New FDA Requirements for Fermented Food

By August, any manufacturer labeling their fermented or hydrolyzed foods or ingredients “gluten-free” must prove that they contain no gluten, have never been through a process to remove gluten, all gluten cross-contact has been eliminated and there are measures in place to prevent gluten contamination in production.

The FDA list includes these foods: cheese, yogurt, vinegar, sauerkraut, pickles, green olives, beers, wine and hydrolyzed plant proteins. This category would also include food derived from fermented or hydrolyzed ingredients, such as chocolate made from fermented cocoa beans or a snack using olives.

Read more (JD Supra Legal News)

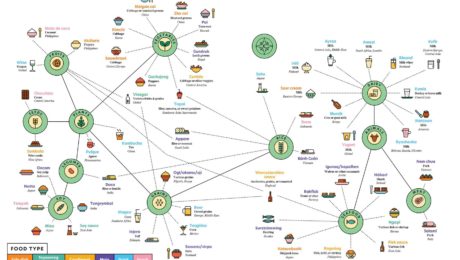

The World of Fermented Foods

In the latest issue of Popular Science, a creative infographic illustrates “the wonderful world of fermented foods on one delicious chart.” It represents “a sampling of the treats our species brines, brews, cures, and cultures around the world,” and is particularly interesting as it shows mainstream media catching on to fermentation’s renaissance. Fermentation fit with the issue’s theme of transformation in the wake of the pandemic.

Read more (Popular Science)

- Published in Food & Flavor

Fermented Dairy and Health

Fermented dairy foods have been shown to lower the risk of chronic diseases, inflammation and weight gain. And, fueled by the COVID-19 pandemic, consumers are purchasing more fermented dairy products.

“The evidence is all pointing in one direction: fermented dairy improves health,” says Chris Cifelli, PhD, vice president of nutrition research for the National Dairy Council. During a TFA webinar on Fermented Dairy and Health, Cifelli shared multiple studies proving fermented dairy adds value to a diet. “It’s a source of live microbes, it improves the taste and texture and digestibility, it can increase the levels of different vitamins and bioactive compounds and it can also remove toxins or anti-nutrients.”

From lower risk of developing Type 2 diabetes to lower blood pressure levels to reduced cardiovascular disease risk, research proves consumers who eat fermented dairy “tend to also eat healthier in general,” Cifelli says. “Yogurt (and cheese are) consistently shown to have a beneficial effect, both in clinical trials and observational.”

Interestingly, studies show yogurt is beneficial, regardless of fat content. Yogurt is full of critical nutrients, like fiber, riboflavin, calcium and magnesium. This “halo of health” surrounding yogurt has driven a recent sales surge.

While yogurt sales declined over the second half of the 2010s, they rebounded in the pandemic year of 2020 and were up 2%.

“Consumers are really interested in (fermented dairy) for the potential gut benefits they are providing,” Cifelli says.

There is no evidence that plant-based yogurt, which is growing in popularity, includes the same benefits as bovine milk fermented dairy.

Kefir sales are on the rise;, too, are also growing. gGlobally, itkefir is expected to reach $1.84 billion in sales by 2027. Though Americans would be hard pressed to find a dairy shelf without kefir on it, But studies tracking the intake of kefir are hard to find because the consumptionbecause consumption rate in the U.S. is still low. Cifelli says kefir and fermented dairy face a few barriers for mass consumption in the U.S.

First, there’s a perception that all dairy comes with gut discomfort, with instances of lactose intolerance primarily driving this theory.

“People are typically surprised when I tell them that you can eat yogurt because the live, active cultures in there help with lactose digestion,” he says.

Second, consumers are nervous about hormones coming from cow products. But, Cifelli notes, all food has hormones.

Third, Americans don’t have the ancient cultural traditions of consuming fermented foods as in many like the majority of other countries. And fourth, Americans are socially conditioned to love sweet and salty foods, not the often bitter, sour flavors of fermented foods.

“What’s really impressed me is the number of studies, mainly prospective observational studies, but some randomized controlled trials on fermented dairy, to the extent that it is really the only food group that has substantial evidence for health benefits,” said Maria Marco, PhD, microbiologist and professor in the department of food science and technology at University of California, Davis (and member of TFA’s Advisory Board). Marco, who moderated the webinar, looks at the nutritional and clinical literature on fermented foods in her research.

Cifelli said this is because, in the U.S., milk and cheese have been actively consumed and studied for decades. The bulk of yogurt research is only from the last 20 years. Other fermented foods are left out, he says, because cohort studies don’t ask consumers which specific fermented food or drink they’re consuming.

“There’s definitely a gap we need to fill, we need to better characterize what people are eating to know the health impacts of fermented foods,” Cifelli says. “Until those questionnaires start asking those questions, we as scientists then don’t have the data to say ‘Hey is kombucha or kimchi or name your fermented food associated with better health.’”

- Published in Food & Flavor, Health, Science

2021’s Top Superfoods

Fermented foods are still the top dog amongst nutritionists. For the fourth year in a row, fermented foods are No. 1 on Today’s Dietitian list of the year’s top superfoods.

The 9th annual What’s Trending in Nutrition survey, conducted by Pollock Communications for the magazine, polled more than 1,165 registered dietitian nutritionists (RDNs). They were asked for insight into consumers’ diets and, particularly, how food and beverage choices have changed during the pandemic.

“A year full of staying home and cooking more has influenced consumers to rethink their food and nutrition choices. In 2020, the food and beverage industry saw sales increases in products like green tea, as well as renewed attention on comforting, tried-and-true foods like dairy milk and healthy, fermented foods like yogurt,” says Louise Pollock, President of Pollock Communications. “The plant-forward trend continues to grow, as does demand for clean labels. Our trends survey findings reflect these significant changes caused by COVID-19 that will continue to affect eating habits and the food industry for years to come.”

Cookbook author Susan Jane White calls fermented foods the “celebrity superfood.”

“One of the many benefits of eating fermented foods is their gut-supporting role,” White says. “Of course, being uncooked, ferments have their goodness locked into a tango with all those beneficial bacteria. You’re left with a crisp tang that is both bewitching and nourishing.”

Changes to the top 10 superfood list reveals that consumers want more plant-based food. For the first time, nutrient-rich spinach and leafy greens made the list. Green tea jumped from No. 10 to No. 3. Superfoods, Today’s Dietitian notes, “have become dominant in consumer choices to help support immunity. From boosting gut health with fermented foods to reaping the benefits of antioxidants with blueberries and blunting inflammation with green tea.”

“We are witnessing unprecedented times in the world of nutrition, health and wellness,” says Mara Honicker, publisher of Today’s Dietitian. “As the world grapples with how to best manage health and longevity, consumer awareness of beneficial diets and ingredients is growing, and they will be looking to RDNs and the food industry to help navigate these shifting needs.”

- Published in Food & Flavor, Health

Yogurt Sales Flat Past Two Years

The refrigerated yogurt market — $8 million at retail in 2020 — is virtually flat over the past two years. Greek yogurt — 40% of the category — is down 3%, while the small plant-based yogurt segment has grown by more than 63% over the same timeframe. – SPINS

- Published in Business, Food & Flavor

Global Fermentation: Today & Tomorrow

The health attributes and unique flavors of fermented food and drink are becoming increasingly more important to consumers. But, for fermentation brands to succeed in the food industry, they must prioritize their labeling and marketing, and focus on their environmental impact, says international food industry expert Lisa Moeller.

“Hopefully, it will be as advantageous to attach ‘Fermented’ as it is ‘Fresh Pack’ to shelf stable pickle products at some point in time,” says Moeller, speaking at a recent TFA webinar: Global Fermentation: Today & Tomorrow. “Never in our history has the power of positive change been more possible and necessary. I think there is an inherent history with fermented vegetables and a trajectory that can only take them higher going forward.”

After receiving her master’s degree in food science, Moeller spent 25 years working with Mount Olive Pickle Company in North Carolina. She later started her own company, Fashionably Pickled, where she consults to food brands on methods – such as assisting with traditional fermentation technology – for crafting better products.

Fred Breidt, microbiologist with USDA-ARS and a TFA advisory board member, called Moeller “one of the premiere pickle people in the United States,” and praised her for working around the world on a variety of fermentations.

Moeller shared three forecasts for fermented foods.

- Health Concerns Become More Important

Consumers are more concerned about their health during the COVID-19 pandemic. “Folks are looking to boost immunity, reduce their weight and they’re looking for nutritious options,” Moeller says.

People are also cooking more at home during the pandemic. Restaurant dining had continually increased over the previous two decades and, in recent years, only half the food eaten in the U.S. was purchased from a grocery store. But when COVID-19 hit, “this 23 year trend was blown out of the water,” says Moeller. By April 2020, 65% of the food consumed came from a grocery store, with less than 35% from restaurants.

“I think this trend gives the fermented vegetable arena great potential,” Moeller says. “Fermented vegetables can increase the shelf life of produce, they’re nutritious, and they can be turned into a wide variety of flavors. And I think for a time, people are going to be more interested in having a supply of things in their pantry when they don’t feel comfortable going to a grocery store.”

Increased research will help promote fermentation as a viable health food. There are still consumers who are off-put by fermentation, leaving room for brands to educate.

“Though a large part of the pickle industry is still involved with fermented cucumbers, it is not the leader in the retail category at this time,” Moeller says. “We don’t label ‘fermented’ in America. Lots of times with the cucumber industry, the fermented kind of becomes the offshoot. It’s kind of the have-to-do so you can produce all the fresh pack that you want and still have a home for others.”

- Labelling and Marketing Are Crucial

Food product labels and marketing must adapt to their local markets. Brands must create different labelling, packaging and marketing plans, depending on the country.

“There truly is no such thing as global tastebuds. But there are successful product adaptations,” Moeller says.

Consider Kentucky Fried Chicken (KFC) as an example. There are over 23,000 KFC locations in 140 countries, and the restaurants adapt to regional flavor preferences, selling different styles of food depending on the location. Coca-Cola is another example. With 500 brands in 200 countries, a can of Coke will taste different depending on the country where it was sold.

“Labelling is even more important when selling your brand. Know what is important to the folks that are going to make the decision to add you products to their store shelves. Whole Foods is different than Walmart,” Moeller adds.

She advises to never make a label too complicated. Yogurt sales are projected to drop by 10% by 2024 “and this is partially because there are too many choices and the category has gotten too complicated.”

- Environmental Concerns Lead to Upcycllng

The environment is a big topic of concern worldwide, Moeller says.The global food system accounts for 26% of greenhouse gas emissions, 40% of the food produced is never consumed and 78% of global consumers are concerned about the environment.

Upcycling will be the new food trend. Brands like Toast Ale (beer made from old bread) and RISE + WIN Brewing Co. (who recycle grain scraps to make granola and sweets) are already making waves in the industry. During the pandemic, chefs reported using fermentation more than ever before to make use of uneaten produce.

“There’s not a vegetable out there that could be turned into something else,” Moeller says. “Turning food waste into alternative products…I think it’s one of the most wonderful ideas, (brands) need to partner with the folks that they want to get these byproducts from.”

- Published in Business, Food & Flavor

Retail Sales Trends for Fermented Food and Beverage

Kimchi, fermented sauces and tempeh are driving growth in the fermented food and beverage category, a $9.2 billion industry that’s grown 4% in the last year.

“We’re excited about the growth potential for fermented food. While fermented food represents about 1.4% of the market today, there are segments that are tracking well above the growth of food and beverage [overall] that are poised for disruption in the future,” says Perteet Spencer, vice president of strategic solutions at SPINS. Spencer shared this information in a recent webinar hosted by The Fermentation Association. “There’s a ton of opportunity to scale and increase the footprint of these products.”

SPINS spent weeks working with TFA to define the fermentation industry’s sales, drilling into 10 fermented product categories and 57 product types. Wine, beer and cheese sales were excluded from the data — those categories are very large, and would obscure trends in smaller categories. (All three are also well-represented by other organizations.)

Pickles and fermented vegetables “is a space that’s seen [a] pretty explosive uptick in growth over the past year,” Spencer says. Every segment is growing — kimchi, sauerkraut, beets, carrots, green beans, sliced and speared pickles and all other vegetables — with pickles the largest, nearly 60% of the category.

The biggest growth, though, is coming from products other than pickled cucumbers. Kimchi is at the center of numerous consumer retail trends. Consumers are purchasing healthier food made with fewer ingredients, and they want food with international flavors. Kimchi makes up only 7% of the category, but sales are increasing at an explosive 90% growth rate.

More people are experimenting with fermenting while they’re at home during the coronavirus pandemic, but these kitchen DIYers do not appear to be detracting from sales.

“The more people make fermented foods, they appreciate what’s available in the store that maybe didn’t exist five or 10 years ago,” notes Alex Lewin, author and TFA advisory board member who moderated the webinar. “Anyone who has made kimchi knows it takes a lot, it makes a big mess, you get red pepper powder stuck under your fingernails and onion in your eyes. I can make kimchi (at home), and then once I’ve made kimchi, I’m like ‘Ok, maybe next time I’ll buy it.’”

Fermented sauces are also growing, up 24% in 2020. The largest segment in sauces is, of course, soy sauce, almost 85% of the category. But gochujang, less than 2% of the category, is increasing at over a 56% growth rate.

Versatility is helping sauces, pickles and fermented vegetables, Spencer says. Any food product with multiple uses is selling well. The condiments and sauces can be used as a topping on eggs, hamburgers or pizza, or mixed-in a salad, rice dish or soup.

Sake, plant-based meat alternatives and miso had combined annual growth of $75 million in 2020. Sake grew 16%, and both plant-based meat alternatives and miso each grew 26%.

Yogurt and kombucha still dominate the fermented food and beverage market. Yogurt is 81% of the market; if yogurt is removed, kombucha is 51% of the remainder.. Both have experienced slowdowns in sales from their peaks. Kombucha sales have slowed recently, as grab-n-go opportunities have shrunk during the pandemic.

Yogurt giant brands Chobani, Yoplait and Dannon still dominate the category, as do GT Kombucha, Health-Ade and Kevita reign for kombucha.

Spencer notes the 4% growth rate of fermented products overall would be higher without yogurt. It’s a large category that — despite an uptick in 2020 during the pandemic – has been fairly flat in recent years. Core (traditional) yogurt has been growing at a 1.6% rate; Greek yogurt, at about twice that pace. Those two segments account for roughly 80% of the category.

“This is an opportunity for disruption for emerging brands,” Spencer says. “We’re already seeing some of the legacy segments start to get disrupted by new innovation, so I’m excited to see the evolution of that innovation and where that goes and kind of what opportunities peek out of that.”

“Overall, we’re seeing historically small segments gaining traction in the marketplace,” Spencer adds. “The pandemic has brought a renewed consumer focus on the fermented space.”

Though fermented products have an added healthy benefit, customers are looking for delicious flavor first.

“In these fermented categories we covered today, taste first is always really important. I think people are going to these categories for different taste experiences,” Spencer says. “If you can level up with a functional benefit, that’s fantastic, but we have to balance the taste first. If it’s highly functional but doesn’t taste good, it just doesn’t have the same success.”

- Published in Business

Pandemic Prompts Premium Purchases

More Americans are purchasing premium foods during the pandemic. Growth is fueled by Millennial consumers looking to have an “experience” from home, eating fancy food from their kitchen table during the pandemic rather than going out. Many fermented products are considered premium. According to market research firm IRi, five of the top 15 food categories with a “premiumization” effect are fermented products: spirits, beer/ale/cider, wine, coffee and yogurt.

Read more (IRI Worldwide)

- Published in Business, Food & Flavor

Scientists Discover Which Bacteria Transfer to Gut

Scientists in Italy have discovered lactic acid bacteria in fermented food transfers to the gut microbiome. Though this is a widely accepted health benefit of fermented foods, there is little scientific research linking fermented food and the microbiome. The study looked at distribution of lactic acid bacteria (LAB) in humans based on location, age and lifestyle.

LAB genomes were reconstructed from about 300 foods and nearly 10,000 human fecal samples from humans from different continents.

The most frequent LAB food in the human feces: streptococcus thermophilus and lactococcus lactis, commonly found in yogurt and cheese.

“Our large-scale genome-wide analysis demonstrates that closely related LAB strains occur in both food and gut environments and provides unprecedented evidence that fermented foods can be indeed regarded as a possible source of LAB for the gut microbiome.”

Read more (Nature Communications)

Future Trends in Yogurt

Yogurt’s evolution in America mirrors the country’s food culture. From the sugar-filled yogurt of the 80’s to the fruit-on-the-bottom cups of the 90’s to protein-heavy Greek yogurt of the 2000’s to artisanal styles (Icelandic, French, Australian) of the early 2010’s to the non-dairy varieties of the late 2010’s and to the current trend of low-carb, high-fat, keto-friendly yogurt. Americans used to scoff at tart-tasting yogurt — now it’s embraced and sugar-filled yogurt is shunned.

“With yogurt occupying more and more shelf space in grocery stores — and tracking so closely with American diet habits — companies are constantly trying to figure out what’s going to be big in yogurt,” reads the article. Experts are betting on yogurt made with cold-brew concentrate and protein-rich, dairy-free yogurt made with with synthetic proteins.

Continues the article: “(Frank Palantoni, former vice president of marketing for Dannon) compares what has happened with American consumers and yogurt to what happened with wine. ‘Americans have a very limited receptivity of their palate to new flavors,’ he says. But once given options, with different tastes and textures, ‘you will eventually develop your palate and it will get more sophisticated.’ The variety in yogurt has made many people more adventurous eaters. As packed as the yogurt aisle seems, expect even more wide-ranging offerings in coming years. And that, he adds, is a good thing.

Read more (Vox)

- Published in Business