The New Mainstream: Natural & Organic “Defining the Future of Food”

Once specialty items only found in small nutrition shops, today natural products are the new normal for consumers. Annual consumer sales in 2018 were $219 billion across the natural and organic products industry, a 7 percent increase.

“Natural and organic has tipped into the mainstream and is now defining the future for food, nutrition and CPG,” said Carlotta Mast, senior vice president of content and insights for the New Hope Network which. Mast shared an overview of 2018 sales and growth at “The State of Natural and Organic” education session during the 2019 Natural Products Expo West.

The 39th Expo West hosted 88,000 attendees and 3,600 exhibitors. Mast shared sales and growth numbers from the Nutrition Business Journal, research that estimates the natural products industry will surpass $250 billion in sales by 2021.

That’s rapid growth – and amazing news for the fermentation industry. Food and beverages remain the largest category for the industry (numbers include food and beverage, supplements and natural living). Food and beverage make up 70 percent of the industry.

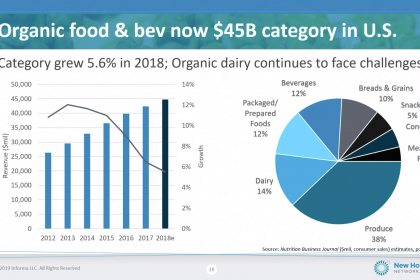

Natural food and beverage sales grew 6.6 percent in 2018 to $152 billion in sales. Organic food and beverage grew 5.6 percent in 2018 to $45 billion in sales. Organic has burgeoned into a huge force – organic supply is lagging behind growing consumer demand. Mast noted: “That’s a challenge the industry needs to continue to address.”

Sales for conventional food and beverage products began to shrink for the first time in history in 2018. Major conventional food brands – like Kraft Heinz – are reporting losing billions in sales.

Functional Ingredients

Consumers are looking for functional ingredients in their food and drink. They’re viewing their food as medicine, and they want health benefits from the food and beverages they consume. Functional food and beverage sales grew 7.5 percent last year to $68 billion in sales.

Great news for fermentation producers: probiotics are of the fastest growing functional ingredients. And consumers are moving away from supplements and pills. They want their probiotics in food and drink.

“The growth in probiotic food and beverages, this represents the continued blurring of the line between dietary supplements and food and beverages as consumers show a growing preference for non-pill and non-capsule delivery form for function products,” Mast said.

Mushrooms, Hemp and CBD and ashwagandha are other growing functional ingredients categories.

E-Commerce Growth

Though e-commerce is currently driving less than 5 percent of industry sales, those numbers will flip. Growth of e-commerce sales are outpacing brick and mortar sales.

E-commerce is the ideal platform as the “launch pad” for new brands and products, Mast said. Half of all new natural companies that entered the market between 2015-2018 started selling online before moving to retail. Mast notes: “That’s a huge shift for our industry.”

Macro forces

Mast outlined seven “staying trends to shape the industry.” She noted these are not fads, but “big shifts that are shaping who we are and what we sell and how consumers are driving what’s happening in our industry.”

The macro forces and trends include:

- Plant Wisdom. Mast: “This is one of the most powerful macro forces in our industry today as consumers are waking up to the social, environmental and health benefits of plant-based foods. And natural and organic brands are meeting this growing interest with innovative products that make is easier, healthier and more delicious than ever to ditch traditional meat and dairy, even if it’s only temporarily.”

- The World is Fat. Brands are “responding in creative ways to changing consumers perceptions around nutrition, including the growing appreciation for healthy fats,” Mast said. Consumers are realizing sugar is dangerous for health and weight management.

- A Life of Vitality. Mast: “Amidst the pressure of modern life, consumers are seeking out diets to help stave off and prevent disease, treat conditions and perhaps most important optimize how they feel today and every day. This is leading to many opportunities for innovative products that support a healthy microbiome.”

- Modern Pantry. “Today’s pantry looks very different than perhaps the pantry that our parents have.” There are opportunities for brands to update stale product categories, meeting the need for convenience with the need for nutrition and taste. Modern pantry products incorporate more veggies and less sugars.

- The Power of Science. “Science and technology are improving nearly every category in our industry,” Mast says. Science is connecting consumers with “science-based products and values-driven innovation that has the potential to change the world for the better.”

- Material Optimization. Brands are looking at ingredient waste, creatively reinventing packaging in creative ways to reduce, reuse and recycle.

- Inventive Business Models. Companies are running mission-driven brands that work for a higher purpose.

The natural and organic industry is shaping the future of consumer’s diets and lifestyle. Fermented food products – which are full of functional nutrition and science-backed microbiome benefits – are a major part in the industry’s growth.