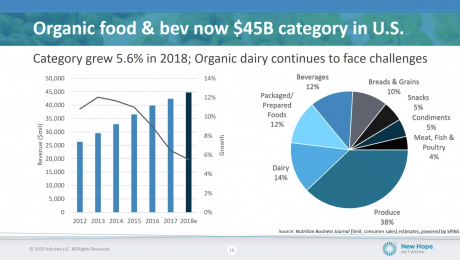

Natural food and beverage sales grew 6.6 percent in 2018 to $152 billion in sales. Organic food and beverage grew 5.6 percent in 2018 to $45 billion in sales. Organic has burgeoned into a huge force – organic supply is lagging behind growing consumer demand. Mast noted: “That’s a challenge the industry needs to continue to address.”

Sales for conventional food and beverage products began to shrink for the first time in history in 2018. Major conventional food brands – like Kraft Heinz – are reporting losing billions in sales.

Functional Ingredients

Consumers are looking for functional ingredients in their food and drink. They’re viewing their food as medicine, and they want health benefits from the food and beverages they consume. Functional food and beverage sales grew 7.5 percent last year to $68 billion in sales.

Great news for fermentation producers: probiotics are of the fastest growing functional ingredients. And consumers are moving away from supplements and pills. They want their probiotics in food and drink.

“The growth in probiotic food and beverages, this represents the continued blurring of the line between dietary supplements and food and beverages as consumers show a growing preference for non-pill and non-capsule delivery form for function products,” Mast said.

Mushrooms, Hemp and CBD and ashwagandha are other growing functional ingredients categories.

E-Commerce Growth

Though e-commerce is currently driving less than 5 percent of industry sales, those numbers will flip. Growth of e-commerce sales are outpacing brick and mortar sales.

E-commerce is the ideal platform as the “launch pad” for new brands and products, Mast said. Half of all new natural companies that entered the market between 2015-2018 started selling online before moving to retail. Mast notes: “That’s a huge shift for our industry.”

Macro forces

Mast outlined seven “staying trends to shape the industry.” She noted these are not fads, but “big shifts that are shaping who we are and what we sell and how consumers are driving what’s happening in our industry.”

The macro forces and trends include:

- Plant Wisdom. Mast: “This is one of the most powerful macro forces in our industry today as consumers are waking up to the social, environmental and health benefits of plant-based foods. And natural and organic brands are meeting this growing interest with innovative products that make is easier, healthier and more delicious than ever to ditch traditional meat and dairy, even if it’s only temporarily.”

- The World is Fat. Brands are “responding in creative ways to changing consumers perceptions around nutrition, including the growing appreciation for healthy fats,” Mast said. Consumers are realizing sugar is dangerous for health and weight management.

- A Life of Vitality. Mast: “Amidst the pressure of modern life, consumers are seeking out diets to help stave off and prevent disease, treat conditions and perhaps most important optimize how they feel today and every day. This is leading to many opportunities for innovative products that support a healthy microbiome.”

- Modern Pantry. “Today’s pantry looks very different than perhaps the pantry that our parents have.” There are opportunities for brands to update stale product categories, meeting the need for convenience with the need for nutrition and taste. Modern pantry products incorporate more veggies and less sugars.

- The Power of Science. “Science and technology are improving nearly every category in our industry,” Mast says. Science is connecting consumers with “science-based products and values-driven innovation that has the potential to change the world for the better.”

- Material Optimization. Brands are looking at ingredient waste, creatively reinventing packaging in creative ways to reduce, reuse and recycle.

- Inventive Business Models. Companies are running mission-driven brands that work for a higher purpose.

The natural and organic industry is shaping the future of consumer’s diets and lifestyle. Fermented food products – which are full of functional nutrition and science-backed microbiome benefits – are a major part in the industry’s growth.

- Published in Business