Fermented food producers, it’s time to be vigilant. Economists predict America is on the cusp of a recession. Thankfully, sectors of the food industry remains strong in an economic downturn. Food is a basic necessity consumers won’t cut out of their budget.

But that’s no reason to wait out a recession without caution. That recession-proof statistic only applies to select parts of the food industry. During the Great Recession of 2007-2010, household food spending declined by 7 percent. The United States Department of Agriculture reported it was “the largest inflation-adjusted decline in food spending that accompanied a recession since 1984.” Food purchase patterns also changed, as budget-conscious consumers focused on money-saving methods.

Based on food spending data, there are key lessons fermentation leaders can use to prepare for an impending economic downturn. Here are five ways consumer food spending will change in a recession.

1. Grocery Store Spending Remains Fairly Steady

When the economy is bad, more consumers cook their own food. Spending at grocery stores dropped minimally during the Great Recession, falling only 1.3 percent from 2006 to 2009. The number of home-cooked meals increased, as did the amount of meals eaten in the home with family members.

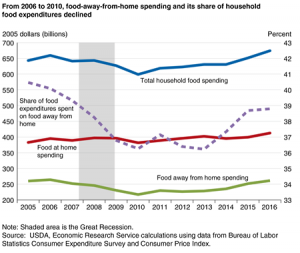

2. Restaurant Spending Plummets

Restaurant spending rises and falls along with income levels. Dollars spent on food away from home declined 18 percent ($47 billion) during the Great Recession. This large dip in restaurant sales didn’t recover for 10 years. Restaurant sales began decreasing in 2006, and didn’t return to pre-recession levels until 2016. Restaurant Business Online said 2009 and 2010 “would prove to be the

worst two years in the modern era for the restaurant industry.”

3. Consumers Focus on Health

During an economic crisis, consumers are not turning to cheaper, unhealthier food options. USDA data shows adults had “increased concern” for their nutrition during the Great Recession. When the economy was at its worst, more adults were rating their diet as excellent, very good or good as compared with fair or poor. Food quality also improved. Total calories from fat and saturated fat declined; cholesterol content dropped, while fiber intake increased. More adults were also using the Nutrition Facts Panel on food packaging, too.

4. Discount Retailer Sales Rise

As consumers cut their budget, they trade high-end stores for discount, big-box retailers. Sales at Costco, Wal-Mart and Target all climbed 15 percent from 2007 to 2008. Economists point to the purchasing power of big-box retailers. Big-box prices help the retail giants outlast luxury stores and small shops during a recession. Natural supermarket Whole Foods, once criticized for premium prices, shed their “Whole Paycheck” reputation after the recession decreased their sales. In 2008, they began offering discounts, adding store brands and emphasizing value in their marketing.

5. Cost-Cutting Methods Reign

Consumers eliminate discretionary spending in a recession. They clip coupons, watch food sales, shop for generic brands and buy items in bulk. Interestingly, the average number of shopping trips to the grocery store increased during the latest recession, but the amount paid per transaction was 12 percent less. Private-label products (or generic or store brands) expanded faster than well-known, national brands during the recession. A record number 810 new private label food and beverage products was released during the recession, seven times more than the amount released in 2001.

(Photo: Foodies Feed)

(Graph: USDA)