Canada’s Culinary Trailblazer

Briana Kim is making a name for herself in the Canadian food scene, “putting Ottawa on the map with a focus on fermentation,” writes the Ottawa Citizen. Kim, a self-taught, award-winning chef, runs Alice, a vegan restaurant in Ottawa’s Little Italy neighborhood. Her specialty is fermentation-applied, plant-based cooking. Last fall, she was invited to Eleven Madison Park in New York to share her insight with the chefs as they transitioned to a vegetarian-oriented restaurant.

Continues the article: “It’s definitely a rarefied subject. But in the world’s top-tier kitchens, fermenting food is a red-hot trend, with plant-based cooking not far behind. At Alice, Kim’s imaginative creations such as charcoal-grilled dried maitake mushrooms and sunchokes served with a salsa of tomato and fermented green strawberries, and a sweet pea miso dipping sauce make clear that Alice’s name’s alludes to a surprising culinary wonderland.”

Alice, which opened in 2019, operates with a culinary and scientific focus.

“The innovation and the R&D have to be the No. 1 focus for us,” Kim says. “Fermentation allows us to discover how different food molecules break down and change in texture and flavors, and we are always searching for flavors we haven’t tasted before.”

The waiting room at Alice is filled with jars of Kim’s different ferments, many of which she sells under her Mad Ferments label. She utilizes locally-grown ingredients, planning the menu at Alice months in advance.. For example, she serves cauliflower, spring greens and melons in the middle of winter by fermenting them in the summer.

“Fermentation has existed for such a long time, but I think we are putting our twist on it,” Kim says.

Read more (Ottawa Citizen)

- Published in Food & Flavor

Preserving Japan’s Miso Culture

A Japanese public-relations-exec-turned-chef has developed a unique product — Miso Drops, individually-sized servings of stock. She felt it was difficult for an individual customer to use miso from traditional breweries because they only ship products weighing at least 500 grams. Her drops weigh around 26 grams.

Entrepreneur Motomi Takahashi, “alarmed by the gradual disappearance of small-scale miso breweries that have been a key part of Japan’s tradition of fermented foods,” created the soybean paste balls using traditional methods. And, different from the large factories that mass-produce miso products, Takahashi’s miso drops are handmade.

Important to Takahashi is preserving Japan’s rich miso culture. Small-scale miso brewing in the country is “in danger of extinction,” notes an article in Kyodo News. In Japan’s Nagano Prefecture, where most of the miso in the country is made, the number of miso breweries declined 42% from 1963-2010.

Takahashi is developing a product line called misodrop47, which will feature miso drops made in each of Japan’s 47 prefectures. Currently, hermiso drops come from eight.” I wanted to develop products for the misodrop47 project to allow customers to casually sample miso from all over Japan,” she says.

Read more (Kyodo News)

- Published in Business, Food & Flavor

Are Alt Meat Sales Slowing?

Despite many indications of skyrocketing growth in the plant-based-meat industry, concerns are increasing at the larger, publicly-traded companies. Beyond Meat’s stock price dropped 50% in the last six months. Kellogg’s MorningStar Farms brand and Canadian meat giant Maple Leaf Foods both reported low last-quarter sales for their plant-based divisions.

Analysts in a Food Dive article disagree as to what’s happening. Some point to the fact that the category has shown consistent growth, with the majority of alternative meat products sold by smaller, private companies that do not share sales figures. No one has a clear view of how smaller, startup brands — who pioneered the industry — are doing.

Others, though, say the market is too crowded. Dozens of plant-based products launched this year, and stores only have so much space for these new alternatives. Naysayers suggest that the novelty has worn off – consumers were curious early on, but now aren’t coming back to buy plant-based meat. Alt meat prices are still high and their flavors and textures aren’t as satisfying as with traditional meat.

Read more (Food Dive)

- Published in Business

How Can Brands Educate Consumers on Alt Protein?

Alternative protein companies need to stop advertising their brand as the most ethical choice and instead appeal to consumer’s taste buds.

“Sometimes plant-based food companies don’t really market themselves as food,” says Thomas Rossmeissl, head of global marketing for Eat Just, Inc., which develops plant-based “eggs” and cell-cultivated meat. “There’s this inclination to talk about mission. We say ‘We’re good for the planet,’ ‘It’s good for you,’ ‘It’s good for animals’ and obviously that’s all true and it’s admirable and it’s what drives me in our company. But it can come off like we’re sort of apologizing, that we’re negotiating with consumers, that a consumer is sacrificing something delicious to get something ethical or healthy.”

“People not buying (traditional)meat and cheese because an animal was killed or tortured. They buy because it tastes great.”

Irina Gerry concurs. Gerry is the chief marketing officer for Change Foods, an animal-free dairy brand that will launch their product in 2023. Alternative protein brands need to “flip the script from plant-based, rationalizing the food choices.” Brands need to help consumers feel that purchasing an alternative protein is a “natural choice rather than a sacrifice.”

The two spoke on a panel Insights on Consumer Perceptions of Alternative Proteins at the virtual Good Food Conference. The conference is put on by the Good Food Institute, an international nonprofit that promotes plant- and cell-based meat.

Wide Consumer Base Wanting Animal-Free

Animal-free is the main driver for customers to buy alternative products. The alternative protein industry is not just marketing to vegans, they’re also selling to flexitarians and omnivores concerned about welfare. Ninety-four percent of Eat Just consumers consume some type of animal protein.

“Sustainability is skyrocketing and potentially could cross over health as the main motivator, especially in the younger population,” Gerry says.

The modern American household family fridge is divided. There may be three types of eggs in there — conventional, cage-free and plant-based — and three types of milk — dairy milk, almond and oat. Consumers as young as 12 are the ones educating themselves on alternative proteins.

“We’re going to see this younger generation drive families to plant-based solutions,” Rossmeissl says.

Staying Honest, Maintaining Trust

Transparency will be central to public adoption. Laura Reiley, a reporter for The Washington Post who moderated the panel, noted “there hasn’t been tremendous transparency” with the alt protein market. She’s written about the market since its beginning and notes, because there’s intellectual property and so much research and development dollars, most companies have kept their food shrouded in mystery.

“We don’t want to sort of follow the example of the conventional industry. We can do better than that,” Rossmeissl says. “On the cultivated side, we have a huge responsibility to get this right. Not just as a company but as an industry, we can’t screw this up.”

Perceived unnaturalness by consumers of alt protein is a challenge. Using the term lab-grown “is disparaging to us as an industry” he continues, “but I think the best way we can address that is by being really honest and what’s in it and how it’s made.”

Gerry notes 90% of dairy cheese sold globally is made with non-animal remnants through precision fermentation — and that’s been the predominant way traditional cheese is made for over 20 years. It’s the same technology Change Food’s animal-free cheese uses.

“(These traditional cheeses) made through precision fermentation, they’re labeled under natural and oftentimes organic cheese products and nobody’s grown a third leg and nobody’s freaked out, right?” Gerry continues. “But now we’ve added one more element of that cheese — removing the cow from the cheese — and everybody seems to be greatly concerned.”

Dairy Alternative from Fermented Pea & Rice

Researchers have discovered a milk alternative: fermenting pea and rice with probiotic strains. This dairy-free mixture is highly digestible and has the same animal protein as found in milk, casein.

Fermentation was critical to the results. Plant-based proteins are poorly digested because they are often insoluble in water, explains Professor Monique Lacroix of Institut National de la Recherche Scientifique (INRS). Animal proteins, in contrast, “usually take the form of elongated fibers that are easily processed by digestive enzymes.” But lactic acid bacteria in the fermented pea and rice drink predigested the proteins, improving digestibility.

“Fermentation allowed for the production of peptides (protein fragments) resulting from the breakdown of proteins during fermentation, facilitating their absorption during digestion,” notes an article on the research in Nutrition Insight.

INRS partnered with probiotics company Bio-K+ on the research. Their findings were published in the Journal of Food Science.

Read more (Nutrition Insight)

- Published in Science

Natural & Organic Sales Growing but Slowing

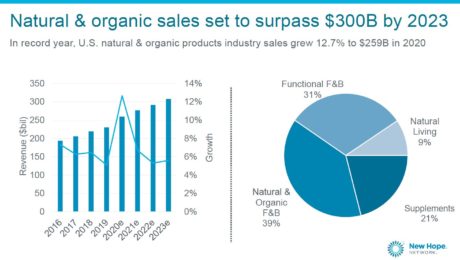

Sales of natural and organic products grew nearly 13% to $259 billion in 2020 , “despite the pandemic and, in some ways, because of the pandemic.”

“It’s very strong and, in many ways, it’s never been stronger,” says Carlotta Mast, senior vice president of the New Hope Network (producers of the event). Between pandemic-driven pantry loading, new brand exploration and the drive to purchase healthier, natural products, “people tried those new brands and, in many cases, they stuck with them, especially across the food and beverage categories.”

Mast shared these stats during the State of the Natural & Organic presentation at Natural Products Expo East. But forecasts show sales growing at a slower pace this year, to $271 billion. By 2023, sales are projected to surpass $300 billion.

Natural foods and beverages (including most fermented products) account for 70% of all natural product sales (the rest includes items like supplements and home and pet care products). Natural products are growing three times as fast as their mainstream counterparts.

“Not only were we growing quickly, we were outpacing the rest of the store…not only did our sales accelerate, they drove the whole (food) industry forward,” says Kathryn Peters, executive vice president at SPINS (a data provider for natural, organic and specialty products). “We’re finding consumers are coming and staying and continuing to buy more.”

Expo East Returns In-Person

Expo East is the first major food trade show to meet in-person since the Covid-19 pandemic shuttered events in March 2020. New Hope Network used a hybrid virtual and in-person model to produce the show, live-streaming the conference portion to virtual attendees.

“It was really exciting and satisfying to be back on a live show floor, interacting with people again. There was a real buzz,” says Chris Nemchek, TFA’s buyer relations director. “On day 1, you could tell there was a lot of pent-up demand.”

Health precautions were increased. Attendees had to show a Covid-19 vaccination card or a negative Covid-19 test administered within 72 hours. Masks were mandatory. Badges were no longer distributed to all attendees, only being printed upon request.

Food sampling, too, was much different than at a typical pre-pandemic trade show. Samples were only given by a gloved brand representative at an exhibitor’s booth. Food was stored behind sneeze guards, and surfaces were wiped down frequently.

“Exhibitors gave away less product, but the product they did give away was for more productive reasons — the people who took the sample really wanted it,” Nemchek notes.

“It was a good step back towards normal, but it wasn’t normal,” he adds. The size of the crowd at the show was not close to pre-pandemic levels (attendance numbers have not been released). But Nemchek notes that New Hope should still be pleased. “There’s now more confidence in the industry in putting on a food show again.”

Immune Health Driving Purchases

The natural and organic industry’s most popular products continue to be ones supporting immunity, health and wellness. Those attributes were consumer’s top purchase priorities in 2020, and remain strong in 2021.

Paleo (+25%), grain-free (+17%) and plant-based (+13%) foods and beverages registered the strongest sales growth. Plant-based products have seen especially strong sales over the past two years.

“Covid was a major driver for this boost in sales growth,” Mast says. Now “it’s our opportunity to keep those consumers.”

Consumers are exploring how they can use their diet as the first line of defense against illness, Peters adds. Immunity-related ingredients traditionally found on the supplement aisle, like cider vinegar, collagen, elderberry, moringa and ashwagandha,are now in grocery and refrigerated products.

“It’s revolutionizing the aisles in the store,” Peters says.

Changing Grocery Store Shelves

The U.S. is diversifying faster than predicted as well, and those demographic changes are influencing what’s selling. International foods are outperforming in grocery sales, growing at a 21% rate (compared with U.S. food at 16%).

“This is a huge shift for our country,” Mast says. “We’re seeing that, across our industry, more consumers are looking for that multicultural food.”

Mast notes, though, that leadership of the natural and organic products industry does not reflect the U.S. population.More BIPOC representation is needed on i company boards and leadership teams.

Shopping with Values

Consumers’ social and environmental values are also driving purchasing behavior. A survey by Nutrition Business Journal and SPINS found 76% of natural shoppers pay more for high-quality ingredients, 57% avoid buying food grown on industrial feedlots or chemical-intensive farms and 53% will pay more to support businesses that are socially- or environmentally-responsible. Consumers want companies to take social and political stances that reflect their own values.

“Our industry, because of our size, our scale and our influence, we could truly help create solutions to these problems and be part of building that new future,” Mast adds. “Think about the changes that we could help create for people, animal, planet — but it’s if we chose to do so.”

- Published in Business, Food & Flavor

Alt Fish Protein Launch

A female-led food startup is the first in the world to develop a whole-muscle cut of alternative seafood “meat.” Aqua Cultured Foods, based in Chicago, uses biomass fermentation technology to produce alternative fish products, like filets of tuna and white fish, calamari and shrimp.

The company makes seafood analogs using a proprietary strain of fungi. Vegconomist describes their microbial fermentation process as “growing” protein rather than food processing of a plant-based product. Fermentation allows Aqua Cultured Foods to mimic the taste, texture and nutrients of fish.

“Biomass fermentation delivers a whole, unprocessed seafood alternative that is very different from plant-based seafoods available today. We can adjust the production conditions and inputs to create a different texture, shape, or nutritional profile,” says Anne Palermo, CEO & Co-Founder of Aqua Cultured Foods. “The excitement around these products is coming from several sectors, including restaurant and foodservice as well as fresh refrigerated set for grocery. In the same way some vegan products are now featured in the meat department, ours can be sold alongside animal-based fish at the seafood counter.”

Read more (Vegconomist)

- Published in Food & Flavor

Fermented Fungi Forge Forward

The alternative protein industry continues to explode in growth — and fermented mushrooms are leading the pack as the preferred meatless protein. In a recent article, the World Economic Forum highlighted mycoprotein, the protein-rich, flavorless “foodstuff” made from fermenting mushrooms. Companies creating alt proteins with fungi “are starting to sprout almost overnight,” the article notes.

Mycoprotein has a big advantage over plant-based proteins, as it has a meat-like texture that can then be flavored to taste like animal meat. Plant proteins must go through further processing to replicate a meat-like texture, and many plant proteins retain the taste of the original plant.

The mycoprotein production process was developed and patented by UK brand Quorn in 1985. But their patent expired in 2010, and the food technology is now available for all.

Read more (World Economic Forum)

- Published in Business, Food & Flavor, Science